If you're interested in options trading, one of the first things to learn is the difference between call and put options. You'll see these terms used all the time, so understanding them is a must.

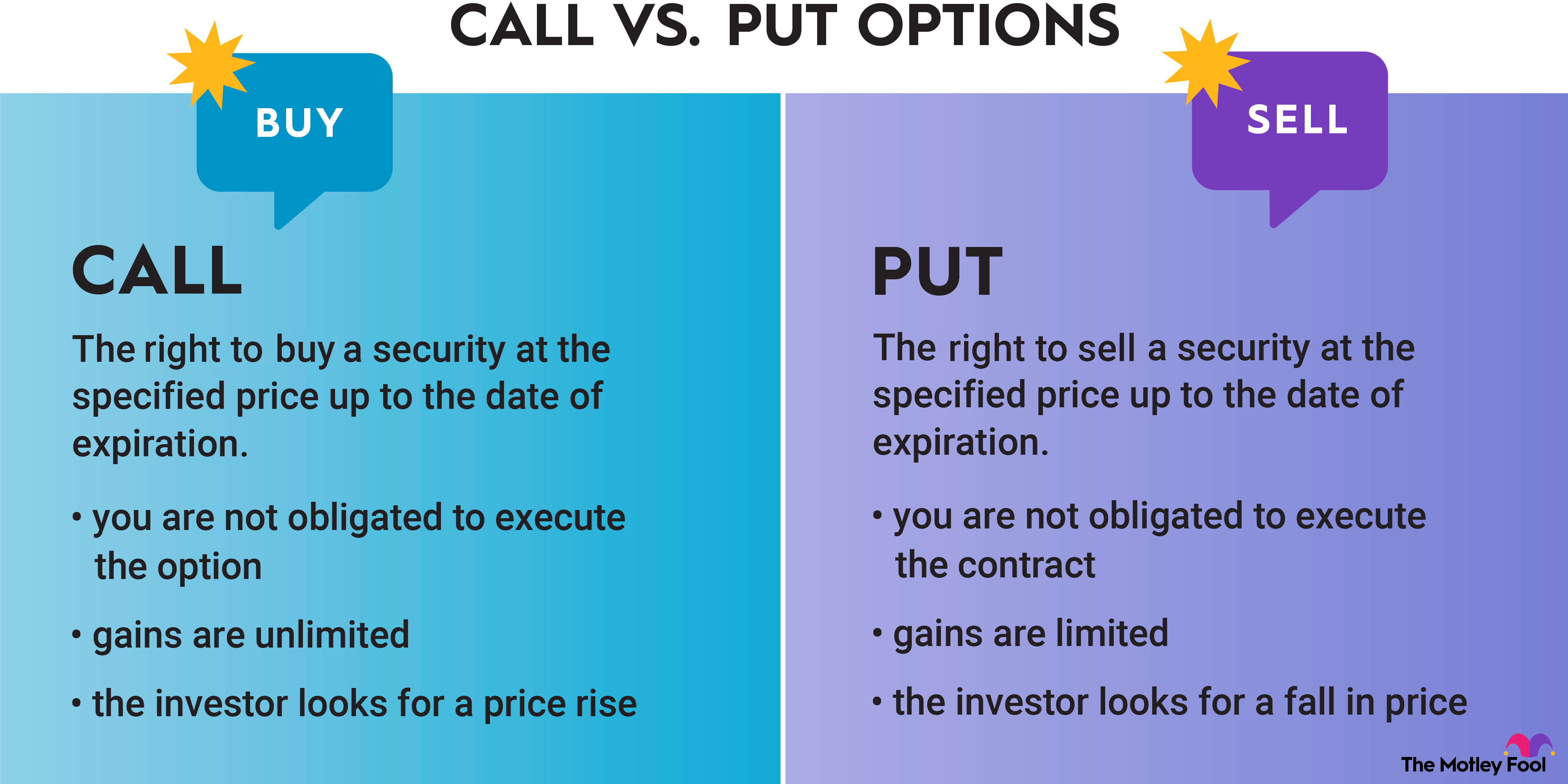

A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price by an expiration date.

That's the short summary of these options contracts. Now, let's take a closer look at how call and put options work, as well as the risks involved with options trading.

How does a call option work?

A call option is a contract tied to a stock. You pay a fee, called a premium, for the contract. That gives you the right to buy the stock at a set price, known as the strike price, at any point until the contract's expiration date.

Strike Price

You're not obligated to execute the option. If the price of the stock increases enough, then you can execute it or sell the contract itself for a profit. If it doesn't, then you can let the contract expire and only lose the premium you paid.

The breakeven point on a call option is the sum of the strike price and the premium. When you have a call option, you can calculate your profit or loss at any point by subtracting the current price from the breakeven point.

As an example, let's say that you're bullish on Apple (AAPL -0.19%) and it's trading at $150 per share. You buy a call option with a strike price of $170 and an expiration date six months from now. The call option costs you a premium of $15 per share. Since options contracts cover 100 shares, the total cost would be $1,500.

The breakeven point would be $185 since that's the sum of the $170 strike price and the $15 premium. If Apple reaches a price of $195, your profit would be $10 per share, which is $1,000 total. If it only goes to $175, you'd have a loss of $10 per share. Your maximum potential loss would be the $1,500 you paid for the premium.

How does a put option work?

A put option is a contract tied to a stock. You pay a premium for the contract, giving you the right to sell the stock at the strike price. You're able to execute the contract at any point until its expiration date.

If the price of the stock decreases enough, then you can sell your put option for a profit. You're not obligated to execute the contract, so if the price of the asset doesn't drop enough, you can let the contract expire.

The breakeven point on a put option is the difference between the strike price and the premium. When you have a put option, you can calculate your profit or loss at any point by subtracting the breakeven point from the current price, or by using the calculator at the bottom of this page.

To give you an example, imagine Netflix (NFLX +0.96%) trades at $500 per share. You think it's overvalued, so you buy a put option with a strike price of $450 and an expiration date three months away. The premium costs $10 per share, which is a total price of $1,000 for the contract.

The breakeven point would be $440, the difference between the $450 strike price and the $10 premium. If Netflix plummets to $400, then you're up $40 per share ($4,000 total) on your put option. If it doesn't drop below $450 at all, then you'd only be able to let the option expire and eat the cost of the premium.

Risks of call vs. put options

The risk of buying both call and put options is that they expire worthless because the stock doesn't reach the breakeven point. In that case, you lose the amount you paid for the premium.

It's also possible to sell call and put options, which means another party would pay you a premium for an options contract. Selling calls and puts is much riskier than buying them because it carries greater potential losses. If the stock price passes the breakeven point and the buyer executes the option, then you're responsible for fulfilling the contract.

The benefit of buying options is that you know from the beginning the maximum amount you can lose. This makes options safer than other types of leveraged instruments such as futures contracts.

Related investing topics

However, options can be riskier than simply buying and selling stocks because there's a greater possibility of coming away with nothing. When investing in stocks, you only need to predict whether the stock goes up or down. For options trading, you need to predict three things correctly:

- The direction the stock will move.

- The amount the stock will move.

- The time period of the stock movement.

If you're wrong about any of those, then the options contract will be worthless. While there's the potential for greater returns with options, they're also harder to trade successfully.

Despite the challenge of successfully trading call and put options, they provide an opportunity to amplify your returns. That can make them a valuable addition to a balanced portfolio. For investors interested in options, there are also more advanced strategies that go beyond buying calls and puts.

FAQs

About the Author

Lyle Daly has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Netflix. The Motley Fool has a disclosure policy.