Just in time for Dec. 25, Santa has crept down a few chimneys and left dividend raises in the stockings of lucky investors.

Lucky, because such increases not only put extra money directly into an investor's pocket, but also often improve the share price of the affected stock, as the market is willing to pay that much more for the extra payout.

This has been a good year for dividend hikes, and last week was particularly fruitful. Of the three we'll be looking at, two are from dividend aristocrats (companies that have increased their payouts at least once annually for 25 or more years running).

AT&T (T -1.29%)

The telecom giant is one of that pair of aristocrats, with a history of payouts stretching back to 1984. The company's latest hike isn't one of the bigger ones, at 2% (or $0.01), but it does bump the quarterly distribution up to $0.47.

AT&T has been doing fairly well, if not spectacularly, of late. Revenues are more or less steady on a quarter-by-quarter basis, while the company has been well in the black on the bottom line.

This allows it to be relatively competitive with its dividends; the new distribution will shake out to a yield of 5.6% on the most recent share price. That's more than three times the average of the S&P 500's stocks, and it continues to outpace the yield of archrival Verizon (VZ -1.20%).

T Dividend Yield (TTM) data by YCharts.

AT&T clearly loves paying a dividend; it tends to spend much of its free cash flow on shareholder payouts. Although this is a bit of a concern, the company produces steady results and has a huge customer base; as such, it looks like a safe bet to keep that aristocrat status going forward.

AT&T's new dividend is to be handed out on Feb. 2 to shareholders of record as of Jan. 9.

3M (MMM -1.42%)

Another dividend aristocrat, this classic industrial conglomerate is keeping true to form by cranking its payout. That verb is not an exaggeration; last week, 3M lifted its quarterly dividend by 20% to just under $1.03 per share.

It's little wonder the company is feeling so flush. In late October, it reported the best Q3 in its history in terms of sales ($8.1 billion) and per-share earnings ($1.98 on a diluted basis).What's particularly impressive about this is that the company has been in business since 1902.

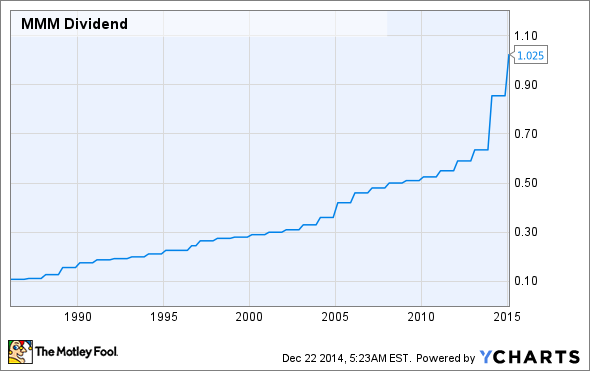

It's also paid quarterly dividends almost as long. Taking only the last 30 years of payouts shows a pronounced upward tilt, especially of late. Investors love to see graphs like this:

MMM Dividend data by YCharts.

However, following the strong Q3 results (which included an upward revision of per-share earnings for full-year 2014), 3M's stock price has -- like the dividend -- advanced by around 20%. This rise has tamped down the yield, which currently stands at 2.5%.

Still, the company's track record of dividend payments and increases is hard to beat, and it's got enough free cash flow to cover those payouts. No one should worry much about the sustainability of 3M's distribution.

The new dividend is to be handed out on March 12 to stockholders of record as of Feb. 13.

Boeing (BA -0.92%)

3M isn't the only company on this list that's recently reported a strong quarter. Boeing also had a fine Q3, and this is similarly reflected in a big dividend boost. The high-flying company raised its quarterly distribution by 25%, to $0.91 per share.

Boeing's doing very well in the commercial sphere of its business, which is more than offsetting a slight decline in its defense, space, and security segment. Overall revenue grew by 7% on a year-over-year basis in the quarter (to $23.8 billion), and net earnings saw an 18% rise to $1.4 billion.

There seems to be more where that came from -- the company reported that its total order backlog reached a record of $490 billion at the end of the quarter.

On the back of these encouraging developments, like 3M, Boeing has upped its guidance for full-year 2014 per-share earnings. Unlike that sturdy industrial, Boeing's stock price hasn't gained much altitude since the Q3 figures were released; just now it's only $4 or so higher, at $126 per share.

As a result, on a recent historical basis, the dividend yield is relatively high for the stock at the moment.

BA Dividend Yield (TTM) data by YCharts.

Boeing's upcoming dividend will be paid on March 6 to shareholders of record as of Feb. 13.