Intel (INTC 3.27%) is the market leader in laptops, PCs, and servers while licensed chips from ARM Holdings (ARMH +0.00%) have conquered the world of smartphones and tablets. Despite ARM's mobile edge, its stock has fallen nearly 22% over the past year. Meanwhile, shares of Intel have soared nearly 44%.

Source: Ycharts

What caused this divergence, and which CPU stock is the better pick for 2015?

How Intel lost the mobile market to ARM

Intel and ARM's business models are very different. Intel manufactures its own chips, while ARM licenses chip designs to other companies like Qualcomm (QCOM 4.79%), Apple (AAPL +0.34%), Samsung (NASDAQOTH: SSNLF), and Nvidia (NVDA +0.04%). Since ARM doesn't manufacture chips, its operating margins have mostly remained higher than Intel's over the past two years.

Source: Ycharts

ARM's mobile chip designs rose in popularity among smartphone makers thanks to their low prices and power-efficient designs. This helped ARM achieve a 95% penetration rate among mobile handsets worldwide. Many smartphone manufacturers adopted ARM-licensed processors in their tablets as well.

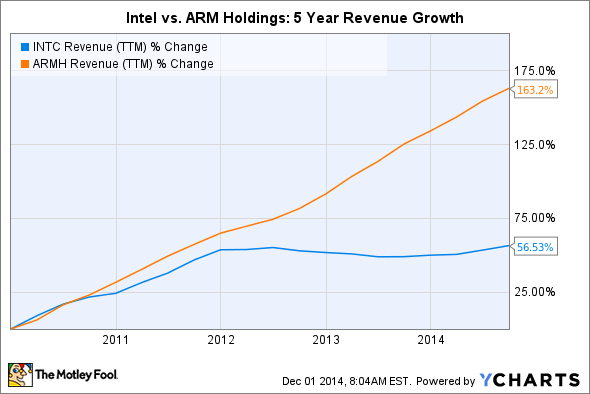

Intel lost this market because its mobile Atom processors failed to demonstrate the same ability to conserve battery life as ARM-licensed products. In 2006, Intel sold its Xscale line of ARM-licensed processors -- which ironically could have helped it retain a mobile foothold -- to Marvell Technology Group (MRVL 0.34%) for $600 million. As a result, ARM's revenue growth easily outpaced Intel's over the past five years.

Source: Ycharts

ARM's three key weaknesses

Despite its formidable top-line growth, ARM has three key weaknesses. First, ARM-licensed chips can't run programs designed for x86 chips manufactured by Intel and AMD. Therefore, older Windows software can't be installed on ARM-based operating systems (like Windows RT), which bars ARM from fully expanding into the enterprise market.

Second, high-end Intel chips generally have more horsepower than high-end ARM chips, making them ideal for servers. Lastly, smartphones and tablets have been heavily commoditized, with sub-$100 smartphones and $99 Android and Windows tablets flooding the global market.

In this saturated market, manufacturers need cheaper CPUs. To capitalize on this demand and steal market share from ARM, Intel convinced netbook and tablet manufacturers to switch to Atom processors through co-marketing agreements, steep discounts on Atom chips, and payments to help companies redesign logic boards for Atom chips.

Intel's plans for the future

That subsidization strategy was costly for Intel. Its mobile chip division racked up $3 billion in losses in 2013, and is on track to lose $4 billion by the end of 2014, according to Morgan Stanley analyst Joseph Moore.

But that strategy helped Intel gain Atom-powered smartphone and tablet allies, including Lenovo, Asus, Acer, and Dell. Intel also recently released its fanless Core M processors, which are 50% smaller and 30% thinner than the Haswell (Core i3, i5, i7) chips, and have a 60% lower idle power level. This allows manufacturers to develop tablets and two-in-one devices as thin as 7.2 mm. By comparison, Apple's iPad Air 2 is 6.1 mm thick.

Intel's strategies might seem expensive, but ARM's operating expenses (much of it spent on R&D) actually climbed at a much faster rate than Intel's over the past five years.

Source: Ycharts

Intel is also expanding into wearables through partnerships with Fossil, Opening Ceremony, and SMS Audio. Its subsidiary Basis also recently released its first smartwatch, the health-tracking Basis Peak. During the first nine months of 2014, Intel's mobile chip revenue fell 80% YOY, but revenue at its PC Client, Data Center, and Internet of Things groups respectively grew by 4.6%, 15.7%, and 25.5%. Companywide revenue rose nearly 6%.

ARM's plans for the future

ARM's licensing fees and royalties respectively account for 45% and 46% of its revenue. In the first nine months of 2014, licensing fees soared 31% YOY, but royalty fees only inched up 4%.

This means ARM is getting more upfront payments, but fewer chips are being installed in marketed devices. ARM also charges different royalties for different chips. The lower-end 32-bit ARM7/9/11 designs only generate 1% to 1.5% in royalties per chip sold, while the popular 32-bit ARM Cortex-A designs net royalty rates between 1.5% to 2%. The newest 64-bit ARMv8 designs enjoy royalty rates topping 2%.

Therefore, ARM needs to wean its customers off the 32-bit designs and onto its 64-bit ones. But that could be tough, since 53% of ARM-licensed shipments came from the ARM7/9/11 segment last quarter. Cortex-A designs only accounted for 18%.

Another problem for ARM is that the high-end tablet market is being cannibalized by the two-in-one market, which is dominated by Intel-powered devices running on Windows. Gartner estimates that sales of tablets will rise less than 11% YOY in 2014, a major slowdown from 55% growth in 2013, but sales of ultramobile premium devices (including two-in-one hybrids) will soar nearly 75%.

ARM's best hope is that stronger sales of newer ARMv8 devices like Apple's iPhone 6 and Samsung's Galaxy Note 4 lead to better royalty growth over the next few quarters.

Looking ahead, Intel is the stronger stock. It only trades at 18 times trailing earnings, compared to ARM's whopping P/E of 73. Intel pays a forward annual dividend yield of 2.4%, compared to ARM's 0.5%. Last but not least, Intel is regaining market share in mobile and two-in-one devices, but ARM's future relies too heavily on convincing an increasingly commoditized market to adopt pricier 64-bit chip designs.