The U.S. Department of Commerce hit Chinese solar manufacturers with a devastating blow on Tuesday when it set anti-subsidy and anti-dumping tariffs that cover not only China but also Taiwan, where panels coming to the U.S. were "tolled" to save paying the previous tariff.

Implications for the U.S. solar industry are far reaching and your opinion on the case may depend on where you sit, or invest, in the industry. Not only will Chinese manufacturers be stung by the news, U.S. installers who used low cost Chinese panels may see prices rise as we head into 2015. Here's what we know.

Image source: SolarCity.

Solar tariffs are strong and far-reaching

SolarWorld brought its original trade complaint to the Department of Commerce in 2012 and when it won the U.S. placed anti-dumping and anti-subsidy tariffs on Chinese solar panels. But a massive loophole was created because the trade case had a limited scope of solar cells and just included China.

Late last year, SolarWorld fined another petition that sought to close the loopholes and include modules as well as products from Taiwan. That's what the ruling on Tuesday included and the cost to Chinese suppliers is incredible.

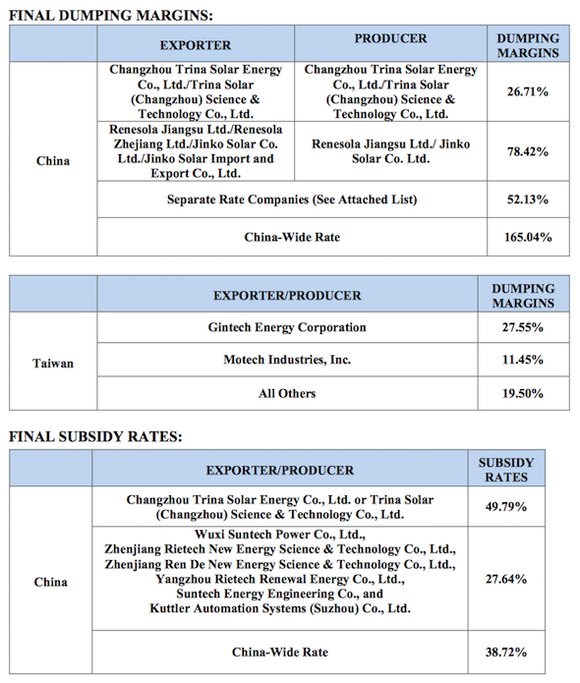

Anti-dumping tariffs will be placed on "certain crystalline silicon photovoltaic products from China" of 26.71%-165.04%. Taiwan's anti-dumping tariff ranges from 11.45%-27.55%.

On top of that, Chinese manufacturers will receive anti-subsidy tariffs of 27.64%-49.79%. The full rate structure for different companies can be seen below. Notable are tariffs on Trina Solar (NYSE: TSL), Yingli Green Energy (NYSE: YGE), and Canadian Solar (CSIQ 18.76%) total 76.5%, 90.9%, and 90.9% respectively.

Source: SEIA and the U.S. Department of Commerce.

The impact on U.S. solar

Chinese solar firms will certainly be negatively affected by this ruling, but they're not the only ones. U.S. installers SolarCity (SCTY +0.00%), Vivint Solar (VSLR +0.00%), and SunEdison all use Chinese panels for their installations in the U.S.

Vivint Solar and SunEdison, in particular, could be hit hard because they're so reliant on Chinese supply. Even as they transition away from non-Chinese suppliers, they'll likely see higher prices because U.S. installers will be clamoring for the same solar panels.

SolarCity has made moves like signing a supply agreement with REC Solar earlier this year. The 100 megawatt deal, which could grow to 240 megawatts, won't supply all of the capacity needed for SolarCity but it'll ease some of the pricing pressure. On top of that, SolarCity is building a 1 gigawatt plant with technology acquired from Silevo, which is intended to supply most of the company's panels as early as 2017.

Some installers like SunPower (SPWR +0.00%) and First Solar (FSLR 2.39%) will actually see a benefit from these new tariffs in the U.S. They manufacture most of their panels in the Philippines and Malaysia respectively and won't be subject to tariffs. They've effectively lowered their costs compared to competitors without doing a thing.

China solar companies are losing competitiveness worldwide

There's a reason China has made a big effort to grow domestic demand for solar panels, their manufacturers are becoming less competitive globally. U.S. tariffs are very punitive and the EU has put a price floor on Chinese solar panels, increasing competitiveness of their local supply.

With companies like Trina Solar and Canadian Solar increasing supply further in 2015 I have to wonder where the solar panels are going to go. We know now that it won't likely be the U.S.