There is a clear and compelling case to be made that Halliburton is a better stock to buy now, and that it is the better company to own for the long term. I'll start with value. As the following chart shows, Schlumberger has historically traded at a premium valuation over Halliburton:

HAL P/E Ratio (TTM) data by YCharts.

HAL Return on Equity (TTM) data by YCharts.

HAL Total Return Price data by YCharts.

BOOM!

It isn't sheer coincidence that Schlumberger's stock has outperformed Halliburton's by close to four times over this decades-long time horizon. It comes down to a few key things.

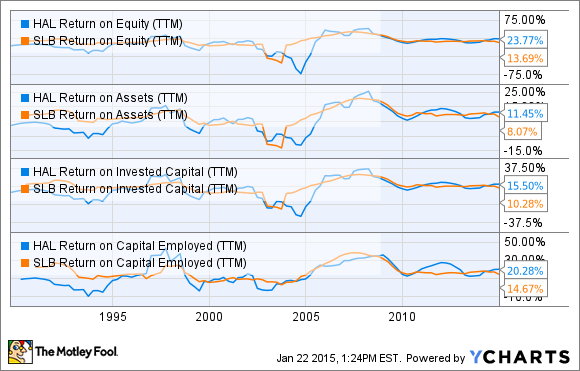

- Schlumberger runs a leaner operation. I'm going to act like a sports journalist and accuse Halliburton of juicing -- on debt, that is. Those higher return numbers from Halliburton (as seen in Matt's chart above) are in part because it has been running a higher debt leverage ratio, and it takes a higher level of working capital than Schlumberger for the company to generate earnings. This can help a company look better in the good times like these past few years, but it can also sink a company when the market goes south.

- Schlumberger's revenue is tied to longer-term, higher-margin projects, such as deepwater operations and international business, while Halliburton is much stronger in North America and in onshore shale drilling. While both of these sources of oil and gas are high cost and will likely decline, it takes far more time to wind down a deepwater project than to close a shale well, meaning the impacts of the production decline will be felt faster by Halliburton. Throw in Schlumberger's more technology-driven, less-commoditized services, and you get EBITDA margins 5 percentage points higher.

HAL Return on Equity (TTM) data by YCharts.

It's far too brazen to say Schlumberger's stock will continue to crush Halliburton's as it has over the past several decades, but that 2.4% dividend yield (compared to Halliburton's 1.8% and Baker Hughes' 1.2%) certainly has helped. Bottom line, Schlumberger has had a higher valuation for a reason: it's just the better company.