Mutual funds are investments that combine money from many investors to invest toward a common goal.

Mutual funds allow investors to pool their money to invest in a diverse portfolio of stocks, bonds, or other assets. They can be a great way to get exposure to the stock market and other types of asset classes, without the need to research and select individual stocks.

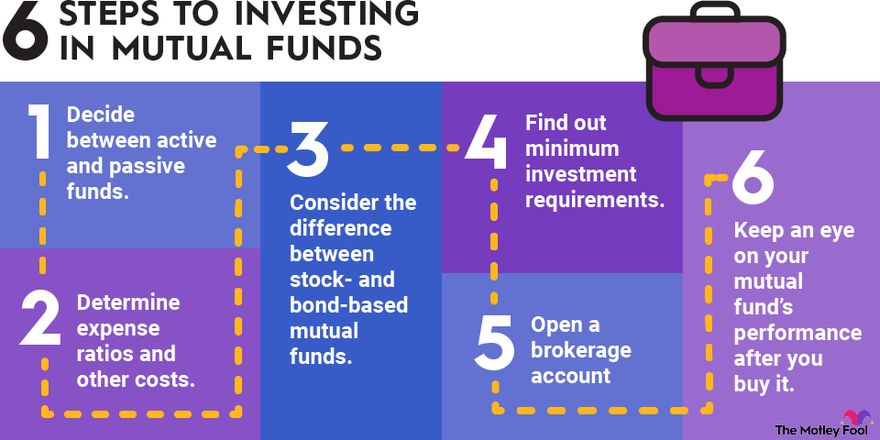

Mutual funds are more hands-off investments than building a portfolio of individual stocks and bonds. That's for sure. However, there's a lot you should know before you invest in your first mutual fund.

With that in mind, here are some things you should consider as you get started. By the time you have read through this article, you will be in a much better position to invest.

Active vs. passive

1. Active versus passive funds

First, you should understand the difference between an actively managed and a passively managed mutual fund.

An actively managed mutual fund employs managers who select investments for the fund. A passive mutual fund simply tracks a benchmark index, such as the S&P 500.

Let's be clear: The goal of a passively managed mutual fund is to match the performance of a benchmark index. An actively managed mutual fund aims to beat a benchmark. For this reason, passive mutual funds are also known as index funds.

In practice, however, the majority of active mutual funds don't outperform index funds. In any given year, 40% to 50% of actively managed funds beat their benchmarks. There are some excellent active mutual funds, but it's essential to take a close look at a fund's track record before investing.

Costs

2. Expense ratio and other costs

Before you invest, you should know how much a mutual fund costs. The main type of fee you should be aware of is the expense ratio, which is the percentage of the fund's assets that goes toward annual fees. For example, a 1% expense ratio means you'll pay $100 in annual investment fees on a $10,000 account.

Passive mutual funds tend to have expense ratios in the 0.03% to 0.25% range. Active mutual funds tend to have higher expense ratios, often in the ballpark of 1%. This is because they have the added expense of paying investment managers.

It's important to mention that an expense ratio isn't a fee you have to pay. It will simply be reflected in the fund's performance over time.

Some mutual funds charge a sales commission, known as a sales load or, simply, a load. A front-end load is a commission paid when you buy the fund, while a back-end load is a commission paid when you sell. That said, there are many great no-load mutual funds in the market, so you should generally avoid any mutual fund with a sales load.

Stocks vs. bonds

3. Stocks versus bonds

You can find mutual funds that invest in many asset classes, but most invest in either stocks (equities) or bonds (fixed income).

Investors should generally have some of each in their portfolio. Older, less risk-tolerant investors should generally focus more on bonds, while younger investors are better off maintaining a more stock-heavy allocation.

One good rule of thumb is to subtract your age from 110 to get a ballpark idea of your appropriate stock allocation. For example, if you're 40, you should have roughly 70% of your invested assets in stocks and the other 30% in bonds or fixed-income investments.

Invest how much?

4. Decide how much to invest

You should weigh a couple of factors when considering how much to invest. First, most mutual funds have minimum investment requirements.

For example, one of the most widely held active mutual funds, the Dodge & Cox Stock Fund (DODGX -2.15%), has a $2,500 minimum initial investment for standard accounts and a $1,000 minimum if you invest through an IRA. Additional investments must also be at least $100. Be sure to check fund minimums before investing.

The other consideration is how much of your portfolio should be in mutual funds. If you want to keep your investments on autopilot, there's absolutely nothing wrong with having a portfolio made up entirely of mutual funds. However, if you want to buy stocks as well, mutual funds can help form a nice core for your portfolio.

Open an account

5. Open an account

When it comes to actually buying mutual funds, you have two choices. First, you can open an online brokerage account and place your mutual fund orders there.

Alternatively, you can open an account and buy mutual funds directly through the companies that offer them. For example, if you want to invest in a mutual fund offered by T. Rowe Price (TROW 3.88%), you can do so directly through the company.

The brokerage route is a great choice if you want to own mutual funds from several different firms. Plus, there is value in holding a portfolio of mutual funds and stocks in one place. Many top online brokers provide excellent mutual fund screening and research tools.

Alternatively, a direct account with the fund provider can be an excellent way to avoid paying a commission for funds that don't appear on your broker's no-transaction-fee (NTF) list.

Monitoring

6. Keep an eye on your mutual funds after you buy them

Finally, it's worth discussing what you should do after you invest in mutual funds. Specifically, it's important to occasionally assess your portfolio and rebalance if needed. Through the natural course of market movements, you might find that your asset allocation shifts.

For example, if you're targeting an allocation of 60% stocks and 40% bonds with your mutual funds, strong stock market performance could push this to 70% and 30%. To keep your portfolio's risk level appropriate to your situation, it's important to conduct this checkup every year or so.

Related investing topics

The bottom line

The bottom line is that mutual funds can be a great means of investing for the long term without worrying about selecting individual stocks and bonds. By understanding the basic concepts discussed here, you'll be equipped to construct a rock-solid mutual fund portfolio of your own.

FAQ

Mutual fund FAQ

When should I invest in mutual funds?

Any time is a good time to invest in a great fund. Don't try to time the market.

Is it worth investing in mutual funds?

Investing in a mutual fund is a good choice if you are looking for a simple way to diversify your portfolio. If you seek a relatively safe investment, pick a passively managed mutual fund (also known as an index fund) that tracks a large index, such as the S&P 500.

Where do I invest in mutual funds?

If this is your first time investing in mutual funds, you must open a brokerage account. Start there and ask your brokerage for specific guidance.

Can I withdraw money from a mutual fund anytime?

Yes, you can generally withdraw money from a mutual fund any time you want. Mutual funds transact once per day, so you can request a sale of your shares, and it will be completed the same business day. However, there are some considerations, and certain mutual funds may have extra fees if you withdraw money before a certain amount of time has passed.

How much money do I need to invest in mutual funds?

The amount of money required depends on the funds you choose. Some mutual funds have minimum investment requirements of $2,500 or more, but there are others that allow much lower investments. Many mutual funds have lower minimums if you invest through an IRA.