You might think the stock market is huge, but the bond market is even bigger. According to the Securities Industry and Financial Markets Association (SIFMA), the global bond market was worth $140.7 trillion at the end of 2023, compared to the $115 trillion global equity market cap.

Although some stock investors may ignore the bond market, fixed-income markets influence the stock market, since bonds compete for investment dollars with stocks and the overall economy. So it's important to understand the bond market even if you have no intention of owning bonds.

If you are considering investing in bonds, there are a number of different options at your disposal, including corporate bonds, municipal bonds, Treasuries, mortgage bonds, and others. In this deep dive into everything about the bond market, we'll review the different kinds of bonds, how the bond market works, how it compares to the stock market, and the pros and cons of investing in the bond market.

What is the bond market?

The bond market refers to the global exchange of debt securities. Unlike the stock market, bonds aren't typically traded on an exchange like the New York Stock Exchange. Instead, bonds are usually bought and sold over the counter through broker-dealers. That's partly because bonds have a range of maturities, coupons, and credit ratings, making it more complex than the stock market, where most companies tend to just have one class of stock available to the public.

Bonds are priced primarily according to two factors: interest rates, which determine how an existing bond compares to a new bond, and the creditworthiness of the borrower. Bond prices, especially for corporate bonds, can fall if investors are concerned that the borrower may become insolvent.

Bonds can be bought and sold in two different ways -- through the primary market and in the secondary market.

Primary market

The primary market refers to new issues of bonds. This is where bonds are originated. If you are buying a bond in the primary market, you are buying it directly from the seller, which could be a company, a government, a bank, or another financial entity that may create a financial product such as a mortgage bond.

Secondary market

On the secondary markets, bonds are bought and sold between investors through a broker. In a sense, bonds on the secondary market are traded like stocks, from investor to investor rather than from the borrower or company. Although bond prices and bond yields can change over time, their coupons and maturities do not, which means bonds generally tend to be less volatile than stocks.

Types of bond markets

Corporate bonds

The corporate bond market is made up of publicly traded and privately held companies that sell debt to finance capital projects. Corporate bonds tend to offer higher yields than other types of bonds, although yields can vary widely from company to company depending on credit ratings and current business prospects. Corporate bonds are divided into investment-grade, which includes any debt rated BBB- or better, according to the Standard & Poor's rating scale, and high-yield. A high-yield bond is also called a junk bond or high-yield bond. Those will pay investors a higher coupon rate, but they also come with greater default risk.

Government bonds

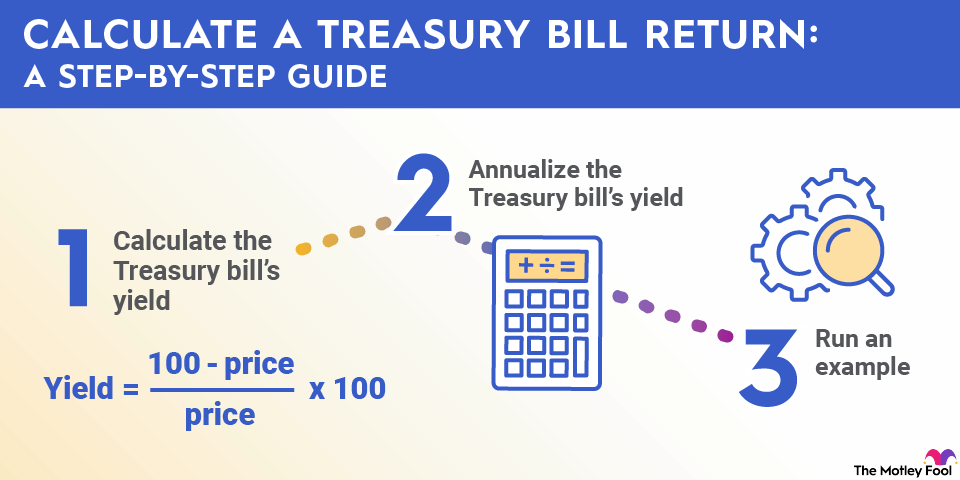

Government bonds are bonds issued by sovereign nations to fund government spending. U.S. Treasuries are the most common example of a government bond. They are considered the safest bonds in the world since they are backed by the U.S. government. In fact, Treasuries are considered so secure that their yields are used to determine the risk-free rate.

Municipal bonds

Municipal bonds are sold by cities and states. Often called munis, the bonds help local governments raise money for a variety of capital projects such as roads, schools, parks, and other infrastructure. Municipal bonds tend to be riskier than government bonds but safer than corporate bonds. Occasionally, a city will default on its debt, but it's a relatively rare occurrence. In 2017, Puerto Rico filed for bankruptcy on $70 billion in debt, the largest public debt default in U.S. history.

Interest from muni bonds is also generally untaxed by the federal government, a bonus for investors.

Mortgage-backed bonds

Mortgage-backed bonds or mortgage-backed securities include individual mortgages that have been bundled into a bond. Mortgage bonds essentially allow fixed-income investors to invest in the real estate market. The 2008-09 financial crisis notwithstanding, mortgage bonds have historically been a safe investment. They can be an opportunity for bond investors looking for high-yield income; interest rates for 30-year fixed-rate mortgages hovered around 6.5% in late 2024.

If you're a fixed-income investor looking for a high yield, emerging-market bonds are the best place to look. Emerging-market bonds are bonds issued by governments or corporations in developing countries. Because debt from emerging markets tends to be riskier, emerging-market bonds tend to offer higher yields than their counterparts from developed countries.

Pros and cons of investing in the bond market

Pros | Cons |

|---|---|

Investors get a reliable income stream. | Unlike stocks, upside potential is limited. |

Credit ratings allow investors to choose the option best suited to their risk tolerance. | The bond market isn't always liquid. Some bonds aren't that easy to sell. |

Falling interest rates will lift bond prices. | If you own bonds, rising yields make them worth less. |

Bond investment strategies

There are two primary investment strategies in bonds, active and passive:

Similar to active vs. passive investing in the stock market, active investing seeks to outperform a certain bond market index through actively buying and selling bonds, based on analysis of market trends, factors like interest rates, and the underlying business.

You can outperform the market with this type of actively managed strategy, but it's more work and is often harder to outperform the index than it looks.

With a passive bond investing strategy, investors typically buy and hold bonds until maturity, aiming to match the performance index. By holding until maturity, you eliminate the risk of fluctuations in bond prices.

For investors looking for fixed income, this is generally a better strategy than active trading.

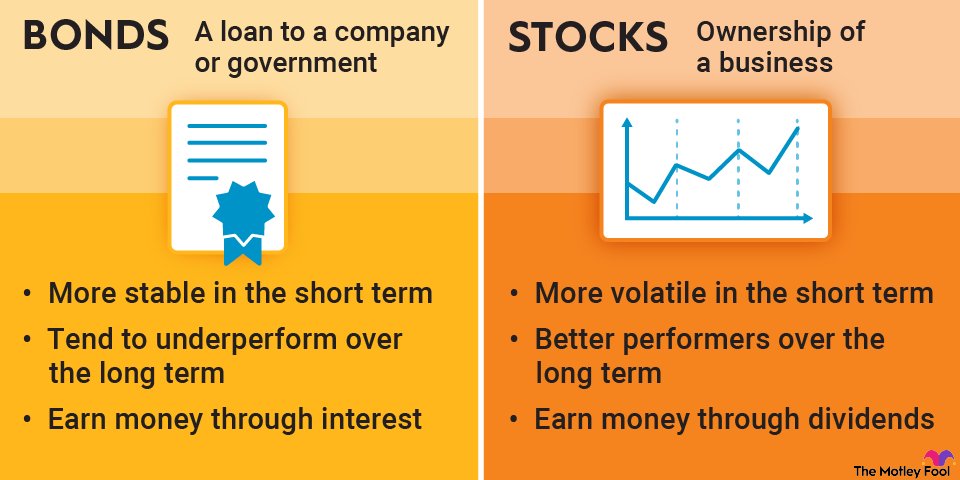

Bond market vs. stock market

The stock market and bond market represent the two main ways businesses raise cash: through equity or debt. Both stocks and bonds give investors an opportunity to collect recurring payments. In stocks, these are called dividends; with bonds, they're coupons. However, with bonds, the purpose of investing is generally to collect the coupon, although investors will be paid back the principal of the bond when it reaches maturity. Some stocks pay dividends, but the price of a stock is generally much more volatile than it is with bonds, so stock investors usually get most of their return from price appreciation rather than dividends.

The bond market and stock market also influence each other. Higher interest rates tend to make bonds more attractive, pulling money out of the stock market and into bonds. The reverse is true in a low-rate environment.

Stocks are generally riskier than bonds, with more upside and downside, so they attract more risk-tolerant investors. Whether you choose to invest in stocks or bonds will likely be determined in part by your time horizon. Financial advisors often recommend a portfolio that shifts from stocks to bonds as the investor approaches retirement. Moving money from stocks to bonds also helps preserve capital, although you lose the opportunity for higher gains.

Why are bond markets generally more stable than stock markets? Stocks represent a share of ownership in a business, so they move according to the prospects of that business, which can change significantly. A bond, on the other hand, represents a share of the business's debt, whose price can change modestly with interest rates, but will be generally stable unless investors fear the company going into bankruptcy.

Fixed income, by definition, is more stable than stocks, whose return is not scheduled the way bonds are.

Related investing topics

The bottom line

The bond market can offer valuable opportunities for investors looking for fixed income streams, and investors of any risk tolerance can find a bond that suits them, from Treasuries to junk bonds to emerging-market bonds.

It also gives corporations and governments a way of raising money. A number of companies prefer to raise money through the debt market rather than by selling new shares and diluting current shares.

In a falling interest-rate environment, bond yields will fall and prices on existing bonds will rise, which could pressure lenders. Lower yields can also encourage investors to move into the stock market, seeking yield from dividend stocks.

Because bonds offer a fixed-income stream, they are popular with retirees and other investors with shorter time horizons. Although you may not choose to invest in bonds, every investor should understand the relationship between stocks, bonds, and interest rates.