Source: Jason Industries.

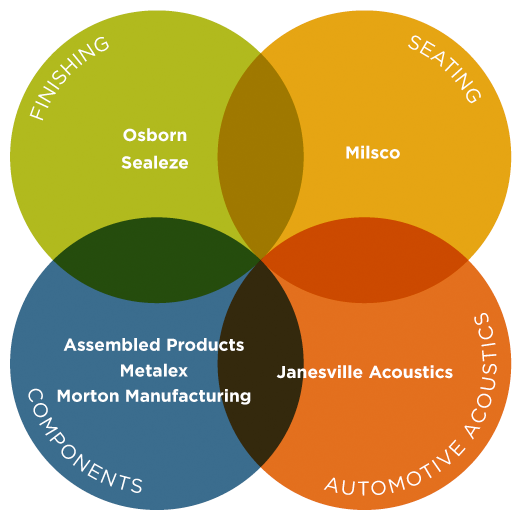

Many small companies cater to a single niche set of customers, looking for ways to become a specialist in a particular area with promise. For Jason Industries (JASN +0.00%), though, one niche isn't enough, with the small conglomerate specializing in everything from automotive acoustics to seating and finishing products as well as component manufacturing. Coming into its second-quarter earnings report, Jason Industries investors had hoped to be able to avoid sales declines, but those efforts proved unsuccessful, and the stock has continued to perform poorly following the company's announcement of its results. Let's take a closer look at Jason Industries to see where it might be able to improve its long-term performance.

Jason Industries leaves investors wanting more

As we've seen in previous quarters, Jason's second-quarter results had both positives and negatives. Sales eased downward by 1.6% to $187.6 million, which was fairly consistent with what investors following the stock had expected from Jason. Substantial costs related to restructuring, integration, and transaction activity contributed to a GAAP net loss of $0.9 million. Yet after adjusting for those costs as well as stock-based compensation, adjusted earnings of $0.12 per share were a nickel higher than the consensus forecast among investors.

A deeper look at Jason's segments showed some pockets of strength. The components segment, which is Jason's smallest, saw a 6% rise in revenue, with the company citing growth in sales of metal products for railroad freight cars. The acoustics division also held up relatively well, with a sales decline of 1.5% coming entirely from adverse foreign currency moves, and larger volumes from newly won business helping to drive organic growth up 1.2%. Yet seating net sales fell 1.3% due to lower volumes of seats for motorcycles and turf-care products, and weaker demand for industrial products sent the finishing segment's sales down nearly 7%, including a 2% drop in organic sales.

The results were fairly similar in looking at segment operating earnings. Components saw rising profits from lower steel prices, and cheaper raw materials also sent acoustics' earnings up. Yet finishing and seating both struggled with operating income declines, in part due to foreign currency weakness.

CEO David Westgate tried to put the company's results in a positive light. "We achieved solid performance in the second quarter driven by volume strength and margin expansion in Acoustics and Components," Westgate said, and "our focus on strong operational execution helped us overcome market softness in Seating and Finishing."

Can Jason Industries keep growing?

The company also is relatively confident about its future prospects. As Westgate said in the conference call, Jason Industries has already received awards of business for which it anticipates starting production during the third and fourth quarters of 2015, and acoustics in particular has a lot of promise with new business coming online. Seating and components should also contribute to future sales.

The acquisition of DRONCO in early June also led Jason Industries to increase its guidance, and the company reiterated those expectations in its conference call. With the German maker of finishing abrasives joining the Jason team, it now expects sales of $708 million to $723 million and adjusted EBITDA of $87 million to $91 million, both of which are higher ranges than Jason had previously forecast. The conglomerate believes that further cost synergies will appear within the first 18 months after the acquisition, and access to a key market could help bolster overall results and be a good strategic fit for its finishing business. New cross-selling opportunities could also result from the combination, further supporting the decision to merge.

Jason Industries shares initially reacted positively to the news, jumping on the day of the report, but since then, they've given back all of those gains and fallen to new lows. There's no question that Jason faces a challenging environment in some of its business, but it still needs to demonstrate its ability to stay resilient if it wants to go beyond its current scope and become a more important player in the industries it has targeted for growth.