There are many ways to invest in real estate that allow you to create passive income streams and build equity as you go, including the BRRRR method.

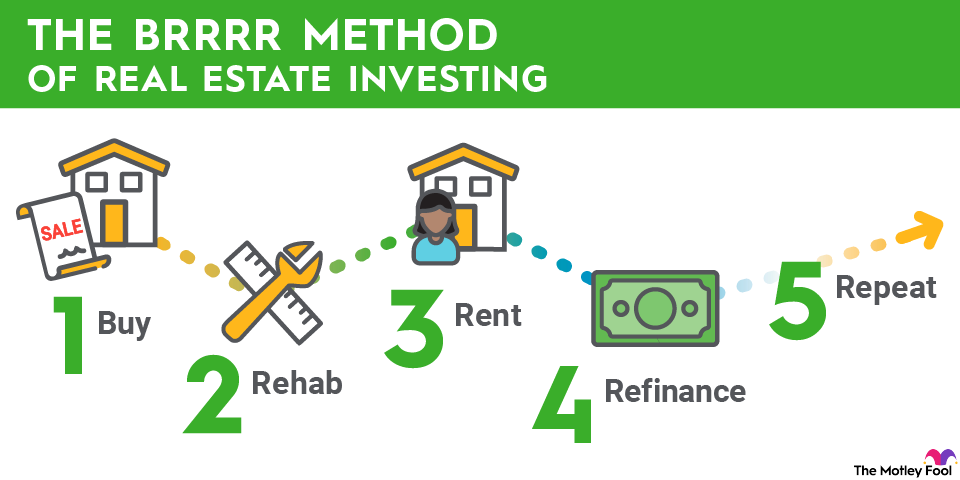

The BRRRR method is a strategy where investors buy and rehab a distressed property, rent it out, do a cash-out refinance, and repeat the process by buying another rental property with the profits. By renovating a property, you’ll build immediate equity that you can then use to buy another property, as well as gain a rental unit that you can rely on for passive income for years to come.

How the BRRRR method works

BRRRR stands for “buy, rehab, rent, refinance, repeat.” It’s a great way to build up a substantial real estate portfolio in a short(ish) time frame.

It’s not an easy process since you’ll need to be intimately familiar with rental housing in your area, as well as the costs associated with a proper rehab. But if your finger is constantly on the pulse of your local real estate market, the BRRRR strategy may be for you. Here’s how it works.

1. Buy

The first step to BRRRR is to buy a property. But not just any property will work, and you can’t enter into a contract lightly. You must be certain that:

- The property is a good value, and you can afford it.

- When repairs are complete, you’ll have significant equity to tap.

- You can generate strong cash flows from rental income.

Estimating the home’s after repair value (ARV) before making an offer is part of the process, as is estimating the costs of those repairs. You’ll want to be sure that the total cost of repair plus the cost of purchase (including things such as closing costs) doesn’t exceed 70% of the ARV.

After Repair Value

This will mean being very honest about what you are capable of doing yourself, what you’ll need to hire outside help for, and what you must do to comply with your local building regulations. The costs of labor and materials can add up, and all of that should go into the estimate.

When you make your offer, do it with no passion whatsoever. Offer what you can afford, and don’t stretch your budget to make something work just because you really like the property. This isn’t your personal home. It’s an investment property, and accounting needs to rule the day.

2. Rehab

Rehabbing is the first “R” in the BRRRR method. Although HGTV makes it look easy to rehab a property, it’s actually a lot of hard work. You’ll need a great eye for detail, a talented crew, and a good sense of what changes will improve your property value versus what will simply make it look nice.

You’ll especially need to consider the mechanical items in your property since you’re not just rehabbing it. You’ll be renting this unit out in the future, which means you’ll also be the one making future repairs. If you gloss over the 15-year-old furnace so you can install shiplap throughout, that’s going to come back to bite you.

Other improvements that can increase both rental and property values include moderate upgrades to kitchens and bathrooms, hard flooring, and installing energy-efficient items such as windows and doors (including the garage door). Curb appeal is a great place to invest as well, especially when it comes to dressing up the front of the home. But above all else, stick to your budget.

3. Rent

Step three, or the second “R” in the BRRRR method, is to rent out your now-completed rehabbed property to someone who will take care of it. This means choosing a great renter who won’t let you down. A strong rental history for your property is going to be important to your future refinance, so look for a stable renter.

This person probably has had the same job, or at least has worked in the same field, for a long time. They haven’t moved around a lot by choice (but work relocation does happen). They don’t have a significant criminal history (although incidents do happen that can stick with people for years). Be sure to pull a credit report so you can see how well they pay their bills and if they appear to be overleveraged already.

Just as a bank wants to see that you’ll come through with each mortgage payment, you’ll need to ensure that your renter has a solid financial profile. A lease is also a must-have since it will be needed for the refinancing portion of this process.

You can hire a property manager to deal with the day-to-day responsibilities of your rental property, but make sure you’ve budgeted that expense into the rent that you charge.

4. Refinance

The fourth step, or the third “R” in BRRRR, is “refinance.” Once your project is done and your renter secured, you’ll talk to the bank about recapturing as much of the equity in your property as possible. The bank, in turn, will need an updated appraisal, a copy of your tenant’s lease, and possibly more information about your own finances. They may also acquire an updated credit report.

In some situations, you may have to be patient and allow for your mortgage to “season” before you can refinance it. Often you’ll be required to hold the same mortgage and make on-time payments for approximately six months, but it will vary based on the loan product you used to secure the property and with what kind of loan you’re refinancing it.

How you choose to refinance that equity is up to you, whether you wholly refinance and take out a new mortgage, or if you simply use a second mortgage to tap what’s available. There are some interest environments where one is a better choice than the other. You may want to speak to an accountant about how to proceed for the best long-term outcomes.

5. Repeat

The last step, if you did the rest correctly, is a piece of cake: repeat. You simply go back to the “B” in BRRRR, and work your way down. Before you choose your next property, it’s a great idea to go over the project you just completed and look at what things you did well and what things you could have done better.

These are simple considerations that can help tighten up your process and improve your efficiency as you go along. Every rehabbed property is different, but the steps you take to bring them back to life are not. Remember, systems first, always, and then make repairs with an eye on both rental and property value increases.

Related investing topics

Example of the BRRRR method in action

Now that you know how BRRRR is supposed to work in theory, let’s walk through a more solid example. Let’s say that the house you’re interested in buying will be worth $350,000 when it’s rehabilitated to be in line with the rest of the neighborhood (the AVR). You’re looking to stay under 70% of that value in total money input so there will be something to refinance out later.

The property itself is in poor condition, but the systems and other expensive items are fairly new. You estimate that you can invest less than $50,000 in materials and labor for repairs and upgrades. Since 70% of $350,000 is $245,000, that’s the budget you’ve got to work with.

From the $245,000, you need to budget out $50,000 for the repairs you’ve calculated. That leaves you with $195,000 to offer the sellers.

Although the real estate market is often fickle, your offer is accepted. The owners weren’t prepared to do all they needed to do to get the house on the market, so this works well for them, too.

Your permanent initial purchase mortgage loan ends up with a payment of around $1,200 per month. You rent the property for $2,500 per month, giving you a healthy cash flow and one that will be sustainable with the higher refinance amount. (Most banks will want you to continue to cash flow after the refinance stage, as well as before it.).

The bank then allows you to refinance your mortgage for 80% of the value of the rehabbed property. The property’s value is now $350,000, which is exactly what you anticipated. So you’ve now successfully mortgaged the property for $280,000, repaying the $245,000 you put into it.

When it’s all over, you have an extra $35,000 in cash to use to invest in the next property (along with whatever cash from your pocket you put into the first one). Pretty neat trick!

Pros and cons to using the BRRRR method

There are pros and cons to anything, including the BRRRR method. Here are a few to consider.

Pros

- In a market where home values continue to climb, you can build both equity and cash quickly.

- Long-term renters will keep the mortgage covered, the home in good shape, and the utilities paid.

- You’ll know your rental properties inside and out.

Cons

- If market conditions deteriorate, you may not be able to “repeat,” and the cycle will end until the market recovers.

- Unexpected repairs or code compliance issues can wipe out a budget in no time flat, possibly forcing you to sell before you’ve finished the job.

- Choosing the wrong renters can mean added expenses simply from the wear and tear of people moving in and out too often, not to mention any actual damages.

The bottom line

The BRRRR method can be a clever way to build capital for a rental portfolio in a relatively short time frame, but it’s definitely not a get-rich-quick situation. You’ll need to commit a lot of thought and energy to the property you choose and what it will become.

But if you’re good at planning ahead, and you’ve got ample experience in home improvement -- or better yet, professional construction -- your very first BRRRR can open up a world of possibilities. Just remember that you absolutely must stick to the budget and choose good renters to keep the cycle alive. No banker will refinance a rental property that can’t pay for itself.