Investors often get excited when a major company announces a stock split. But are stock splits good for investors?

With a forward split -- the most common type of split -- the company increases the number of shares on the market. As a result, the share price decreases and potentially attracts more investors, increasing trading activity.

This seems positive, but does it actually affect the value of a stock? We've gone over the stock splits calendar, combed the data from five high-profile stock splits, and compared their performance to the S&P 500. Keep reading to see the results.

Key findings

- Stock splits don't affect the value of shares that you hold in a company.

- A stock split isn't a reliable indicator of whether a stock's value will increase or decrease.

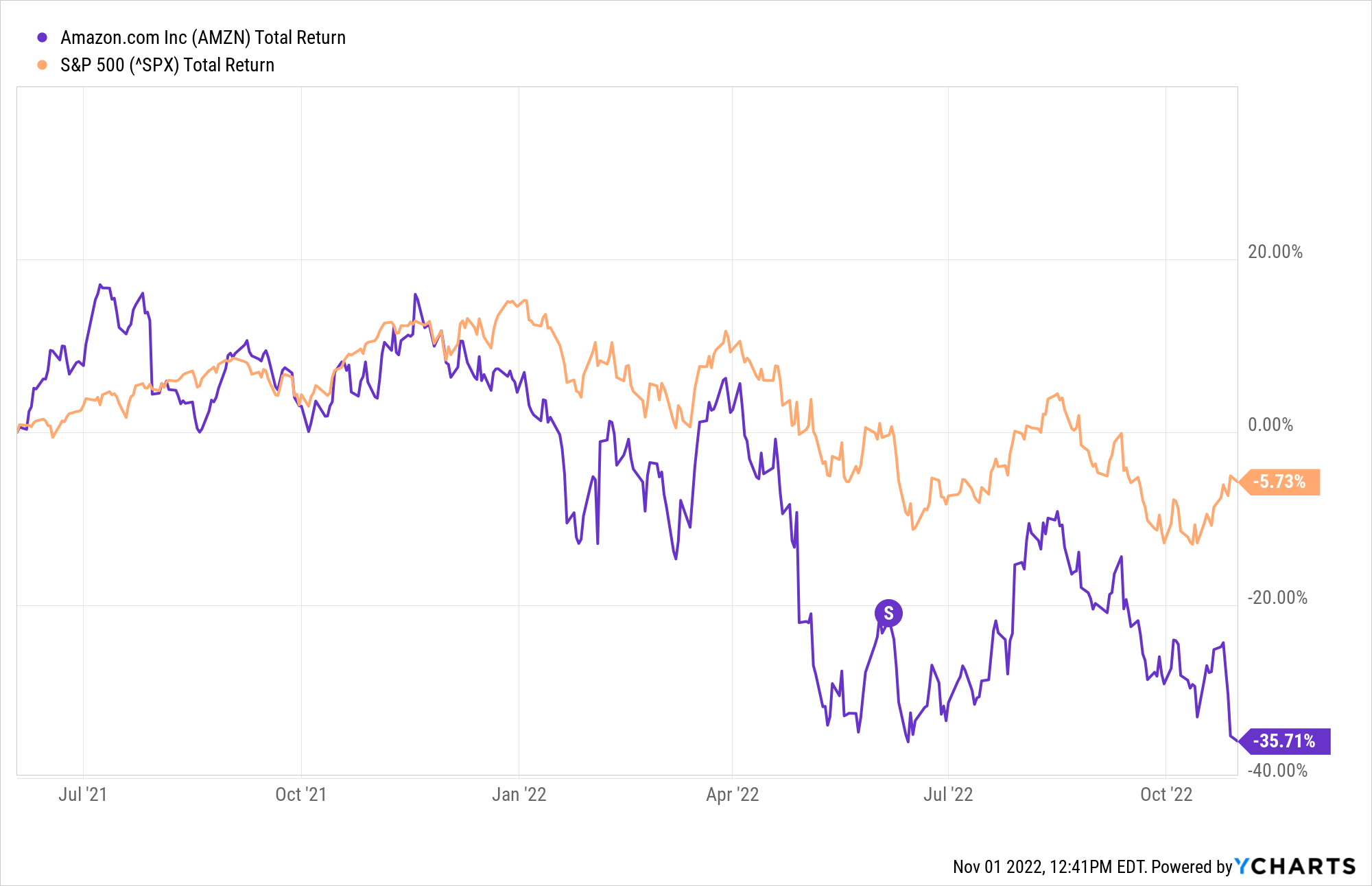

- Of the five stocks analyzed, only Amazon (AMZN +1.19%) outperformed the S&P 500 three months after its stock split, but it also fell behind over the long term.

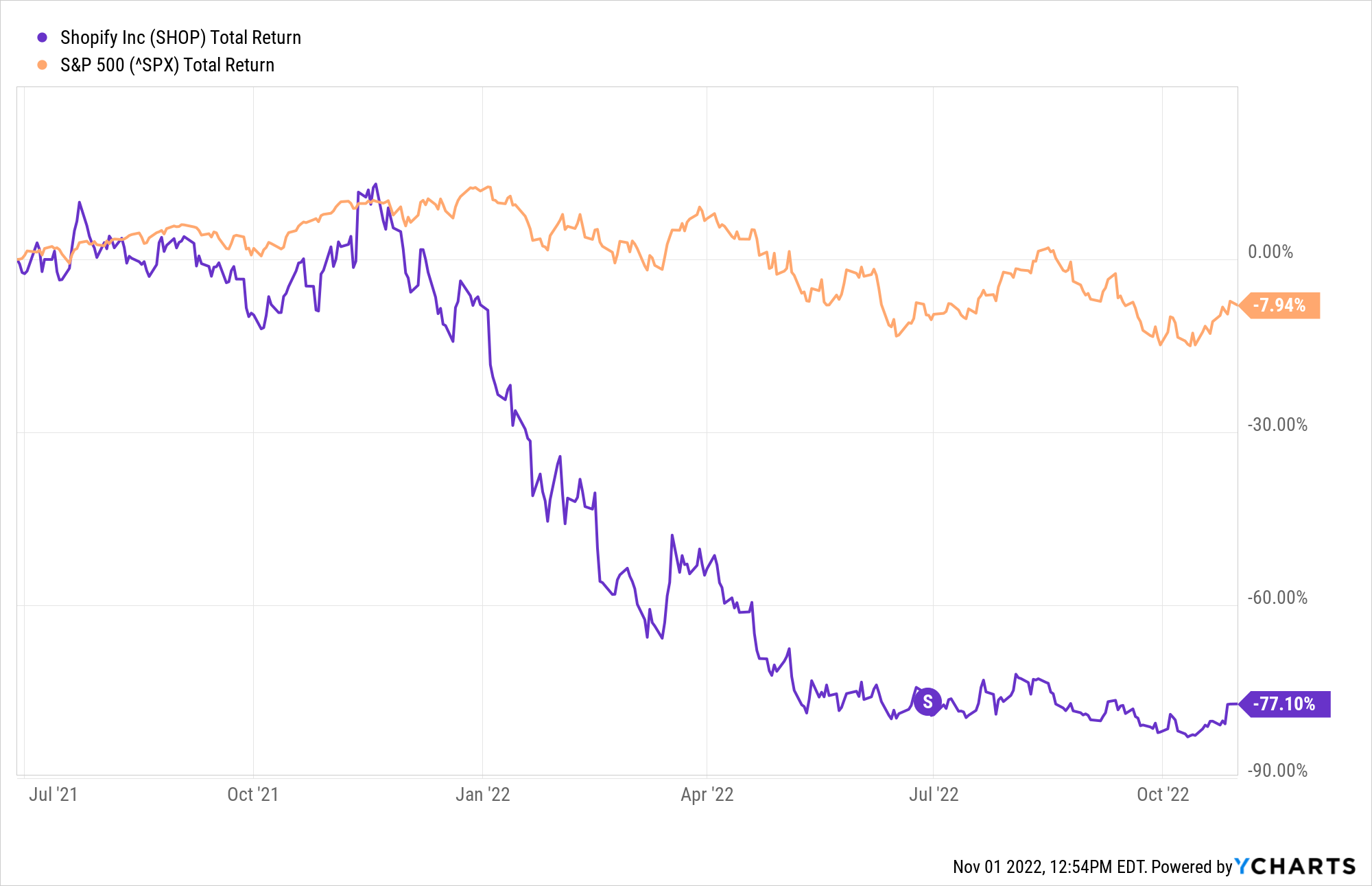

- Shopify (SHOP +0.74%) had the worst results, with its share value dropping significantly (although this was a continuation of a longer trend).

- Changes in price that may look related to a stock split are often better attributed to longer-term or market trends.

What is a stock split?

A stock split is when a company multiplies or divides its share count. It doesn't change the company's market value or capitalization. If you own shares in the company, a stock split doesn't change the value of your holdings.

You can get many more details (including a video explanation) on What Are Stock Splits?

There are two types of stock splits:

- Forward stock split: A company increases its share count and issues new shares to existing investors. For example, in a 2-for-1 forward split, each investor's share count doubles, and the share price is adjusted to half of its pre-split price.

- Reverse stock split: A company decreases its share count and replaces existing shares with a proportionally smaller number. For example, in a 1-for-2 reverse split, each investor's share count gets cut in half, and the share price is adjusted to twice its pre-split price.

Forward stock splits are far more common because they make it cheaper to buy shares in a company. Reverse stock splits don't happen nearly as much, and they're often due to a decline in the company's share price.

Do stock splits affect share value?

In a way, yes. The split changes the value of each share, but the number of shares held by any shareholder is also adjusted so that their total holdings have the same value as before the split.

But what about over the long term? Do stocks tend to go up or down before or after a split, and what does that mean for when you should buy? As you'll see in the following sections, any short-term changes around the time of a split are very minor compared to the long-term trends you should be watching as a Foolish investor.

Amazon's 2022 stock split

Tech giant Amazon announced a 20-for-1 stock split on March 9, 2022, at a time when its shares were trading for $2,785.58.

Amazon performed well initially after the announcement, with share prices rising 10.9% over the next month, compared to 4.9% for the S&P 500. However, prices fell from there.

Overall, from the March 9 announcement to the June 3 stock split, Amazon's share price decreased by 12.2%. The S&P 500 also decreased in value, but only by 4.0%. After the split, Amazon dipped and then recovered, as did the S&P, though the index didn't quite get back to positive.

Stock | June 3, 2022 (split) | July 1, 2022 | Sept. 2, 2022 |

|---|---|---|---|

Amazon | $122.35 | $109.56 (-10.5%) | $127.51 (4.2%) |

S&P 500 | 4,108.54 | 3,825.33 (-6.9%) | 3,924.26 (-4.5%) |

What about over a longer time period? Let's take a look at Amazon's performance from one year before its stock split until the end of October 2022. As you can see in the chart below, there's a dip right after the split (marked by the "S" icon), but that coincided with a dip in the entire market.

Google's 2022 stock split

On Feb. 1, 2022, Google (GOOGL -1.24%) announced a 20-for-1 stock split. Shares were trading at $2,752.88 on the date of the announcement.

Google outperformed the market over the next month. Its share prices dipped by 2.6%, compared to a 5.3% drop for the S&P 500. But between the Feb. 1 announcement and the July 15 stock split, Google share prices decreased by 18.8%. The S&P 500 didn't lose quite as much, with its value falling by 15.0%.

In the months after the stock split, Google didn't keep up with the S&P 500.

Stock | July 15, 2022 (split) | Aug. 15, 2022 | Oct. 14, 2022 |

|---|---|---|---|

Google | $111.78 | $122.08 (9.2%) | $96.56 (-13.1%) |

S&P 500 | 3,863.16 | 4,297.14 (11.2%) | 3,583.07 (-7.3%) |

However, if we take a look at Google's performance beginning one year before its split, we can see that it has underperformed the market over that period, though maybe not as consistently as the short-term results may imply. The chart below shows Google's returns over that period compared to the S&P 500.

Shopify's 2022 stock split

E-commerce platform Shopify announced a 10-for-1 stock split on April 11, 2022, when shares were trading at $617.40.

The announcement didn't help the stock's performance, as the price plummeted by 48.4% over the next month -- far more than the S&P 500, which suffered a 10.8% decline.

There was a minor improvement between the announcement and the stock split. Overall, Shopify's share price went down 43.3% from the April 11 announcement to the stock split on June 28. The S&P 500 dropped by 13.4% during that time. In the first three months after its stock split, Shopify's share value continued to decline.

Stock | June 28, 2022 (split) | July 28, 2022 | Sept. 28, 2022 |

|---|---|---|---|

Shopify | $35.03 | $35.91 (2.5%) | $29.24 (-16.5%) |

S&P 500 | 3,821.55 | 4,072.43 (6.6%) | 3,719.04 (-2.7%) |

It's doubtful that the stock split carries much blame for Shopify's performance. Zooming out, we can see that after some success in 2021, its share price began dropping rapidly in early 2022.

Apple's 2020 stock split

Since going public in 1980, Apple (AAPL +3.17%) has split its stock several times. The most recent Apple stock split was a 4-for-1 split announced on July 30, 2020. The share price on the date of the announcement was $384.76.

The lead-up to the stock split was great for Apple shareholders. Share values rose 29.8% from the July 30 announcement to the Aug. 28 stock split. That was more than three times the increase in the S&P 500, which rose by 8.1%.

Although the early months were up and down, Apple ended up with a solid return for the year after its split but fell short of the S&P 500.

Stock | Aug. 28, 2020 (split) | Sept. 28, 2020 | Nov. 27, 2020 | Aug. 27, 2021 |

|---|---|---|---|---|

Apple | $124.81 | $114.96 (-7.9%) | $116.59 (-6.6%) | $148.60 (19.1%) |

S&P 500 | 3,508.01 | 3,351.60 (-4.5%) | 3,638.35 (3.7%) | 4,509.37 (28.5%) |

Since Apple's stock split happened several years ago, we have more data on the long-term changes. The chart below tracks Apple's return about one year before its stock split until October 2022. Overall, it has significantly outperformed the market during that time period.

GE's 2021 reverse stock split

General Electric (GE +3.61%) announced a 1-for-8 reverse stock split on June 18, 2021. At the time, shares were trading for $12.78.

There was minimal change in General Electric's share price after the announcement. From June 18 until the stock split on July 30, it ticked up by 1.3%. The S&P 500 increased by 5.5% over that time period.

For the three months after the stock split, General Electric's value continued to stay more or less the same. But over the first year as a whole, its share price sank.

Stock | July 30, 2021 (split) | Aug. 30, 2022 | Oct. 29, 2021 | July 29, 2022 |

|---|---|---|---|---|

GE | $103.60 | $105.19 (1.5%) | $104.87 (1.2%) | $73.91 (-28.7%) |

S&P 500 | 4,395.26 | 4,528.79 (3.0%) | 4,605.38 (4.8%) | 4,130.29 (-6.0%) |

That's not surprising when looking at GE's performance starting the year before its stock split. It has been somewhat volatile, going through periods of rapid growth and decline. Overall returns have been similar to the S&P 500, but it took a much more dramatic ride to get there.

Related stock split topics

Should I buy stock before it splits or after?

Even though stock splits sometimes get a lot of attention, don't base your investing decisions around them. If you believe a stock is a good long-term investment, then you should buy it, regardless of whether it's before, after, or nowhere near a stock split.

The advantage of buying a stock after it splits is that shares will be much more affordable. This used to be more important, but now that there are so many brokers with fractional share investing, it doesn't matter nearly as much. Fractional share investing allows you to buy expensive stocks, even if you can't afford a full share.

Strategizing about buying stocks before or after they split is, essentially, a form of timing the market. Market timing is a heavily studied subject, and the results are clear -- it's extremely difficult. You're better off learning how to research stocks and investing for the long term with quality companies. That will bring you much better results than trying to buy at the perfect time.

And it's worth saying one more time: stock splits do not change the value of your holdings.