Introducing Motley Fool Moneyball, Microball, Cryptoball, and AIball – Cutting-Edge Databases That Leverage Artificial Intelligence to Help Investors Make Better Decisions

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

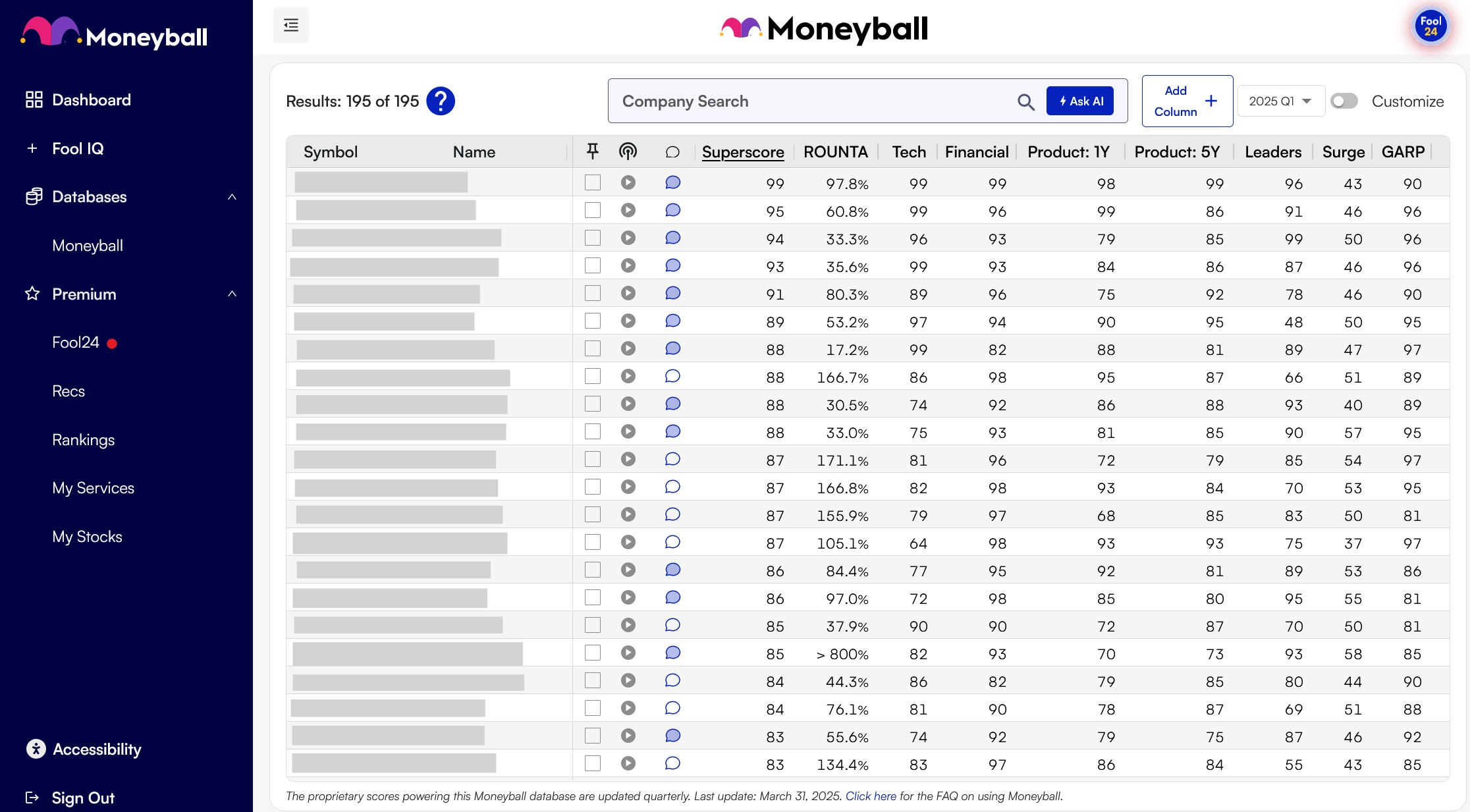

Alexandria, Va. (May 19, 2025) – The Motley Fool, a leader in financial services for over 30 years, announced the launch of its comprehensive suite of AI-powered investment tools designed to empower investors with deeper insights and more efficient research capabilities. The suite includes Motley Fool Moneyball, Microball, Cryptoball, and AIball databases, each tailored to specific investment categories.

"We've been working every day with a team of worldwide AI specialists, designers, and investors to build the most robust databases we've offered in our 30 years," said Tom Gardner, co-founder and CEO of The Motley Fool. "These tools are powered by artificial intelligence, informed by investing acumen, oriented to long-term business performance, and designed to help you make better investment decisions."

The suite of databases provides numerical scores from 1 to 100 across various categories, allowing investors to quickly evaluate companies based on multiple dimensions. The higher the score, the better a company ranks relative to others in the database.

What sets these databases apart is their combination of AI-powered analysis with The Motley Fool's time-tested investment philosophy:

"These databases aren't meant to automatically generate buy or sell decisions," Gardner added. "Instead, they provide valuable context to enhance your investment research process. They're tools for inspiration and deeper research, whether you want a comprehensive deep dive or a quick assessment through our Superscore."

The Motley Fool Moneyball suite of databases is now available to Motley Fool members at various subscription tiers. Members can access these tools through their online dashboard, with the ability to customize views, sort by different metrics, and filter results based on specific criteria.

For more information about Motley Fool Moneyball or to become a member, visit www.fool.com/terms/m/motley-fool-moneyball/.

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, books, newspaper column, radio show, and non-profit The Motley Fool Foundation.

Media contact: [email protected]