A solo 401(k) is a special type of retirement account designed for self-employed workers with no employees. A solo 401(k) operates by very similar rules to a regular 401(k), although there are a few differences. Below we'll discuss who can contribute to a solo 401(k), how much they can keep in the account, and how the government taxes solo 401(k)s, plus we'll cover how to open one if you decide a solo 401(k) is right for you.

How a solo 401(k) works

Solo 401(k)s are available only to self-employed workers with no employees, with an exception for business owners who employ their spouses. To open one of these accounts, you must have an employer identification number (EIN), which you can get from the IRS.

You're allowed to make two types of contributions to your solo 401(k): an employee contribution and an employer contribution. Your employee contribution limit is the same as the 401(k) contribution limit for any traditionally employed worker, which is $23,500 if you're 50 or older in 2025. Those rates are $500 higher than the 2024 limits of $23,000.

In both 2024 and 2025, workers 50 and over can make additional catch-up contributions of $7,500 per year. The SECURE 2.0 Act also created a new catch-up contribution limit for workers ages 60 to 63; they can now contribute $11,250 in 2025.

If you'd like to contribute more than this, you can make additional contributions as an employer, but this calculation is a little more complicated. You may contribute up to 25% of your net self-employment income for the year. That is all the money you've earned from your business minus any business expenses, half of your self-employment taxes, and the money you contributed to your solo 401(k) as an employee contribution.

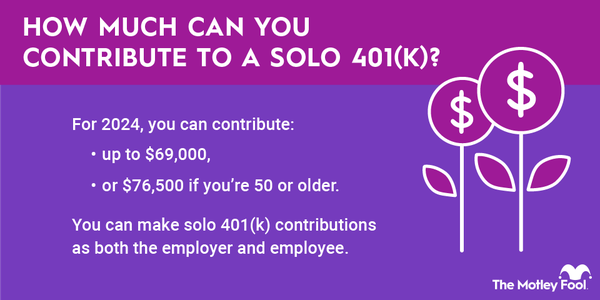

In 2025, only the first $350,000 in net self-employment income counts for the year, and the total amount you may contribute to your solo 401(k) as employee and employer in 2025 is $70,000, not including catch-up contribution. In 2024, those limits were $345,000 and $69,000.

If you find yourself in need of cash later on, you can take a loan from your solo 401(k) just as you can from a traditional 401(k). Typically, you're limited to the lesser of 50% of your balance or $50,000.

You should withdraw your solo 401(k) funds early only if you have no other choice. It can give you the cash you need right now, but your money can't grow when it's not invested. Also, if you don't pay your loan back within five years, the government considers it a distribution and taxes it accordingly.

Covering a spouse

Your spouse is the singular exception to the no-employees rule. As long as they are a part- or full-time employee of the business or a co-owner, they can also contribute to your solo 401(k) using the income they earned from your business.

You can effectively double the contributions listed above if both you and your spouse contribute up to the maximum amount. But in order to do that, both of you must have earned enough to cover your contributions for the year.

Taxes on a solo 401(k)

Tax-deferred vs. Roth solo 401(k): You can open your solo 401(k) as either a tax-deferred or a Roth account. Tax-deferred account contributions reduce your taxable income for the year, which can help you save money now. But then you owe taxes on your distributions later on. Roth contributions don't reduce your tax bill today, but once you pay taxes on your contributions, your savings grow tax-free.

The right type for you depends on how you think your earnings today will compare to your spending in retirement. If you believe you're making a lot more now than you'll spend in retirement, a tax-deferred account makes more sense. You can put off taxes until retirement, when you might be in a lower tax bracket, enabling you to keep a higher percentage of your savings.

But if you think you're earning about the same as, or less than, you'll spend in retirement, a Roth solo 401(k) is a better choice. You'll likely give less money back to the government if you pay taxes on your contributions up front rather than on your contributions and earnings in retirement.

Multiple solo 401(k)s: You may have one of each type of solo 401(k) if you choose, but you should favor the one you believe will give you the better tax breaks. Remember, the above contribution limits apply to your total solo 401(k) contributions for the year, not to each account separately. If you decide to contribute some money to a tax-deferred solo 401(k) and some to a Roth solo 401(k), keep track of your total contributions to make sure they don't exceed the annual limits.

Withdrawals: If you withdraw money from a tax-deferred solo 401(k) while you’re younger than 59 1/2, you'll typically owe taxes on your contributions, plus a 10% early withdrawal penalty. You can avoid this penalty if you qualify for certain exceptions such as becoming disabled or incurring a large medical expense.

By contrast, you can withdraw Roth solo 401(k) contributions at any time, although you could face taxes and penalties if you withdraw your earnings before age 59 1/2.

How to open a solo 401(k)

- Apply for an EIN with the IRS: Before you can open a solo 401(k), you need to obtain an employer identification number (EIN). You can apply for one of these on the IRS website if your principal business is based in the United States or its territories. You'll need a valid taxpayer ID, such as a Social Security number, to apply for an EIN. As soon as you've completed the application and the IRS has verified your information, it will send you an EIN.

- Find a brokerage: Next you must decide where you're going to open your solo 401(k). You can do so with just about any broker. The choice comes down to fees, investment options, and customer service. Explore a few different options before deciding which one is the best fit for you right now. It's not set in stone -- you can always do a rollover later -- but rather than going through all that hassle, take the time to choose your broker carefully.

- Meet the annual deadlines: You must have opened your solo 401(k) by Dec. 31, 2024, to make contributions for the 2024 tax year. If you decide to make a 2024 solo 401(k) contribution in 2025, make sure your broker applies your contribution correctly. Some may default to a current-year contribution, and that can cause problems between you and the IRS if you try to write off those contributions on your 2024 taxes.

Overall, a solo 401(k) is a great option for sole proprietors who want to be able to set aside more money for retirement than an IRA would allow. There are a few extra hoops you must jump through to open a solo 401(k), but it's definitely worth it, especially for those who are earning a lot more from their businesses than they're spending right now.