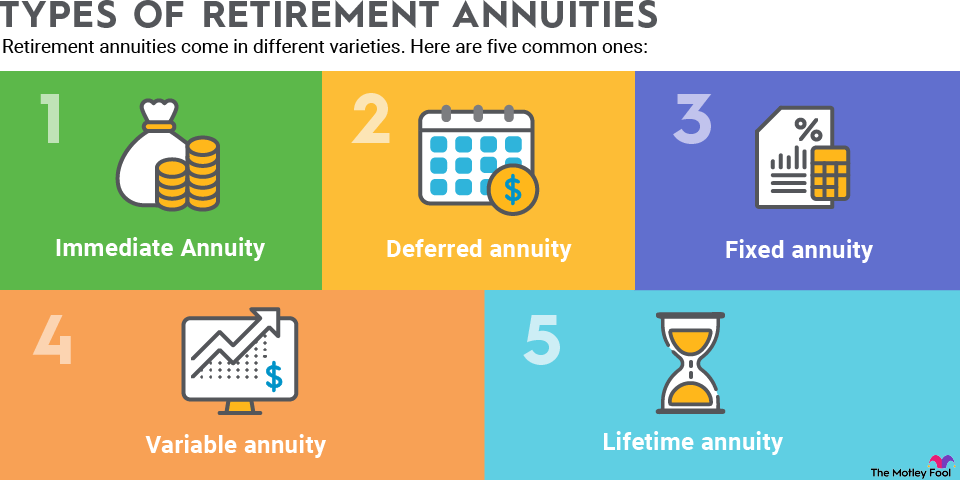

Alternatives to annuities

If you want long-lasting income without the fees and complexity of annuities, there are other options. Social Security and dividend stocks are two that may serve your needs.

Social Security

Besides annuities, Social Security is one of the few income streams designed to last for the rest of your life after you start claiming it.

Your Social Security benefit is calculated from your earnings history. Still, you can influence the amount -- even as you near retirement. You could, for example, raise your working income in the last few years of your career to push your benefit higher. Waiting to collect Social Security would also increase your benefit.

Relative to an annuity, Social Security has the obvious advantage of no up-front cost. If you delay your retirement to raise your Social Security benefit, you will forgo income up front. But at least that money doesn't come out of your savings account.

Dividends

Dividend stocks could also generate lifelong income. Unfortunately, this is not guaranteed. A company always has the option to lower, suspend, or cancel its dividend.

The good news is that some dividend stocks are more reliable than others. Dividend Aristocrats® (the term "Dividend Aristocrats®" is a registered trademark of Standard & Poor's Financial Services LLC), for example, are companies that have paid and increased their dividends for 25 or more consecutive years. There's also a group of 50-year dividend increasers called Dividend Kings.

Dividend Aristocrats and Dividend Kings don't guarantee dividends, but they won't be quick to cancel a dividend, either. If you can handle some risk, these stocks are suitable options for retirement income.

Relative to annuities, dividend stocks have more uncertainty but greater income potential. You'll earn the dividend income, plus your stocks should also appreciate over time.

The premium for guaranteed income

A retirement annuity guarantees income for a specific duration or for the rest of your life. That guarantee can be comforting, especially if you're worried about outliving your savings. A big downside is that annuities charge a premium for the peace of mind they provide.

Fortunately, you don't necessarily have to choose between an annuity and other income strategies.

Your retirement plan can incorporate multiple income sources -- an annuity, a strategically timed Social Security benefit, plus dividend income, for example. Diversifying in that way can soften the drawbacks of each income source, including your annuity's fees and the uncertainty of a dividend portfolio.