Investing isn't a perfect science. If it was we would all be filthy rich and have yacht demolition derbies on the weekend just to pass the time. Plenty of investments don't pan out, while other times we write off companies that turn out to be huge winners.

We asked three of our energy contributors to each discuss a company they brushed off, only to watch the stock skyrocket while they sat on the sidelines. Here's what they had to say.

XOM Total Return Price data by YCharts.

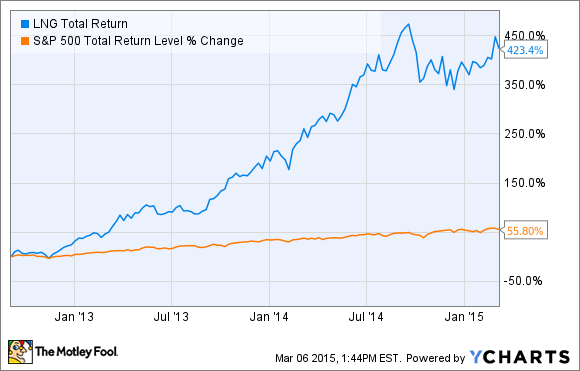

LNG Total Return Price data by YCharts.

Oops.

What turned a hope and a dream of CEO Charif Souki into a viable business was the simple fact that the company was able to line up customers left and right to sell LNG under 20-year take or pay contracts. Those contracts guarantee a stable revenue stream for years to come at both its Sabine Pass and Corpus Christi facilities, which have close to 70% of their processing volumes under firm contract. This amount of certainty made it much easier to go to financiers to raise capital, and it makes the company look much more interesting as an investment.

I'm guessing that if Souki reads this (he won't) he'll be the one laughing at me while sitting on a massive pile of money.