Everybody wants to be independent in retirement. Unfortunately, life doesn't always turn out how we want.

One of the biggest threats to many people's retirements is right there in front of them: accessible housing. According to a study from Harvard University's Joint Center for Housing Studies, there are already more than 10 million households in the United States with someone over 50 who has difficulty walking or climbing stairs.

Before you assume you'll never have mobility problems, think about this: Nearly 70% of people over 65 will need long-term care at some point in their lives, according to the U.S. Department of Health and Human Services. If you're married, the odds are high that either you or your spouse will need such care. If your need is the result of a fall -- the No. 1 cause of injury to seniors -- then you could also end up with mobility problems. If your home does not meet your mobility needs, the necessary changes can cost tens of thousands of dollars.

It's not all doom and gloom, but these are serious issues that deserve your attention. With proper planning, you can avoid the pitfalls -- and the serious financial implications -- that come with aging.

Just the facts

Investing in accessibility before a fall can save money and hardship. Photo credit: pixabay.com.

Where did the $13.2 billion number from the headline come from? From the Harvard study:

About 10.3 million households aged 50 and over report having someone at home with serious difficulty walking or climbing stairs. At the same time, 5.5 million of these households also report having to climb stairs to enter or exit their homes. Assuming the average outlay for a ramp falls at the midpoint of the range described above ($2,400), the cost of improving the accessibility of these 5.5 million homes would total $13.2 billion -- an amount that not only speaks to the extent of need, but also to the potential market opportunity that accessibility modifications hold for the remodeling industry.

The report goes on to describe the high cost of falls: An estimated 2.3 million seniors fell in 2010, at a cost of $30 billion, with nearly one-third requiring hospitalization. Falls often lead to mobility problems and the need for long-term care, which can be expensive. The HHS Administration on Aging estimates that 65% of all American seniors will require some level of in-home care. On average, they will have two years of care needs, with almost one year of that care coming from paid providers.

While family members -- usually a spouse or adult children -- provide much of the care, this isn't typically because of their ability, but rather a matter of cost. Going back to the Harvard study, the average cost of paid in-home care is more than $2,500 per month. Forty-two percent of people will use this kind of care, in which even one year would cost tens of thousands of dollars, largely out of pocket. Medicare will only pay for certain services, and might not cover them in your home, requiring a stay in a nursing home. Medicaid will typically only cover the costs for the indigent.

Combined, the health- and housing-related costs of in-home care and accessibility for seniors amount to tens of billions of dollars each year, and millions of baby boomers are moving closer to retirement, unprepared.

Source: American Advisors Group

Proactive steps

While the statistics stated above might make it seem inevitable that you or a loved one will suffer severe financial and emotional effects of a disability, there are steps you can take to better prepare yourself or a loved one for the expense. Maybe even more important, you can reduce the chance that you suffer a fall.

The National Council on Aging's "Six Steps to Reducing Falls" is a great place to start. Avoiding falls -- again, the No. 1 cause of injury and injury-related deaths to seniors -- vastly improves your odds of maintaining mobility and avoiding long-term care. The Center for Disease Control and Prevention's checklist for reducing home falls is another great resource, including measures including:

- Installing grab-bars in bathrooms, and anti-slip mats in bathtubs and showers

- Adding additional light switches and lighting to improve visibility, especially around stairs

- Arranging your kitchen for easier access, and buying a stool with handles for those hard-to-reach items

If you invest in these features before you need them, you're much less likely to suffer from a debilitating -- and costly -- fall. Furthermore, by taking these steps, the home you live in now might serve you much better in retirement.

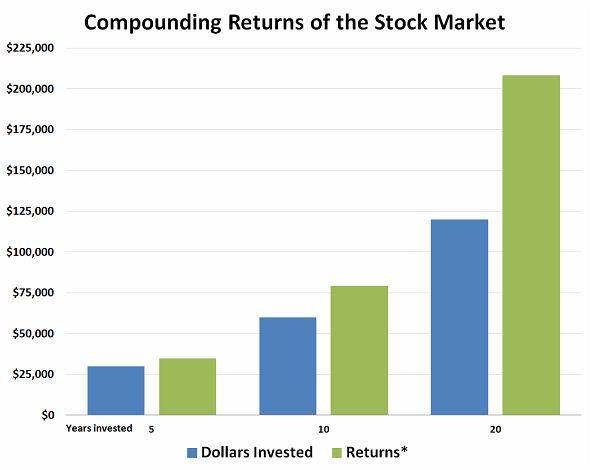

You can also take financial steps. As a starting point, building up the largest nest egg possible means a larger safety net. Considering that the older you get, the more likely you are to be disabled, use that time to your advantage:

Souce: Harvard study

The most effective way to grow your savings is by investing in stocks for the long term. The U.S. stock market has returned roughly 10% per year on an annualized average since 1980, significantly more than the paltry returns that current savings accounts offer. Also, if your employer offers any kind of matching contributions to your retirement plan, take advantage of that match. You can contribute up to $18,000 to a 401(K) plan this year. If you're over 50, you can contribute as much as $24,000 via an extra $6,000 in "catch-up" contributions. If you're behind, take advantage of the opportunity to contribute as much as you can.

What are those "catch up" contributions worth? Potentially a lot:

*Returns based on 5% annualized rate of return

The returns above are based on a very conservative 5% annualized rate of return, half of the market's 10% historical average. Those extra funds could go a long way toward paying for accessibility upgrades and long-term care.

Additionally, long-term care insurance might be worth considering, depending on your age, health, and financial situation. According to AccuQuote CEO Byron Udell, in-home care could cost more than $600-$800 per day in 25 years, based on current costs and annual increases, and only about 30% of people are preparing for that possibility. Not only is long-term care an option, but, according to Udell, many life insurance policies let you use the death benefit to pay for long-term care.

But don't just assume your current policy offers this benefit, as you'll typically need to ask for a separate rider, and it could affect the premium.

Thinking about the big picture

If there's one thing is certain, it's that we all will die. Taking steps as early in life as possible to provide income for retirement and pay for late-in-life care is the best way to get the most out of our golden years. Even if retirement is closer than you'd like, it's never too late to start setting aside funds for your future needs.