Source: SunPower Corporation.

SunPower Corp. (SPWR +0.00%) boasts the most efficient, mass-produced solar panels in the world -- but that doesn't necessarily make it the best solar stock. Here are three reasons 8point3 Energy Partners (CAFD +0.00%) may be a better buy for your portfolio.

8point3 101

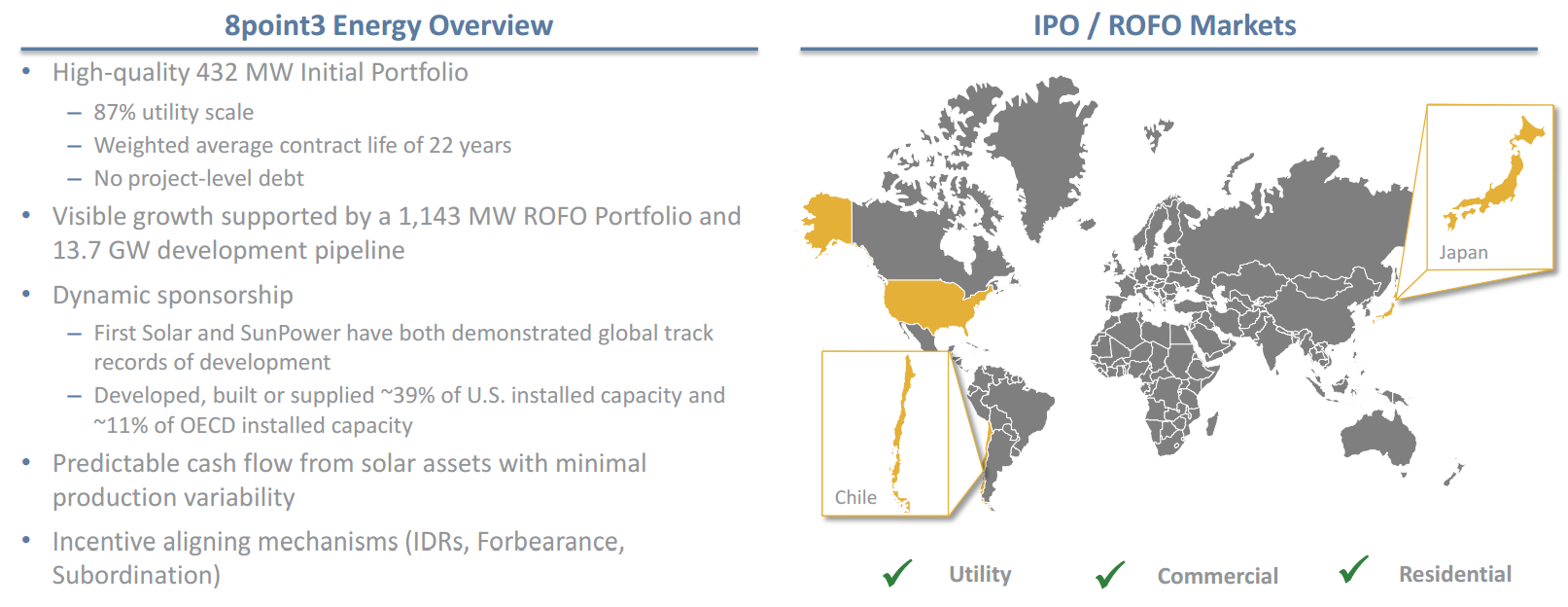

Named for the amount of time it takes light from the Sun to reach the Earth (8.3 minutes), 8point3 is not your average solar stock. Jointly launched by SunPower and First Solar (FSLR +5.42%), this stock is essentially an amalgamation of the two companies' steadiest solar projects. Its "yieldco" status allows it to distribute most of its earnings directly to investors via dividends, in similar fashion to real estate investment trusts and the master limited partnerships of the fossil fuel business. This mandate also allows its sponsor companies, SunPower and First Solar, to focus their finances on growth opportunities, creating clearer options for investors to choose from.

Built-in diversity ...

SunPower and 8point3 are intrinsicly linked. But since 8point3 is a joint creation with First Solar, investors enjoy built-in corporate diversity when they buy this stock. Both companies have enjoyed relative success in an industry littered with losers, but each resides in an independent niche. While SunPower primarily plays the role of solar panel producer, First Solar is mostly in the business of developing entire utility-scale solar projects to sell off and run on contracts.

... But also a pure renewable-energy play

While it's true that 8point3 benefits from dual-parent diversity, it's also a unique opportunity for income investors interested in renewable energy pure plays. Before the advent of yieldcos, investors with an eye for both green energy and dividends had to make do with utility stocks. Even the "greenest" utilities out there, such as NextEra Energy (NEE +1.39%) with its nearly 11,300 MW of wind energy generation capacity, still rely on non-renewable balance. Natural gas, nuclear, and oil, account for a combined 38% of NextEra's energy portfolio fuel mix.

With 8point3, investors know what they're getting themselves into: 432 MW of contracted clean energy projects, with more of the same on the way.

Dividend Dynamite

Currently, 8point3 offers investors a 5.5% dividend yield. Its most recently quarterly earnings exceeded expectations, meaning the yieldco is continuing to pull in the kind of cash it needs to support distributions.

Its 2016 plans call for annual dividend growth of 12% to 15%, supported by both existing long-term contracts and new drop-down assets from First Solar and SunPower. Commenting on future cash available for distribution, 8point3 CEO Chuck Boynton recently noted, "We believe that with our stable, diversified portfolio of solar assets, our dual sponsor structure and associated pipelines and the current favorable policy environment, we are well positioned to sustain targeted growth rates."

Know the Risks

There are a lot of reasons to love 8point3, but every investment carries risks. The yieldco status that the corporation enjoys is relatively new, and it remains unclear whether markets will ultimately accept these stocks as useful investments. 8point3 launched in mid-2015, when many yieldcos were in the midst of getting hammered by bear markets. Compared to its IPO, 8point3's share price is down more than 25%.

Investors should keep a close eye not just on 8point3, but on how Mr. Market treats yieldcos in general over the coming year.

Regardless of the risks, 8point3 stock presents itself as a formidably favorable investment option in the solar industry space now. Before buying SunPower stock, investors should consider whether there's a place for 8point3 Energy Partners in their portfolio.