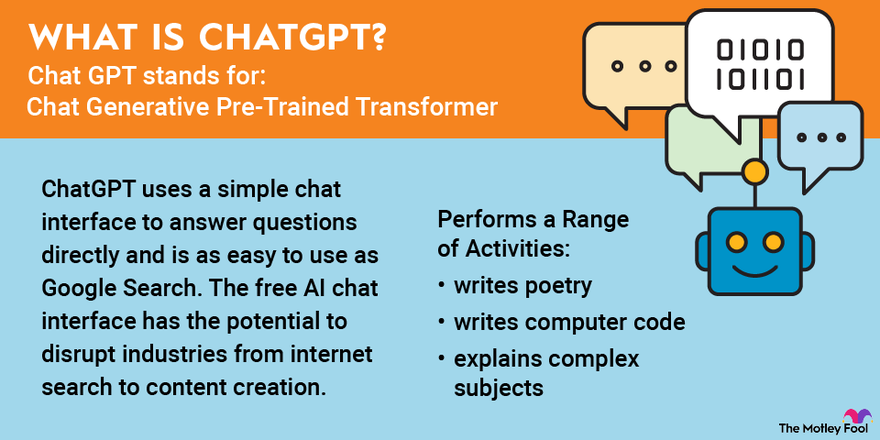

Generative AI has become the most hyped technology since the smartphone, and ChatGPT is the biggest reason.

The technology has wowed everyone from CEOs to technologists to ordinary users, performing a range of activities like writing poetry and computer code or explaining complex subjects in neatly packaged paragraphs. It's also passed high-level exams for law school, medical licensing, and MBA programs, and it continues to get better with regular updates.

ChatGPT (the name stands for "Chat Generative Pre-Trained Transformer") uses a simple chat interface to answer questions directly and is as easy to use as Google Search. The free AI chat interface signed up 100 million users in just two months after its November 2022 launch, and it has the potential to disrupt industries from internet search to content creation.

In this article, we'll discuss the implications for ChatGPT and generative AI chatbots more generally, how you can get exposure to it as an investor, and whether you should invest in ChatGPT.

How to invest in ChatGPT

How to invest in ChatGPT

ChatGPT isn't publicly traded, and OpenAI, the company that built it, isn't either. However, there are a number of ways to get exposure to ChatGPT.

The most direct one is through Microsoft (MSFT 0.11%), the tech giant that has had a strategic partnership with OpenAI since 2019 and has invested billions of dollars into the AI startup. After ChatGPT was unveiled in early 2023, Microsoft invested $10 billion in OpenAI, showing both the company's confidence in OpenAI's potential and its belief that artificial intelligence is the next major computing platform.

Another way to get exposure to ChatGPT is through Nvidia (NVDA -0.79%). Nvidia is one of the world's most valuable semiconductor companies and the leading producer of graphics processing units. Its GPUs and accelerators are often used for artificial intelligence purposes, training large language models like ChatGPT and processing large amounts of data. They are a key component in many machine learning models, and they have been in such high demand that there are frequent shortages.

Nvidia dominates the market for data center GPUs, but that could change as competition from peers like Advanced Micro Devices (AMD 0.09%) and Intel (INTC 2.19%) arrives.

Artificial Intelligence

Finally, Arm Holdings (ARM -0.17%) is also a good choice for investors looking to get exposure to ChatGPT and the broader generative AI revolution. Arm is a close partner with Nvidia and licenses its CPU designs to Nvidia and other partners who prize it for its efficiency.

Arm's CPU designs excel at conserving power, which is why they're used in 99% of smartphones and why they're becoming popular for AI data center components. Running AI applications like ChatGPT demands a lot of power, and as that industry scales, demand for Arm's CPUs is likely to rise, as well.

There are also a number of exchange-traded funds (ETFs) that broadly offer exposure to stocks related to ChatGPT and generative AI more.

| Name | Ticker | Market Cap | Description |

|---|---|---|---|

| Microsoft | (NASDAQ:MSFT) | $3.16 trillion | Diversified global tech giant. |

| Nvidia | (NASDAQ:NVDA) | $2.33 trillion | Leading maker of graphics chips. |

| Arm Holdings | (NASDAQ:ARM) | $114.9 billion | Designer of power-efficient CPU and other chip components. |

1. Microsoft

1. Microsoft

Microsoft is best known as a diversified global tech giant. It makes money from a wide range of products, including its Windows operating system, Azure cloud infrastructure service, subscription products like its Office software suite, hardware like Surface, gaming products under Xbox, and the LinkedIn professional social network.

However, more recently, Microsoft has been getting attention for its strategic partnership with OpenAI since the company has bet big on OpenAI and ChatGPT. Microsoft CEO Satya Nadella has called AI the next major computing platform and has already leveraged the power of ChatGPT and OpenAI's tools in a number of products, including Azure and Copilot, Microsoft's new AI assistant.

Its partnership with ChatGPT is also delivering results in its AI partnership, as Microsoft has seen traction in Azure OpenAI. More than 65% of the Fortune 500 now use Azure OpenAI, and in the December quarter, those features increased Azure revenue by six percentage points. The tech giant also said new AI features helped drive LinkedIn revenue up by 29%

If you're looking for the company that's most closely connected with OpenAI and ChatGPT, Microsoft is your best choice. However, the company is big enough that only a relatively small amount of the business is exposed to ChatGPT.

2. Nvidia

2. Nvidia

Nvidia stock has taken off over the last decade as its graphics processing chips have become a vital part of everything from gaming to self-driving cars to artificial intelligence.

AI comes with extraordinary computing demands, and Nvidia's chips are able to handle the workload better than its competitors. Demand for its chips has skyrocketed over the last year soaring, as the company sells the building blocks for AI platforms. More than a year after ChatGPT's release, Nvidia has emerged as the biggest winner from the AI boom since cloud infrastructure companies and others need its chips to run AI models. Revenue more than tripled over multiple quarters.

UBS (UBS 2.08%) estimated that 10,000 Nvidia graphics processing units were used to train ChatGPT, and some analysts estimate that 30,000 of its GPUs are now being used to run OpenAI's chatbot. That number is likely to rise as ChatGPT grows.

Nvidia has also teamed up with Microsoft to build a massive cloud AI computer using tens of thousands of Nvidia GPUs and other Nvidia AI software tools.

Given Nvidia's strength in AI computing power, it looks like a good AI stock to own if you're looking for an investment that will benefit from the growth of artificial intelligence.

3. Arm Holdings

3. Arm Holdings

Arm Holdings has seen its growth rate accelerate in recent months as AI demand begins to flow through, and the company is benefiting because of its low-power CPU architecture.

Arm operates with a unique business model, earning revenue from licensing its designs and then from royalties once those products come to market. In its March quarterly earnings report, management noted that "increased demand for Arm's power-efficient technology for AI from data centers to edge computing" helped drive licensing revenue up 47%.

Arm's fortunes seem closely tied to AI demand as the speed with which generative AI technology, including ChatGPT, gains adoption will determine how fast the company grows.

ETF options

ETFs with exposure to ChatGPT

Although there aren't ETFs with direct exposure to ChatGPT or OpenAI, investing in ETFs can get you exposure to some of the stocks and related companies working with ChatGPT or developing their own generative AI programs. Let's take a look at a few of them.

1. Invesco AI and Next Gen Software ETF

The Invesco AI and Next Gen Software (NYSEMKT:IGPT) focuses on AI stocks that are closely related to generative AI and ChatGPT.

Its top three holdings, for example, are Alphabet (GOOG 0.23%)(GOOGL 0.23%), Nvidia, and Meta Platforms (META -0.05%), three companies that are all investing heavily in generative AI.

The ETF is based on the STOXX World AC NexGen Software Development Index, which comprises companies with significant exposure to technologies that contribute to advancements in software development. The ETF has been around for almost 20 years and charges an expense ratio of 0.61%.

2. Roundhill Generative AI & Technology ETF

Roundhill Generative AI & Technology ETF (CHAT -1.34%) was the first ETF designed to track generative AI stocks. Roundhill believes that generative AI will be one of the most impactful technological innovations of the future as it delivers significant productivity growth.

Its top three holdings are currently Nvidia, Microsoft, and Alphabet. The fund began trading in May 2023, making it one of the newer ETFs available on the market. It has an expense ratio of 0.75%.

3. iShares Robotics and Artificial Intelligence Multisector ETF

If you're looking for a broader approach to a generative AI ETF, the iShares Robotics and Artificial Intelligence Multisector ETF (IRBO 0.18%) could be a good option.

This ETF holds more than 100 stocks and is one of the largest ETFs focusing on AI. The fund seeks to track an index of stocks that could benefit from long-term growth and innovation in robotics technologies and artificial intelligence.

Its top three holdings include Microstrategy (MSTR -1.07%), Nvidia, and Arm Holdings.

Related investing topics

Should you invest?

Should you invest in ChatGPT?

ChatGPT and generative AI have the potential to change everything from the way we work to the way we learn and are entertained.

It's still very early for ChatGPT and the next iteration of AI. Some are even asking if ChatGPT is safe to use since the product is new and has only just started to be monetized. Additionally, the hype around AI stocks sparked a surge at the beginning of 2023, leading shares of AI stocks like C3.ai (AI 3.5%) and anything else connected to artificial intelligence to soar. More recently, a number of those stocks have pulled back as the hype ebbs.

However, for risk-seeking investors, it's not a bad idea to invest in some of these ChatGPT stocks. Microsoft seems like the most stable bet of the bunch. The company has a wide range of products to make use of the AI chatbot, and its partnership with OpenAI will help it benefit from future advances in generative AI technology.

Nvidia should also be a winner since it's likely to benefit from increased demand for computing power, and Arm has similar exposure, thanks to its advantage in power-efficient CPUs.

Although the tech stock crash in 2022 may have chastened investors, ChatGPT has crystallized the potential of AI and is likely to kick off a new race in artificial intelligence.

To hedge your bets, investing in all three of these stocks and holding them for the long term may be one of the best ways to get exposure to ChatGPT. You can also invest in an AI exchange-traded fund (ETF) for broad exposure to the sector, including any of the three above.

Any new technology comes with risk for investors, but the upside potential of the new generative AI technology could be enormous.

FAQ

ChatGPT FAQ

Can you buy stock in ChatGPT?

ChatGPT is owned by OpenAI, which isn't publicly traded, so you can't buy stock directly in ChatGPT. However, you can buy stock in Microsoft, which owns almost half of OpenAI.

Who owns ChatGPT?

ChatGPT is owned by OpenAI, a company that was founded to develop artificial general intelligence (AGI) and to ensure that it benefits all of humanity.

OpenAI was founded as a nonprofit but restructured as a capped-profit company in 2019.

Can I buy stock in OpenAI?

OpenAI is not publicly traded, so you can't buy stock in it. It has no plans to go public at the moment.

Is OpenAI a publicly traded company?

OpenAI is not a publicly traded company, and it currently has no plans to go public.

Is ChatGPT publicly traded?

No, ChatGPT is not publicly traded. OpenAI, the company that owns ChatGPT, is also not publicly traded.

What's the best AI stock to buy?

No one knows for sure what the best-performing AI stock will be, but Nvidia has so far been the leader in generative AI and the biggest beneficiary from the explosion in AI. It's one of the easiest AI stocks to own, and is likely to continue to benefit from the growth of the sector.