Eaton Corp plc (ETN 0.38%) basically said the third quarter was worse than it thought it would be when it released quarterly earnings results. To make the reading even more dour, the industrial giant expects future results to be worse then previously expected, too. Here are the key takeaways.

Missing it

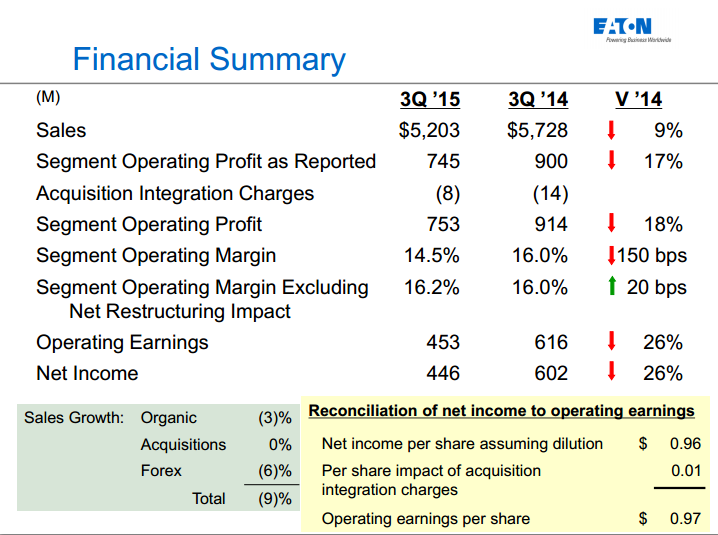

Eaton posted third quarter earnings of $0.97 a share, a full 25% drop from the year ago period. With the global growth headwinds the company has been facing that wasn't exactly surprising. However, Eaton also missed analyst expectations of roughly $1.00 a share. And it lowered it's full year guidance and highlighted that end-market weakness is likely to linger into 2016, as well. Essentially, the company is telling investors the tough times aren't over.

Eaton Corp's third quarter summary. Source: Eaton Corp.

On the top line Eaton posted revenues of $5.2 billion. That was below consensus estimates of a touch over $5.3 billion and 9% lower than the year ago period. To be fair, six percentage points of that can be attributed to currency fluctuations, but that still leaves a three percentage point impact from organic revenue declines.

The "bright" spots in the quarter were basically flat organic sales in the electric products segment and a 1% organic sales increase in the aerospace business. Neither of which are something to write home about. Everything else was pretty weak, with the hydraulics segment still the standout on the downside, suffering from the slowdown in China and weak agricultural sales.

This is in stark contrast to General Electric Company (GE 2.71%), where organic sales rose 4% in its industrial business during the third quarter. And the company was able to post solid results at five of its seven industrial business divisions. That said, not even GE has been able to sidestep the tough market, with new orders down roughly 23% year over year. Clearly Eaton isn't doing well, but the market is obviously getting tougher for everyone.

Doing something

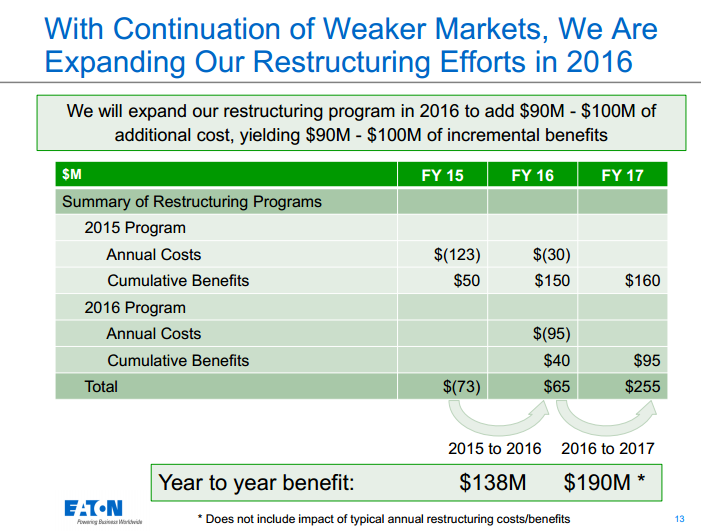

So that's not a great backdrop. Which is why Eaton announced that it was increasing its restructuring plans for next year by around $40 million. That will push the planned spending from around $50 to $60 million to $90 to $100 million. Eaton is basically looking to pull out costs to better align its businesses with the current state of the market.

Eaton Corp's updated savings plans. Source: Eaton Corp

While the market is weak and Eaton's results prove that out, the company is also generating lots of cash. According to the company it produces a record $973 million of operating cash flow in the quarter. It's putting that to use. For example, it made a small acquisition in the quarter, adding a maker of stadium LED lighting to its portfolio.

And, more notably, Eaton has been buying back shares. In the quarter it repurchased $284 million worth of stock, bringing its year to date total up to 1.5% of the outstanding share count at the start of the year. CEO Alexander Cutler noted that, "Given the weak stock price performance for U.S. dollar denominated industrials, we would expect to continue our strong bias toward deploying our excess cash flow over the next year for share repurchases." So look for the company to keep buying on price weakness.

We're working on it

Eaton's numbers were pretty bad in the quarter, there's no way around it. And it doesn't look like the near future is going to be much better. That said, the company is eating its own cooking, if you will, buying shares at what it believes is a low price. Moreover, it's moving to adjust to the new environment. These are all positive signs and, truth be told, Eaton has survived lean times before in its over 100 year history. For those with a long-term bent, now might be a good time to take a look. That said, don't go in expecting a near-term turnaround.