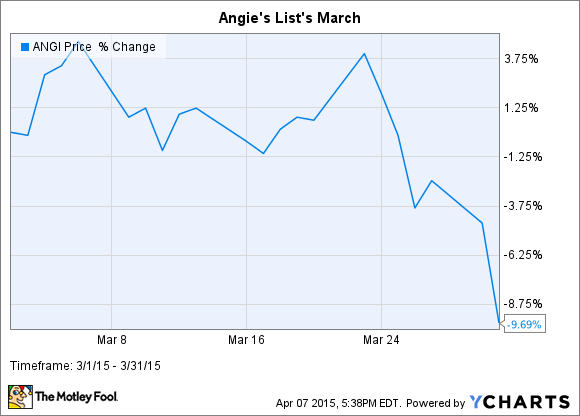

What: Shares of subscription-based review site Angie's List (ANGI +0.00%) dropped 10% in March, according to S&P Capital IQ data. Investors gave back some of the huge gains the stock had in February after reporting earnings, as reports that online retailer Amazon.com was looking to enter this business tempered the forward outlook.

So what: For Angie's List, its fourth-quarter report in February was mostly a reprieve for the company. The company had its initial offering in late 2011 priced at $13 per share. After a strong performance in 2013 drove the company to nearly $30 per share, the stock has continued to fall and was below $5 before its Q4 earnings report. It closed out March trading at $5.87 per share. All told, the company still sits 50% lower than its IPO price.

To be fair to Angie's List, the stock closed March still more than 22% higher than its closing price before that February earnings report. But Amazon's entrance into the space helped the stock quickly shave off a significant amount of its post-earnings gains and signifies how hard it is to create a durable competitive advantage in the referral industry.

Now what: Angie's List is in a space with very low barriers to entry and must contend with new entrants. Amazon's newest foray into the space with its Amazon Home Services product is just one competitor; Yelp is another; more recently Google announced its intentions to enter the space as well. In Amazon, not only does Angie's List have to deal with a deeper-pocketed competitor, but it must also deal with an entirely different business model. Amazon appears to not be running a subscription-based model. Rather, the company sees Amazon Home Services as complementary to its core marketplace business and will take a cut of the provider's fee.

Recently, Angie's List has continued to deepen the relationship with both subscribers and service providers through its redesigned iOS app and newly launched Android app. The apps boast interesting features, such as its SnapFix feature that allows you to snap a photo and Angie's List will coordinate your desired changes with a provider. That said, even with a great quarter and an intuitive app, the company still trades at roughly half of its 2011 IPO price. I'm willing to watch this one from the sidelines.