Westport Innovations (WPRT -1.76%) is set to report financial results for the third quarter on Nov. 10 after market close, and the expectations are relatively low. We know the company will report a net loss in the quarter, but the biggest questions surround its ongoing efforts to cut costs while several key products work through their development cycles.

Factor in the impending merger with Fuel Systems Solutions (NASDAQ: FSYS), which is on track to close before year-end, and there are a lot of moving parts. Let's take a closer look at some key items to focus on when Westport reports earnings on Tuesday afternoon.

Expenses trending lower, but there's work to do

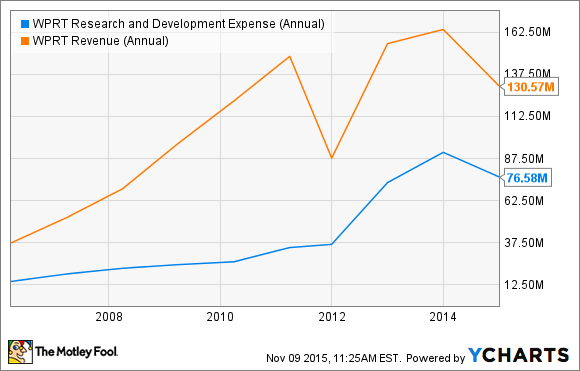

Westport Innovations has historically spent a huge amount of money on research and development:

WPRT Research and Development Expense (Annual) data by YCharts.

Unfortunately, those investments have been very slow to produce profits. Outside of the company's joint venture with diesel engine maker Cummins, which has regularly paid a profit to both partners, Westport has failed to move out of the red:

WPRT EPS Diluted (Quarterly) data by YCharts.

Those ramped-up investments in R&D (along with a slew of other expense increases) have only led to bigger losses in recent years, as end markets like heavy trucking have been slower to adopt natural gas engines than Westport or most experts expected.

Unfortunately, it could get worse before it gets better. Estimates are for an ugly demand environment in the near future, due to the huge decline in diesel and gasoline prices over the past year. Westport has been forced to take some major steps to cut costs:

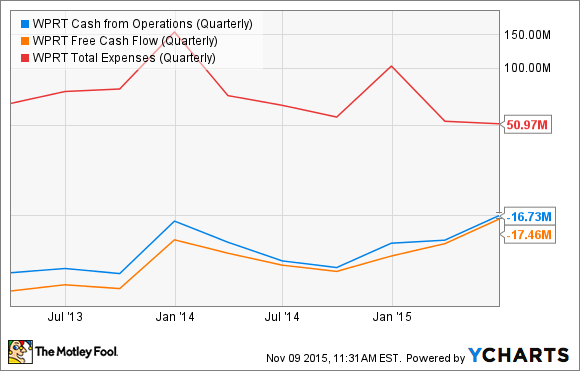

WPRT Cash from Operations (Quarterly) data by YCharts

As you can see, costs are indeed falling, and total expenses are down significantly in recent quarters. This has helped improve cash from operations and free cash flow, though both remain negative.

Pay attention to SG&A, R&D expenses

Westport has significantly cut these costs in recent quarters:

WPRT Research and Development Expense (Quarterly) data by YCharts.

But even with the cuts, these expenses still make up a substantial percentage of revenue and the profit share from Cummins Westport. In other words, management needs to continue lowering these expenses.

Cash and capital

Because Westport's efforts to build a market have yet to pay off, the company has used a significant amount of equity to fund operations over the past few years, nearly doubling the share count since 2011. With the stock now trading in the low single digits, management has chosen to sell off some non-core assets to raise additional cash in an effort to help buy time for the market to recover.

At the end of the second quarter, Westport had $60 million in cash and equivalents on hand, down about $33 million from the beginning of the year. The asset sales management discussed are not expected to close before the fourth quarter, so it's likely that cash will have declined between $10 million and $20 million in the quarter, depending on the timing of Westport's payments to and from vendors and customers.

The clock is indeed ticking, but the key here is to look for incremental reductions in cash burn each quarter.

Fuel Systems Solutions merger

This won't really have any material impact on what is reported in the third quarter since the deal won't close until Q4, but it's still critically important to the company's future.

Fuel Systems has historically focused on industrial and automotive markets, while Westport has worked to develop engine technology for medium- and heavy-duty markets. The merger will combine the two companies, with Westport investors holding 64% of the combined company and Fuel Systems shareholders holding the remaining 36%.

It's not clear how much more we will learn, but expect management to provide an update on the status of the merger, which is expected to generate some $30 million in combined cost reductions by 2018.

Looking ahead

Over the past year, Westport and partner Delphi Automotive PLC have worked toward commercialization of the company's proprietary high-pressure, direct-injection technology for heavy-duty engines. Westport recently released an update on the status of HPDI 2.0, announcing several key steps in the first half of 2016, including delivering components to OEM partners for customer field testing by mid-year. And while final commercial launches are up to the OEMs, this will be a major step forward for one of Westport's most important products.

In the interim, cash preservation is critical, and management must continue to focus on strengthening operational efficiency and capital allocation. Pay close attention to the company's cost structure, as well as updates on asset sales and the upcoming merger with Fuel Systems when the company reports.