Even with a billion viewers, Google's (GOOG 3.16%) (GOOGL 3.22%) YouTube still can't squeeze out a profit. Last year, YouTube's revenue rose 33% annually to $4 billion, according to The Wall Street Journal. However, in paying for content and investing in better streaming technology, YouTube barely broke even, ultimately contributing nothing to Google's bottom line.

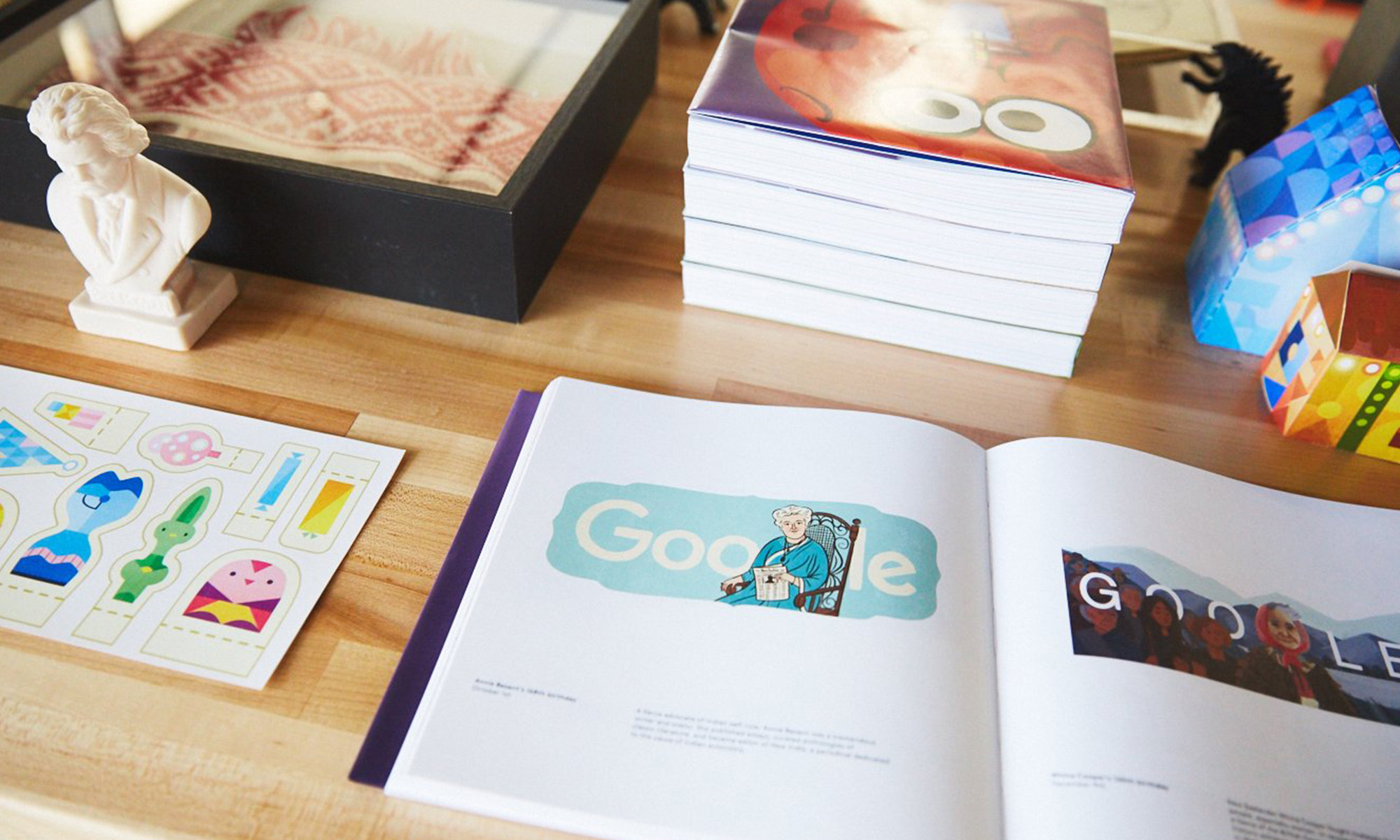

YouTube's Android app. Source: Google Play.

Why is Google having so much trouble monetizing YouTube, which it acquired for $1.65 billion in 2006, and how can the company help it achieve profitability?

YouTube's biggest problems

YouTube only started generating meaningful revenue in 2010, when Google launched skippable ads. This was a win-win situation for the viewer and advertiser, since the advertiser only paid if the ad was watched.

In 2011, Google upgraded YouTube to compete against cable networks by investing $100 million in its "YouTube Original Channel Initiative" to complement the 2010 launch of Google TV. The effort brought stars including Tom Hanks and Madonna to exclusive YouTube channels, but many of the channels failed or were too pricey to maintain. Today, YouTube's top-earning celebrities are mostly amateurs who cater to a fairly narrow audience of younger viewers. In fact, 9% of YouTube's "1 billion" viewers account for 85% of all video views on the network, according to Pivotal Research analyst Brian Wieser.

Lastly, many of YouTube's views come from embedded and linked videos from external sites such as Facebook (FB 1.16%) and Twitter (TWTR +0.00%). This is troubling because both social networks are beefing up their own video platforms, which could reduce traffic to YouTube.

What YouTube plans to do

To counter those problems, YouTube took steps to evolve its site. To broaden its appeal among viewers of all ages, it signed a distribution deal with the NFL and started streaming episodes of Sesame Street and Thomas the Tank Engine.

In 2013, YouTube made it easier to compare YouTube ads to TV spots by letting advertisers use Nielsen technology, instead of its own, to check viewership of their ads. Last year, it let advertisers reserve ad spots on videos from its most popular stars. YouTube also plans to eventually launch autoplay videos, similar to those on Facebook and Instagram.

In addition, YouTube is trying to tap into Google's search data to craft better-targeted ads for the site. YouTube currently uses old-fashioned tracking cookies, which are deployed on users' PCs but don't carry over to mobile devices. That's why Google now deploys single-sign ons to tether more apps and sites to its ecosystem without cookies. If Google shares that data with YouTube -- as it should have done long ago -- YouTube ads could better target individual users.

In November, YouTube unveiled a music subscription service, similar to Spotify's, that offers ad-free music for $10 per month. If YouTube expands the subscription service to include premium video content, it might start producing higher-quality original programs on par with those from Netflix (NFLX +0.23%) and Amazon (AMZN 0.58%).

YouTube Music Key. Source: YouTube.

Why YouTube should tread carefully

But as YouTube strolls into these new neighborhoods, the stakes get higher. The bottom lines of Spotify and Netflix are both burdened by hefty licensing costs.

Spotify's revenue rose 74% year over year to €747 million ($838 million) in 2013, but it still posted an operating loss of €80 million ($89.75 million) due to hefty royalty payments to record companies. YouTube's streaming music efforts are unlikely to fare much better.

Meanwhile, Netflix's streaming content obligations (the amount it promises to pay studios to license future titles) rose from $7.3 billion to $9.5 billion between the fourth quarters of 2013 and 2014. That's why Netflix produces original programming -- to wean users away from pricey licensed content.

YouTube doesn't have any plans to license major TV shows and films yet, but it's already paying top dollar for its top performers. PewDiePie, one of YouTube's leading stars, with nearly 35 million subscribers, earns as much as $18.4 million per year in ad revenue, according to YouTube tracking site Social Blade. YouTube is reportedly paying these top stars even more in bonuses to prevent them from being poached by competing sites. These costs might not equal the billions Netflix pays for content, but they could certainly prevent YouTube from ever becoming profitable.

Should YouTube maintain the status quo instead?

There are two paths for Google to take with YouTube. It could maintain the status quo, tether YouTube's users to the rest of Google's ecosystem, and be content with breaking even on the bottom line. Or YouTube could evolve into a paid streaming service that has more in common with Spotify and Netflix -- a riskier path in which expenses could soar. Since Google seems to favor the latter, investors should keep an eye on the evolution of YouTube to see if it could accidentally devolve into a massive money pit.