The Uniform Transfers to Minors Act, or UTMA, is a law that allows minors to receive gifts without the need to establish a separate trust. As long as there is an appointed adult custodian to oversee account transactions, UTMA accounts can be a useful tool to keep certain property in a child’s name.

Understanding UTMA

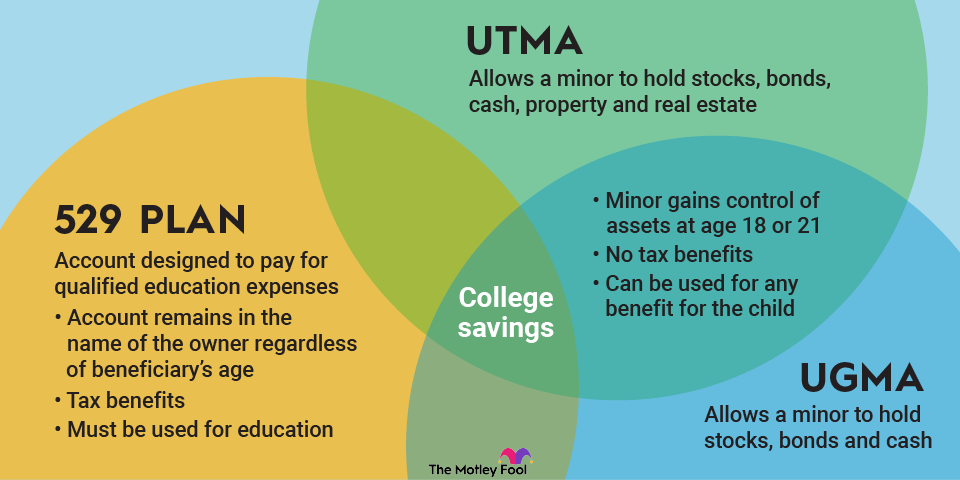

Simply put, UTMA exists to allow minors to receive property. It’s similar in nature to UGMA, or the Uniform Gifts to Minors Act, but not quite the same. UGMA allows a minor account to hold stocks, bonds, cash, and other standard financial instruments, while UTMA allows all the same privileges but also permits real property and real estate.

UTMA accounts aren’t tax-exempt either. Any unearned income over $2,300 arising from UTMA accounts -- such as dividends, interest, and capital gains -- is taxed at the parents’ rate. This is widely known as the kiddie tax.

Taxable Income

In certain cases, if your child’s total unearned income is $11,000 or less, it’s possible to include it on the parents’ income tax return (and not have to file an additional income tax return for the child).

The UTMA account becomes the sole property of the minor when they reach a certain age, which varies from state to state. This is sometimes known at the “age of termination,” or the “age of majority.” The age of termination is usually 18 or 21, but it depends on the state of residence.

When it comes to Social Security, UTMA accounts are not seen as available resources for children applying for disability payments. This logically makes sense. Because property is deposited by someone other than the minor (usually a parent or guardian), and the minor has no immediate access to or control over the assets in question, the UTMA account should not be seen as an “available resource.”

However, once the minor reaches the age of termination, all funds in the name of the minor are then considered available for support. It is the responsibility of the account custodian to be mindful of this transition since a minor child receiving Social Security distributions for years could suddenly have them limited or turned off if the UTMA balance is substantial.

Custodians for UTMA accounts are usually either the parent or guardian of the minor beneficiary. This is the most administratively easy choice, although, depending on the family dynamic, it’s possible that a bank or trust company could be appointed custodian. It’s the custodian’s responsibility -- and fiduciary duty -- to manage the account assets prudently until the minor reaches the age of termination.

UTMA vs. UGMA: What’s the difference?

Let’s take a quick look at the similarities and differences between the two account types:

UTMA Accounts | UGMA Accounts | |

|---|---|---|

Property allowed | Financial assets (stocks, bonds, etc.) and real property. | Financial assets (stocks, bonds, etc.) only. |

Taxation | Unearned income over $2,300 taxed at parents’ rate; may be included on parents’ tax return in certain situations. | Unearned income over $2,300 taxed at parents’ rate; may be included on parents’ tax return in certain situations. |

Age of termination | Varies by state; usually 18 or 21. | Varies by state; usually 18 or 21. |

Counts toward Social Security calculation? | No, but does count after the age of termination. | No, but does count after age of termination. |

Custodian | Required by law. | Required by law. |

You’ll note that UTMA and UGMA accounts are quite similar; the main difference is the additional types of property you can hold in UTMA accounts.

Pros and cons of opening UTMA/UGMA accounts

Pros

- Build assets for minor children: Kids often receive cash gifts for any number of reasons, like birthdays and graduations, and custodial accounts allow for earlier investing and asset growth opportunities. A sizable UTMA account balance at the age of termination can make a huge difference in a child’s life, and the parents or guardians can play an active role in that process.

- No contribution limits: Unlike many accounts with special designations, there are no contribution limits. This allows parents, guardians, family members, or friends to give a child money without regard to hitting a predetermined balance ceiling. However, if the cumulative transfers to the minor by any one person are beyond the annual gift exemption ($17,000 in 2023), the giver would be required to report the gift to the IRS.

- Flexible spending: Although deposits to a UTMA account are considered irrevocable, custodians may withdraw money under certain circumstances as long as the money is used to benefit the minor beneficiary. Once a UTMA account is terminated -- once the minor reaches their state’s qualifying age -- the funds can be used for any reason. This is a big difference between UTMA accounts and 529 plans, which require that invested savings are used on qualified education expenses.

Cons

- No real tax benefits: Unlike many other potential college savings vehicles, such as 529 plans and Roth IRAs, UTMA accounts offer nothing special in the way of tax savings. This is a big deal, especially if the minor’s parents are particularly high earners since this could mean a hefty kiddie tax bill come the following April.

- Contributions are irrevocable: Even though it’s possible to withdraw money early if it’s for the direct and documented benefit of the beneficiary, the money you deposit to a UTMA account is considered an irrevocable gift. This means the money is no longer that of the depositor; instead, it’s the property of the minor, protected by the custodian. It’s in everyone’s best interest to not consider UTMA funds as the same as your own personal savings.

- UTMA/UGMA balances will count as available resources: This applies to both financial aid and Social Security disability benefit calculations. When the minor beneficiary reaches the age of termination, their UTMA money transfers to their name only and is considered a usable asset when it comes to calculating a potential financial aid award. Additionally, if the minor is disabled, any newly released UTMA funds will be used in the consideration of future Social Security benefit payments.

Related investing topics

The bottom line

UTMA and UGMA accounts can be of some use in certain situations, but they don’t offer much in the way of tax savings. There are other accounts, such as 529 plans and Roth IRAs, that can be of use in increasing money for a particular goal like a future education. But for those looking for an additional way to help a child get a leg up, UTMA and UGMA accounts are a viable option.

If you’re seeking an unlimited way to save money for your child, UTMA and UGMA accounts can be useful tools. Be sure to understand your roles and responsibilities as a fiduciary if you’re appointed custodian since you’ll want to abide by the law while doing the right thing for your child.