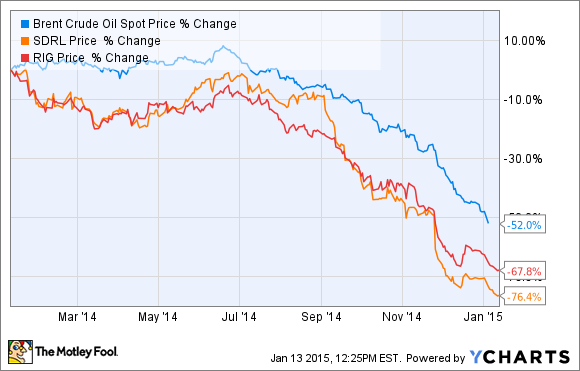

The price of oil has crashed to its lowest level in nearly six years, taking shares of offshore drillers including Seadrill (SDRL) and Transocean (RIG 4.64%) with it.

Brent Crude Oil Spot Price data by YCharts.

While investors are right to be worried about these two companies, with Seadrill recently suspending its dividend and Transocean announcing nearly $3 billion in write-offs for its aging fleet, other areas of this industry still offer investors high, and much safer, distributions.

Seadrill Partners and Transocean Partners might be the best offshore drilling investments

Seadrill Partners (SDLP) and Transocean Partners (NYSE: RIGP) are two securities created by their parent companies as alternative financing methods. The way it works is that Seadrill and Transocean sell rigs with existing contracts to their partnerships while maintaining a working interest in part of the cash flow. In exchange, Seadrill Partners and Transocean Partners gain valuable assets with long-term contracted cash flow with which to pay generous distributions to unitholders .

In this way Seadrill and Transocean can offset the cost of building new rigs while keeping a percentage of their revenue. In addition, both companies maintain a substantial ownership interest in the partnerships -- 68% and 31%, respectively. That means the companies receive distributions from Seadrill Partners and Transocean Partners, as well as fees from incentive distribution rights.

Why Seadrill and Transocean may be in trouble

The reason I think investors should consider Seadrill Partners and Transocean Partners is that their contracts provide them with much better cash flow security than their parent companies. For example, Seadrill and Transocean must secure contracts for their 44 and 100 respective rigs, which are either contracted only through the next 18 months, newbuilds without contracts, idle, or cold stacked and not yet scheduled for scrapping.

Compare this to Transocean Partners, which has a fleet of three state-of-the-art rigs built in 2009 and 2010 and has only one contract expiring in November of 2016. In fact, one rig, the Discoverer Inspiration, is under contract through March with Chevron (CVX -0.13%) in the Gulf of Mexico. At the end of March, the day rate will actually increase 12% from $523,000 per day to $585,000 per day on a second contract that runs through March of 2020.

Meanwhile, Seadrill Partners is almost as well off, with only one rig, which represents just 5.7% of its daily revenue, facing contract expiration through mid-2017.

Source: Seadrill Partners investor presentation.

Seadrill Partners and Transocean Partners: safer yields and incredibly undervalued

| Company or Partnership | Yield | Price to Tangible Book Value | Free Cash Flow Yield | Distribution Coverage Ratio |

| Seadrill | 0% | 0.69 | na | na |

| Transocean | 19.30% | 0.41 | na | na |

| Seadrill Partners | 15% | 0.69 | 11.90% | 1.06 |

| Transocean Partners | 11.60% | 0.86 | 21.60% | 1.47 |

| S&P 500 | 1.90% | 5.49% |

Sources: Yahoo! Finance, Morningstar.com, MLPdata.com, Multpl.com.

As this table shows, both Seadrill Partners and Transocean Partners are trading at very generous, yet highly sustainable yields. With a distribution coverage ratio of 1.47 in the latest quarter -- the company only recently had its IPO -- Transocean Partners should be able to maintain its current payout, especially with the day rate increase for the Discoverer Inspiration about to kick in. Meanwhile, Seadrill Partners has reported a distribution coverage ratio of 1.03 and 1.09 in its last two quarters. This means its distribution should also be safe, even if the West Vencedor is unable to find work and winds up cold stacked.

Seadrill Partners and Transocean Partners are, like their parent companies, trading at substantial discounts to their tangible book values. That means you can buy $1 worth of assets -- state-of--the-art offshore oil rigs and rig support vessels -- for as little as $0.69. In addition, both young fleets have high contracted dayrates that generate substantial free cash flow, or FCF. In fact, 37% and 40% of Transocean Partners' and Seadrill Partners' respective revenue are converted to free cash flow. This indicates they are incredibly undervalued and pose a potential for enormous long-term profit.

Risks to be aware of

While the existing contract backlogs of both Seadrill Partners and Transocean Partners insulate their distributions from the worst of the current oilpocalypse, if the price of oil falls too low there is still a risk of contract cancellations.

Reuters estimates that the breakeven price for deepwater offshore drilling is $54 to $60 per barrel, which means some offshore drilling is simply uneconomical. For offshore drilling companies the issue of how long oil stays below this key level is not just a matter of dividend security or earnings growth. If oil remains so cheap that oil companies won't hire rigs to drill no matter how low the dayrate, then both Seadrill and Transocean could be faced with immense debts and armadas of idle rigs that are solely a drain on their finances. The situation is made even worse by newbuilds that both companies will have to pay for over the next two years, a problem not shared by their respective partnerships.

One other risk factor specific to SeaDrill Partners is its high debt load of $2.88 billion, 88% of which is variable rate. In fact, for each 1% interest rate rise, Seadrill Partners' annual interest costs increase by $7.2 million. This would negatively impact SeaDrill Partners' DCF by 3.4% to 4.5%, but not until 2016 since rates would rise gradually and not until the second half of the year. Should interest rates rise still higher in 2016 and beyond and oil prices remain weak, SeaDrill Partners might have to cut its distribution.

The takeaway: Seadrill Partners and Transocean Partners represent oil investments you can make today

Long-term investors in Seadrill and Transocean, one of which has suspended its dividend and the other which might soon follow suit, should consider Seadrill Partners and Transocean Partners as two alternative high-yield investments. These partnerships' superior contract backlogs, which are generating gobs of free cash flow, insulate their generous distributions far better in a world of cheaper oil. That being said, nothing in investing is guaranteed, and the risk of oil dropping so low that some of those contracts will be canceled, while small, is still there. Potential income investors should consider this risk and allocate their diverse income portfolios accordingly.