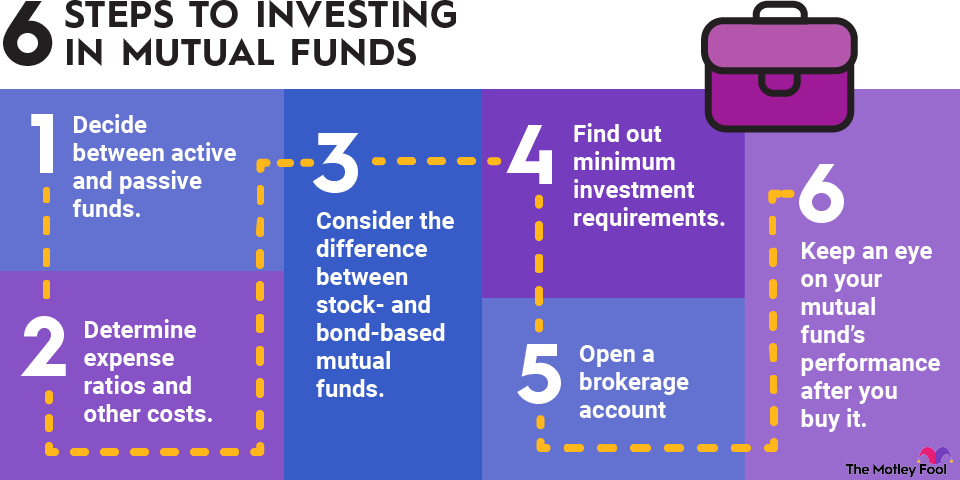

With that in mind, here are some things you should consider as you get started. By the time you have read through this article, you will be in a much better position to invest.

1. Active versus passive funds

First, you should understand the difference between an actively managed and a passively managed mutual fund.

An actively managed mutual fund employs managers who select investments for the fund. A passive mutual fund simply tracks a benchmark index, such as the S&P 500.

Let's be clear: The goal of a passively managed mutual fund is to match the performance of a benchmark index. An actively managed mutual fund aims to beat a benchmark. For this reason, passive mutual funds are also known as index funds.

In practice, however, the majority of active mutual funds don't outperform index funds. In any given year, 40% to 50% of actively managed funds beat their benchmarks. There are some excellent active mutual funds, but it's essential to take a close look at a fund's track record before investing.

2. Expense ratio and other costs

Before you invest, you should know how much a mutual fund costs. The main type of fee you should be aware of is the expense ratio, which is the percentage of the fund's assets that goes toward annual fees. For example, a 1% expense ratio means you'll pay $100 in annual investment fees on a $10,000 account.

Passive mutual funds tend to have expense ratios in the 0.03% to 0.25% range. Active mutual funds tend to have higher expense ratios, often in the ballpark of 1%. This is because they have the added expense of paying investment managers.