How to buy bonds

Unlike stocks, most bonds aren't traded publicly but rather trade over the counter, meaning you must use a broker. Treasury bonds, however, are an exception. You can buy those directly from the U.S. government at TreasuryDirect without going through a middleman.

The problem with this system is that investors have a harder time knowing whether they're getting a fair price because bond transactions don't occur in a centralized location.

A broker, for example, might sell a certain bond at a premium (meaning above its face value). Thankfully, the Financial Industry Regulatory Authority (FINRA) regulates the bond market to some extent by posting transaction prices as that data becomes available.

Pros and cons of investing in bonds

Pros:

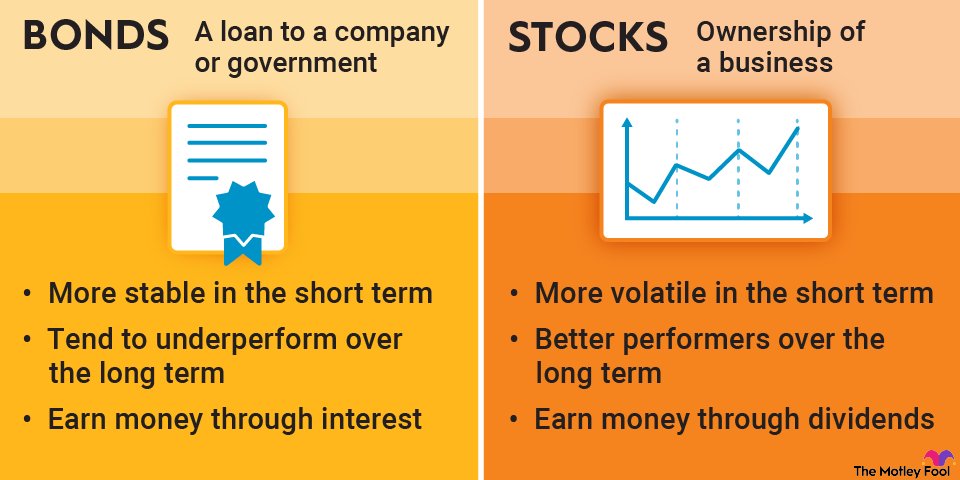

- Safety: One advantage of buying bonds is that they're a relatively safe investment. Bond values don't fluctuate as much as stock prices.

- Income: Bonds offer a predictable income stream, paying you a fixed amount of interest twice a year.

- Community: When you invest in a municipal bond, you might help improve a local school system, build a hospital, or develop a public park.

- Diversification: Perhaps the biggest benefit of investing in bonds is the diversification they bring to your portfolio. Over the long run, stocks have outperformed bonds, but having a mix reduces your risk. Investors tend to allocate more money to bonds as they get older and want to trade growth for safety.