Star Trek Beyond, the latest film in the legendary sci-fi franchise, opens on July 22.

Like most entertainment companies, Viacom (VIAB +0.00%) is a diversified business whose primary interests are in film and television. But to look at the financials is to understand that broadcast and cable programming deliver the lion's share of profits.

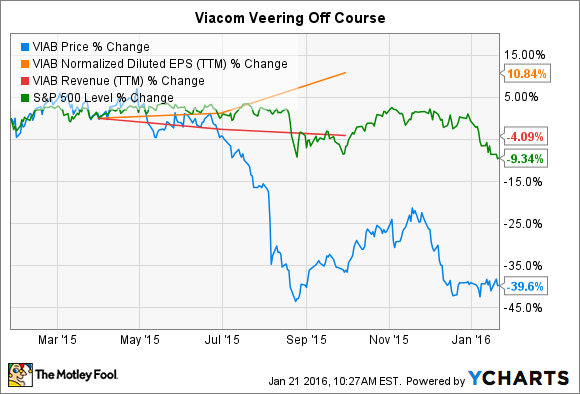

There's been less to go around in recent years. According to S&P Capital IQ, revenue has declined in each of the last four fiscal years. Operating profits had been slowly climbing over the same period, until last year, when they declined 4.9%. The stock responded as you'd expect.

Investors shouldn't expect better results in 2016. Here's why:

- Intense box office competition. While theatrical releases aren't Viacom's bread and butter, accounting for less than 3% in operating income in fiscal 2015, good franchises tend to produce above-average Blu-ray, download, and streaming sales. The few that Viacom's Paramount Pictures has scheduled for 2016 will face terrific competition. For example, Teenage Mutant Ninja Turtles: Out of the Shadows, due on June 3, opens just one week after X-Men: Apocalypse and one week before the video game adaptation Warcraft. The next month, Star Trek Beyond gets nearly immediate competition from a new Jason Bourne adventure, followed by Time Warner's intriguing antihero adventure, Suicide Squad in early August. Another year of declining box-office revenue and profit seems likely.

- A glut of interesting cable programming. History may mark the period we're living in now as the golden age of cable TV. From HBO to Showtime to a bevy of streaming options and fringe networks, it's rarely been easier to find good programming to watch. In response, Viacom has been forced to cut back in some areas -- including layoffs at MTV. Initial reports from last March had Viacom targeting a better-than-10% reduction in staff at the network. Recent cuts include eliminating reporters tasked with covering the genre entertainment business. Don't be surprised if this trend continues into 2016 and beyond.

- Uncomfortable changes to the advertising business. Advertisers aren't signing long-term deals in the same volume or at the same price as they used to. Practically, this means Viacom networks such as Nickelodeon and MTV are having a tougher time selling space "up front," after the initial fall TV schedule is developed and released. Instead, buyers are increasingly waiting to scoop up open slots just before programs air via what's known as the "scatter" market. Viacom, in particular, has seen more sales move to the scatter market; domestic ad revenue declined 9% year over year in fiscal Q3 and another 7% in the fourth quarter. Increasing options and programmatic tools from the likes of TubeMogul and others have given buyers more leverage in negotiating fees. I don't see that changing anytime soon.

Now it's your turn to weigh in. Even if the trends don't favor Viacom, the stock trades for less than 9 times earnings and pays a dividend yielding 3.8% as of this writing -- enticing figures for bargain hunters. Would you buy at these levels? Keep the conversation going in the comments section below.