How does the discounted cash flow model work?

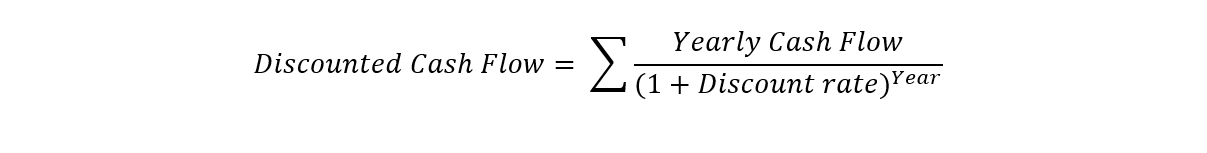

The basic concept underlying the discounted cash flow model is that businesses are theoretically worth the present value of all of their future cash flows. So let's start with the idea of present value. Because money can be invested to generate returns, and inflation generally makes the value of a dollar worth progressively less over time, money today is thought to be worth more than an equivalent amount of money at some point in the future. The further in the future, the higher the discount or the less the money is worth.

For example, if I invest $1,000 today in a Treasury bond with a 2% yield, in a year that $1,000 would be worth $1,020. Conversely, if I know that I'm getting a payment of $1,000 in one year from now, then the present value of that $1,000 is 2% less because it is money that is not already in my portfolio generating returns.