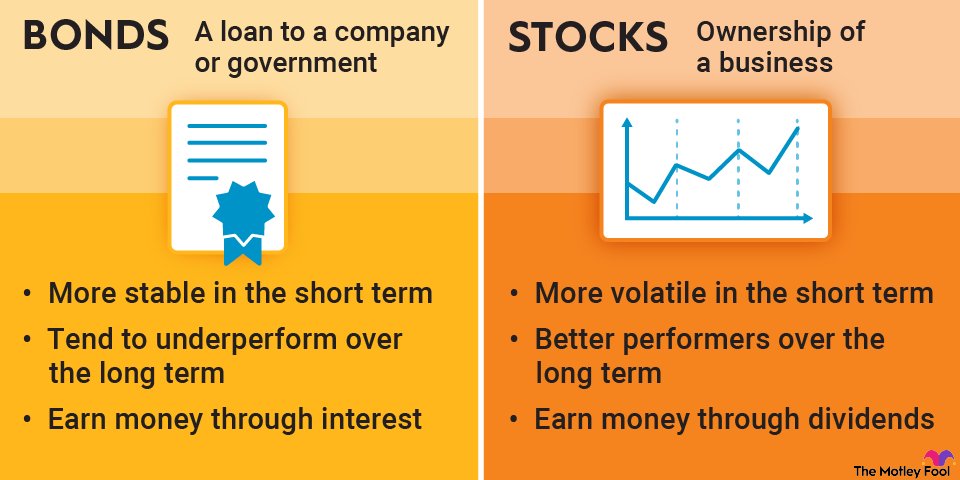

A bond is a loan made to a government entity or company with a set interest rate and maturity date. Many investors buy bonds to help reduce risk, diversify their portfolio, and generate interest income.

In addition to that guaranteed fixed-income return, bonds offer some other advantages in a high-interest-rate environment. For example, if interest rates fall, the price of a bond goes up, and you can make money selling your bond rather than holding it until maturity.

Interest Rate

If interest rates remain elevated, more investors are likely to turn to bonds to earn a reliable return on their investment. That includes bond funds and bond exchange-traded funds (ETFs), as well as options such as corporate bonds and municipal bonds. If you want to invest in bonds, keep reading to see some of the best bonds and bond funds you can buy today.

Top eight bonds to invest in for the long term

Name | Ticker | Yield | Description |

|---|---|---|---|

10-year Treasury note | Benchmark | 4.1% | Benchmark Treasury bond |

26-week Treasury bills | N/A | 3.8% | Six-month Treasury bill issued by the U.S. Treasury |

iShares iBoxx Investment Grade Corporate Bond ETF | 4.4% | Fund holding investment-grade-rated corporate bonds | |

Vanguard Tax-Exempt Bond ETF | 3.6% | An index fund that tracks investment-grade municipal bonds | |

Vanguard Short-Term Corporate Bond Index Fund | 4.2% | Fund that tracks the Bloomberg 1-5 year corporate bond index | |

Guggenheim Total Return Bond Fund | 5.2% | Bond fund that seeks to maximize total return | |

Vanguard Total International Bond Index Fund | 3.0% | Fund that tracks the performance of a Bloomberg index, excluding U.S. assets | |

Fidelity Short-Term Bond Fund | 3.9% | Fund managed to have similar interest rate risk to the Bloomberg Barclays U.S. 1-3 Year Government/Credit Bond Index |

1. 10-year Treasury note

If you're looking for a straightforward bond investment, it's hard to beat Treasuries. U.S. Treasury bonds are considered the safest in the world and are generally regarded as risk-free. The 10-year rate is considered a benchmark and is used to determine other interest rates, including mortgage rates, auto loans, student loans, and credit cards.

Treasury yields are closely tied to the federal funds rate, so they are likely to move as the Federal Reserve adjusts rates.

2. 26-week Treasury bills (T-bills)

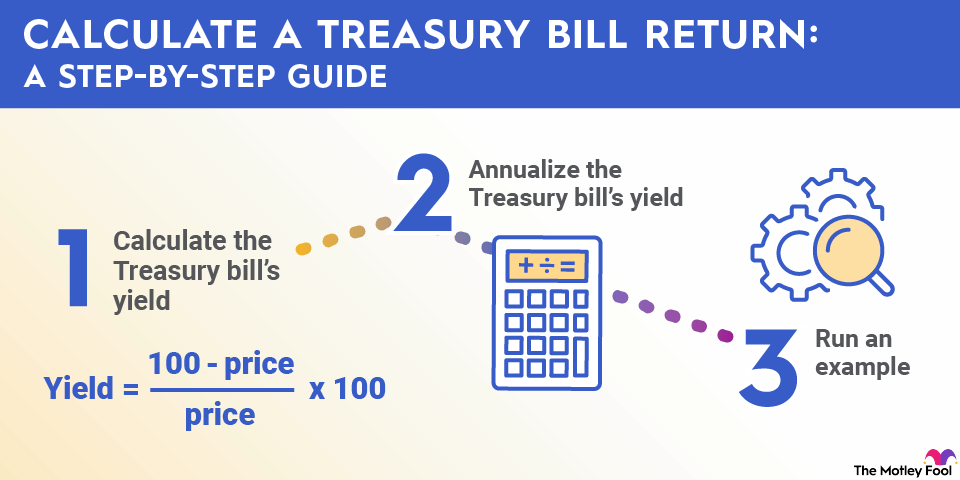

If you're looking for a place to park your cash short-term, T-bills are the gold standard. The U.S. government issues these shorter-duration securities. They differ from Treasury notes and bonds in that they don't pay interest. Instead, the U.S. Treasury sells T-bills at a discount and redeems them at their face value at maturity.

The Treasury sells T-bills that mature in four-, six-, eight-, 13-, 17-, 26-, and 52-week terms. The 26-week term tends to be a popular option because it typically offers a higher interest rate than shorter-duration notes.

3. iShares iBoxx Investment Grade Corporate Bond ETF

NYSEMKT: LQD

Key Data Points

Investment-grade corporate bonds tend to offer higher interest yields compared to government bonds. While they're not "risk-free" like 10-year Treasury notes, they tend to be lower-risk bonds backed by companies with investment-grade bond ratings.

The iShares IBoxx Investment Grade Corporate Bond ETF makes it easy to invest in high-quality corporate bonds. This bond ETF provides access to almost 3,000 investment-grade bonds through a single fund. This bond fund offered a yield of more than 4.4% in late 2025.

4. Vanguard Tax-Exempt Bond ETF

NYSEMKT: VTEB

Key Data Points

State and local governments issue municipal bonds to fund their operations and projects. They offer investors a way to earn interest income with the added bonus that the interest is exempt from federal taxes.

The Vanguard Tax-Exempt Bond ETF tracks the performance of investment-grade municipal bonds. The fund holds more than 9,800 securities and offered a yield of about 3.6% in late 2025.

5. Vanguard Short-Term Corporate Bond Index Fund

NASDAQMUTFUND: VSCSX

Key Data Points

Short-term bonds offer some advantages over long-term bonds, depending on your investing needs. Because of the shorter duration of short-term bonds -- considered to have maturities of five years or less -- they have less interest rate risk and are more likely to preserve the principal.

The fund holds almost 2,600 bonds from a range of blue chip companies such as Bank of America (BAC +1.57%), CVS Health (CVS -0.50%), and AbbVie (ABBV -2.96%). It aims to track the Bloomberg U.S. Corporate 1-5 Year index. The fund offered a yield of 4.2% in late 2025.

6. Guggenheim Total Return Bond Fund

NASDAQMUTFUND: GIBIX

Key Data Points

A total return bond fund differs from a typical bond fund in that it generates returns through both coupon payments and rising bond prices. This can happen either because yields fall, which is generally determined by central banks and macroeconomic forces, or because the fund owns bonds whose credit ratings improve, which also leads to falling yields and rising prices.

The Guggenheim Total Return Bond Fund owns a range of more than 1,950 bonds, including Treasuries, municipal bonds, and corporate bonds. It paid a yield of 5.2% as of late 2025.

7. Vanguard Total International Bond Index Fund

NASDAQ: BNDX

Key Data Points

If you're looking for diversification from your bonds, there's no reason to stay within U.S. borders. Emerging markets can offer some of the best opportunities for high-yield investors, so it's worth considering international bonds like the Vanguard Total International Bond Index Fund.

The fund's top holdings are European government bonds, although it holds almost 6,600 different bonds, largely investment-grade. It tracks a Bloomberg index adjusted to exclude U.S. bonds, and it offered a yield of 3% in late 2025.

8. Fidelity Short-Term Bond Fund

NASDAQMUTFUND: FSHBX

Key Data Points

If you're interested in short-term bonds, you don't have to limit yourself to corporate bonds. The Fidelity Short-Term Bond Fund -- one of the best short-term bond funds available-- invests in both short-term Treasury bills and corporate bonds from companies such as financial giants Bank of America, JPMorgan Chase (JPM +0.63%), and Wells Fargo (BCS -3.74%).

The fund is managed to have a similar overall interest rate risk to the Bloomberg Barclays U.S. 1-3 Year Government/Credit Bond index and aims for a dollar-weighted average of three years or less. It offered a yield of 3.9% in late 2025.

Related investing topics

How to choose the best bond

Investors have a multitude of choices when it comes to bonds. You can invest in U.S. government bonds, corporate bonds (investment-grade and junk), or international bonds. Investors have the option of directly buying bonds in their brokerage accounts or buying a bond fund (ETF or mutual fund). With so many options, it can be hard to choose the best bonds to buy. Here are some factors to consider:

- Active or passive: You need to decide whether you want to actively manage a portfolio of directly held bonds or passively invest in a bond fund.

- Maturity: Short-term bonds are less susceptible to changes in interest rates than those with longer-dated maturities. However, long-term bonds tend to have higher interest rates.

- Issuer: Bond issuers such as the U.S. government or an investment-grade corporation offer less risk than some foreign countries or a company with a non-investment-grade credit rating.

- Taxes: Some bonds have tax advantages. For example, bonds issued by the federal government are typically exempt from state and local income taxes. Meanwhile, municipal bonds are exempt from federal taxes and state taxes in the state that issued the bond.

- Costs: If you invest in a bond mutual fund or ETF, make sure you're aware of the cost. A high-cost fund can eat into the interest income generated by the bond holdings.