Renewable energy stocks aren't exactly known for their steady returns. But for investors willing to dig deeper, there are several safe investments in renewable energy that offer significant returns with relatively little risk. Here are three safe investments in renewable energy.

1. NextEra Energy Partners LP (NYSE: NEP)

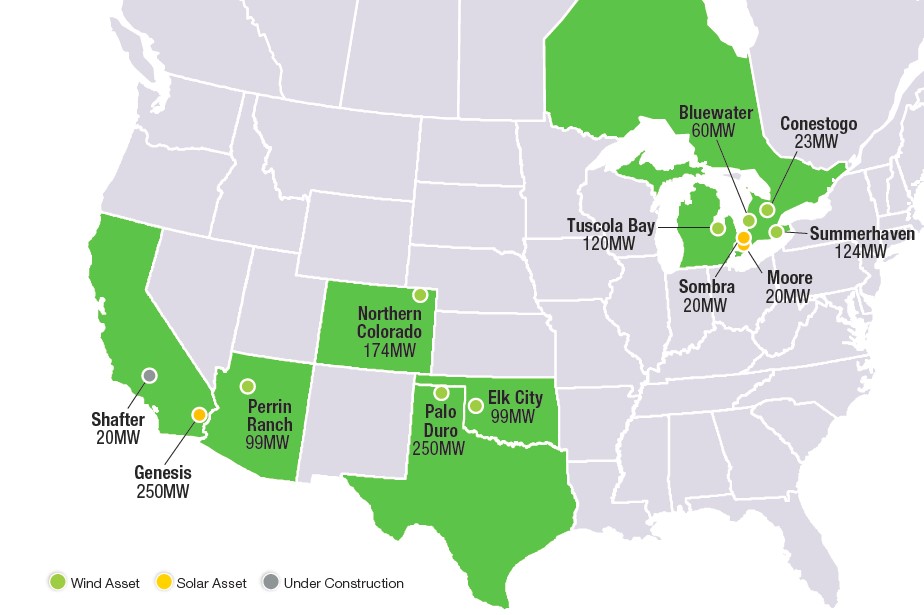

Source: NextEra Energy Partners LP

One of the safest ways to invest in renewable energy is also one the safest ways to invest in energy period, and even the stock market in general. Utilities like NextEra Energy Inc (NYSE: NEE) are highly regulated, allowing investors to reasonably predict steady returns for years to come. But a relatively recent innovation has allowed investors a specific investment in the renewable energy assets of utilities.

Last year, NextEra Energy Inc created NextEra Energy Partners LP, a yieldco company that serves as a holding company for NextEra Energy Inc's most stable renewable energy assets. Like the master limited partnerships, or MLPs, of fossil fuel-based energy stocks, yieldcos enjoy tax benefits for their status as steady earners. NextEra Energy Partners LP owns 1,260 MW of wind and solar projects, all of which are fully contracted and based in areas where favorable regulation, wind, and/or sun ensure long-term sustainability.

Source: NextEra Energy Partners LP.

Since NextEra Energy Partners LP is, by nature, the steadiest assets of already steady utility NextEra Energy Inc, it is highly unlikely this stock will ever see fast rises and falls. Instead, investors can expect this stock to move steadily higher or lower as its contracts are or are not renewed, and as it does or does not continue to experience favorable market conditions for renewable energy.

Since its creation last summer, NextEra Energy Partners LP is up around 30 %. Over the same period, the company has increased its dividend once by 9% to put its current yield at 1.9%. As opinions smooth out on this stock, investors should expect to see more similar performance to MLPs, with smaller price gains and larger dividend distributions.

2. Intel Corporation

Intel Corporation (NASDAQ: INTC) might not be the first stock that comes to mind when considering how best to invest in renewable energy -- and that's understandable. It's a tech company from beginning to end, manufacturing microchips and other digital technology solutions for everyone from individual consumers to the largest corporations in the world.

But Intel Corporation is obsessively clean. For nearly a decade, the company has been blowing away the competition in EPA's Green Power Partnership program. For fiscal 2014, Intel Corporation was the largest corporate purchaser of renewable energy, buying up a whopping 3,102,050,000 kWh of biogas, biomass, small-scale hydro, solar, and wind power to keep its plants up and running. That's equivalent to the average annual power consumption of more than 327,000 American homes and represents 100% of Intel Corporation's total energy use.

In addition to its power purchases, Intel Corporation has facilitated the construction of 18 solar farms at its facilities, is designing all its new facilities to be at least LEED silver certified, uses environmental metrics to determine a part of every employee's compensation, and has a forward-thinking Intel-approved global climate change policy statement.

An investment in Intel Corporation is, first and foremost, an investment in a technology manufacturing company. But for investors looking for a safe entry into a stock supporting more renewable energy than any other, Intel is your best buy. It's on the famed Dow Jones Industrial Average (INDEX: ^DJI) list and, since the early 1990's, has grown its stock price 1,800% and its dividend 7,600%. With a current 3.1% dividend yield, Intel is a decidedly mature tech stock with a renewable energy approach unlike any other.

3. First Solar

Source: First Solar, Inc .

First Solar (NASDAQ: FSLR) is the least safe of these renewable energy stocks. In both name and business, it's a solar stock. If the sun stops shining on the solar industry, either figuratively or literally, First Solar will head straight into the red.

But if the past few years and expected trends are any evidence, solar will be an increasingly important part of America's energy portfolio, and First Solar is the safest solar investment around.

First Solar isn't your average rooftop solar company. Instead, this corporation focuses on big projects with important and predictable partners. First Solar manufactures modules for utility-scale solar plants, builds those plants, and then sells them off to utilities or other companies as it continues to pull in steady earnings from operating and maintenance fees.

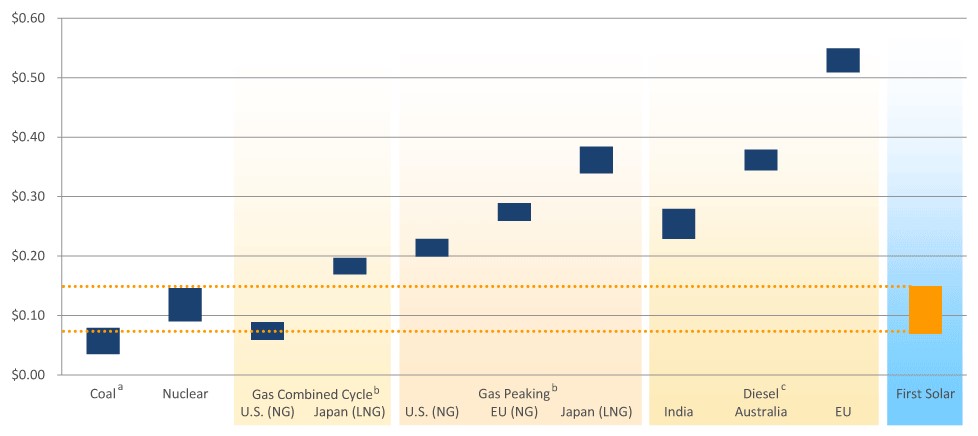

Utility-scale solar investments have gained major traction over the last couple years as utilities look to diversify and build out their renewable energy credits to meet state mandates. For many of these utilities, First Solar is their partner of choice. It's the name behind some of the biggest facilities in the world, and has converted more power purchase agreements, or PPAs, into energy projects than any of its competitors. Its massive 550 MW Topaz Solar Farm will provide PG&E Corporation with enough electricity to power 160,000 average California homes. Until recently, that kind of power was only possible from fossil fuel and nuclear plants, but First Solar's products are currently competitive with a variety of energy sources in a variety of settings.

First Solar stock has come into its own in the past couple years and is doing something it's never done before: it's growing steadily. While there's no dividend to keep income investors happy from quarter to quarter, First Solar, is no longer scrambling to cover every aspect of the solar market. It's found its niche and is both the first and largest mover in the space. The company isn't as reliant on subsidies or tax credits as many of its competitors, and its steady stream of unfilled orders from major corporations should keep this stock on a more predictable path in the years to come.

Go green to make green?

It's safe to say that the renewable energy sector still suffers from a shortage of safe investment options. But as these three stocks show, there are interesting and innovative ways to make safe investments in renewable energy -- investments that could lead to major gains in the years to come.