Source: SunEdison Inc

SunEdison Inc (SUNE +0.00%) isn't your average solar stock. Its relatively small size has some investors looking for bigger fish -- but SunEdison Inc has some solar surprises up its sleeve. Here are three reasons SunEdison Inc's stock could rise.

1. It's growing

One of SunEdison Inc's biggest critiques is its small size. On the top end, its $2 billion in revenue lags that of competitor SunPower Corporation's (SPWR +0.00%) $2.5 billion, and pales in comparison to First Solar's (FSLR +5.42%) $3.3 billion. Solar stocks are risky enough without worrying about too-small-to-succeed issues.

But SunEdison, is making smart moves to make up lost ground. On the financial front, the company spun off subsidiary TerraForm Power (TERP +0.00%) in July, creating what's known as a "yield co." TerraForm is owned by SunEdison, but its independent status mimics a master limited partnership (MLP) for oil and gas companies, allowing both SunEdison, and investors to benefit from a predictable cash flow from existing solar assets.

That also frees up SunEdison to scour opportunities for new investments. In the past month alone, the company has signed a Memorandum of Understanding for 5,000 MW with the Rajasthan, India government, closed deals on 26 MW of utility-grade and 18 MW of distributed projects in California, and signed a joint venture with a Chinese asset management company to construct up to 1,000 MW in China over the next three years. Long story short – there's a lot in SunEdison's pipeline.

2. Google's buying

Jumping on the bandwagon can often lead to disaster. Investors have blindly followed analysts down some dark, scary investing paths. But when certain folks like Berkshire Hathaway's (NYSE: BRK-B) Warren Buffett or visionary corporations like Google Inc (GOOGL +2.73%) add a piece to their portfolio pie, I'm watching.

In September, Google Inc agreed to provide $145 million in equity financing for an 82 MW SunEdison Inc solar farm in California. In total, Google has funded 17 renewable energy projects totaling $1.5 billion, and where it's spending its hard-earned money is indicative of where it believes the future of green energy is.

"We believe the world needs a wide range of clean energy technologies, each serving different needs," said Nick Coons, renewable energy principal at Google.

"This project with SunEdison presented an opportunity to take an old gas and oil field and turn it into a clean energy producing solar site. It made sense to support it on multiple levels."

While a $145 million investment only amounts to 6% of SunEdison Inc's total assets, it's strategic partnerships like this that pique my interest and lend legitimacy to more volatile investments.

3. Diversity

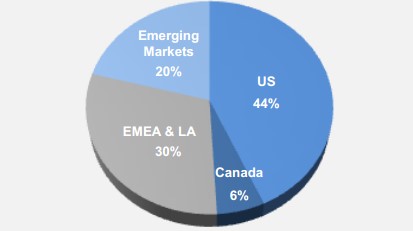

SunEdison Inc may be firmly entrenched in the solar market, but it's spreading its assets and investments across scales and countries to reduce risk. Of the 3,400 MW project pipeline SunEdison had in February, only 50% of that was located in the United States or Canada. Europe, the Middle East, and Africa took 30% of the project pie, with emerging markets accounting for a sizable 20%.

Source: SunEdison; Capital Markets Day, February 2014

The same goes for project sizes, as well. While utility-scale solar is showing promising results, SunEdison Inc isn't putting all its eggs in a one-size-fits all basket. 17% of its pipeline projects are 10 MW or less, while 24% are 100 MW or more. That leaves SunEdison positioned to adopt new solar technology quickly, no matter what the size.