One major key to success in investing is to avoid overpaying for an asset, as that can hurt your returns. Investors often turn to a valuation calculation to gauge whether they're paying a fair price on a potential investment opportunity. There are a variety of valuation methods out there for investments, falling within two basic approaches:

- Relative valuations: These compare multiples and metrics in relation to other companies in a sector.

- Absolute valuations: These value a company based on an estimate of future income, such as discounted cash flow (DCF) or the dividend discount model (DDM), to put an intrinsic value on the company.

One of the absolute valuation methods is the residual income model. Here's a closer look at an approach widely used by analysts to value a company's stock.

What is the residual income model?

Residual income is the income a company produces after accounting for its cost of capital (the weighted average cost of a company's debt and equity). Thus the residual income model attempts to adjust a company's future earnings projections to account for the cost of equity, which includes dividend payments and other equity costs. This approach enables analysts to put a more accurate value on a company.

The residual income model is similar to the DCF and DDM approaches. However, in contrast with the DDM, it substitutes future residual income for dividends. Meanwhile, instead of using the weighted average cost of capital for the discount rate like the DCF model, the residual income model uses the cost of equity.

When should investors use the residual income model?

The best use of the residual income model is for valuing companies that either don't pay a dividend or generate positive free cash flow.

The DDM is a better valuation model for dividend stocks, while DCF is the best method for stocks that don't generate dividends but still generate free cash flow. However, neither valuation method is useful for companies that don't generate free cash flow -- and thus likely can't afford to pay dividends -- since they lack either of those key inputs. However, this is where the residual income model shines, as investors can easily access the required data on a company's financial statement.

How to use the residual income model

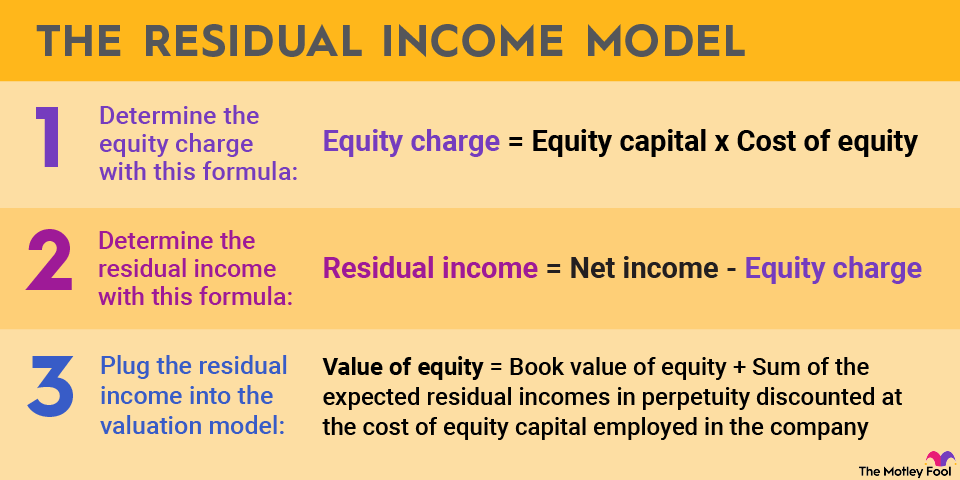

To value a company using the residual income model, an analyst must first determine the company's residual income. That's a two-step process:

First, determine the equity charge. This number is the equity capital (the funds paid into the business by investors in exchange for common or preferred stock) multiplied by the cost of equity (dividends per share for the next year, if any, divided by the current market value of the stock plus the growth rate of dividends).

Put another way, the formula is:

Growing companies often use the residual income model to determine the best price at which to issue new equity to finance expansion. The model helps place an absolute value on a company based on its projected residual income and the cost of equity. That way, the company won't end up issuing new shares at too low a valuation, which would dilute existing investors, or selling at too high a price, which might result in a poorly received stock offering.

The pros and cons of the residual income model

There are several benefits to using the residual income model, including:

- It uses readily available data from a company's financial statements.

- It's a useful valuation method for companies that don't pay dividends or generate free cash flow.

- It focuses on a company's economic profitability instead of its accounting profitability.

Meanwhile, there are several drawbacks to this method, including:

- It's not the best valuation model for companies that pay dividends or generate free cash flow.

- It relies heavily on forward-looking estimates.

- The cost of equity, a key input, can be arbitrarily set by an investor, skewing the results.

Related investing topics

Another tool in the investor's valuation toolbox

The residual income model, like most others, is far from a perfect valuation method. However, it does help investors put an absolute value on companies that aren't generating free cash or paying dividends. That makes it a useful tool to help investors make more informed investment decisions about earlier-stage companies.