Understanding UTMA

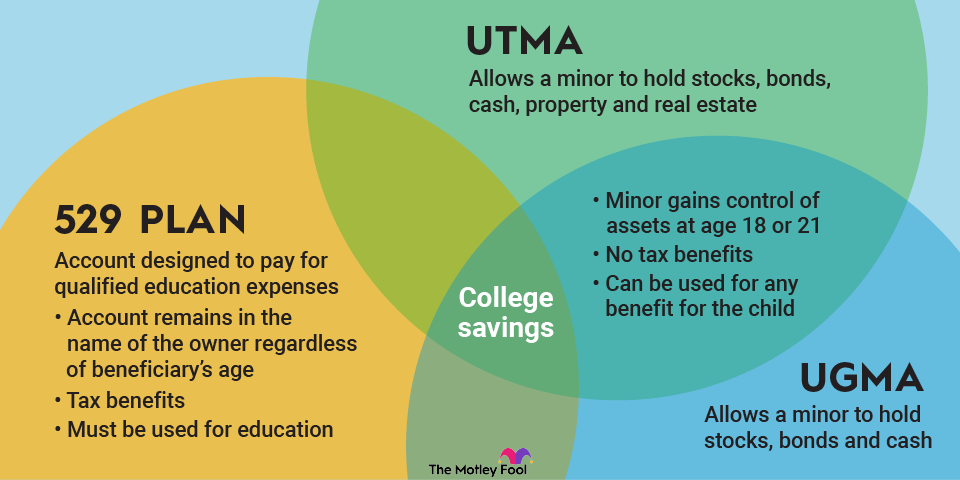

Simply put, UTMA exists to allow minors to receive property. It’s similar in nature to UGMA, or the Uniform Gifts to Minors Act, but not quite the same. UGMA allows a minor account to hold stocks, bonds, cash, and other standard financial instruments, while UTMA allows all the same privileges but also permits real property and real estate.

UTMA accounts aren’t tax-exempt either. Any unearned income over $2,300 arising from UTMA accounts -- such as dividends, interest, and capital gains -- is taxed at the parents’ rate. This is widely known as the kiddie tax.