How much money do you need to comfortably retire? $1 million? $2 million? More?

Financial planners often recommend replacing about 80% of your pre-retirement income to sustain the same lifestyle after you retire. This means that if you earn $100,000 per year, you'd aim for at least $80,000 of income (in today's dollars) in retirement.

However, several lifestyle factors must be considered, and not all of your income will need to come from savings. With that in mind, here's a guide to help you calculate how much money you will need to retire.

It's not about money, it's about income

One important point to consider when determining your retirement "number" is that it isn't about deciding on a specific amount of savings. For example, the most common retirement goal among Americans is a $1 million nest egg. But this is faulty logic.

The most important factor in determining how much you need to retire is whether you'll have enough money to create the income you need to support your desired quality of life after you retire.

Will a $1 million savings balance allow you to create enough income forever? Maybe, but maybe not. That's what we're going to determine in this article.

How much income do you need to retire?

The reason you don't need to replace 100% of your pre-retirement income is that, when you retire, you're typically able to eliminate certain expenses. For example:

- You'll no longer have to save for retirement (obviously).

- You may spend less on commuting expenses and other work-related costs.

- You may have paid off your mortgage by the time you retire.

- You may not need life insurance if you no longer have dependents.

But retiring on 80% of your annual income isn't perfect for everyone. You might want to adjust your goal based on the type of retirement lifestyle you plan to have and whether your expenses will be significantly different.

For example, if you plan to travel frequently in retirement, you may want to aim for 90% to 100% of your pre-retirement income. On the other hand, if you plan to pay off your mortgage before you retire or downsize your living situation, you may be able to live comfortably on less than 80%.

Let's say you consider yourself the typical retiree. Between you and your spouse, you currently have an annual income of $120,000. Based on the 80% principle, you can expect to need approximately $96,000 in annual income after retirement, which translates to $8,000 per month.

Social Security, pensions, and other reliable income sources

The good news is that, if you're like most people, you'll get some help from sources other than your savings, such as your Social Security benefits. For most people, Social Security is a significant income source.

However, the percentage of income that Social Security will replace is typically lower for higher-income retirees. For example, Fidelity estimates that someone earning $50,000 per year can expect Social Security to replace 35% of their income. But someone earning $300,000 per year would have a Social Security income replacement rate of just 11% on average.

If you're unsure of your expected benefits, check your most recent Social Security statement or create a My Social Security account to obtain a more accurate estimate based on your work history.

If you have any pensions from current or former jobs, be sure to take those into consideration. The same goes for any other predictable and permanent sources of income, such as an annuity that kicks in after you retire or a reverse mortgage.

Pension

Continuing our example of a couple that needs a monthly income of $8,000 to retire, let's say each spouse expects $1,500 per month from Social Security, and that one spouse also receives a $1,000 monthly pension.

This means that, of the $8,000 in monthly income needs, $4,000 will come from guaranteed income. The remaining $4,000 will need to be sourced from investments and savings.

In summary, you can estimate the monthly retirement income you need to generate using this formula:

How much savings will you need to retire?

Now, let's determine how much savings you'll need to retire.

After you've figured out how much income you'll need to generate from your savings, the next step is to calculate how large your retirement nest egg needs to be for you to produce this much income in perpetuity.

A retirement calculator is one option, or you can use the "4% rule." The 4% rule says that in your first year of retirement, you can withdraw 4% of your retirement savings.

So, if you have $1 million saved, you would take $40,000 out during your first year of retirement, either in a lump sum or as a series of payments. In subsequent years of retirement, you would adjust this amount upward to keep up with cost-of-living increases.

The idea is that if you follow this rule, you shouldn't have to worry about running out of money in retirement. Specifically, the 4% rule is designed to make sure your money has a high probability of lasting for a minimum of 30 years.

To calculate a retirement savings target based on the 4% rule, you use the following formula:

We saw in the previous section that our couple would need $4,000 per month ($48,000 per year) from their savings. So, in this case, they should aim for $1.2 million in retirement savings accounts, such as a 401(k) plan or individual retirement account (IRA), to provide $48,000 per year in sustainable retirement income.

It's essential to acknowledge that the 4% rule has several limitations. It assumes you'll withdraw the same amount each year in retirement, adjusted for inflation. It also assumes that your portfolio will be split between stocks and bonds throughout your retirement.

In some circumstances, you may want to withdraw significantly more or less than the standard 4%. For example, as of mid-December 2025, the S&P 500 index was up almost 19% year to date, so you're replacing your 4% withdrawal rate plus a lot more. On the other hand, during a stock market correction or a bear market, you may want to limit your withdrawals to give your investments time to rebound.

Regardless of your retirement goals, recent stock market volatility shows just how essential it is for retirees to have some cash on hand. This can act as a buffer for your portfolio by helping you avoid selling investments while the market is still down.

Things to consider when planning retirement goals

There is no perfect method of calculating your retirement savings target. Investment performance will vary over time, and it can be difficult to accurately project your actual income needs.

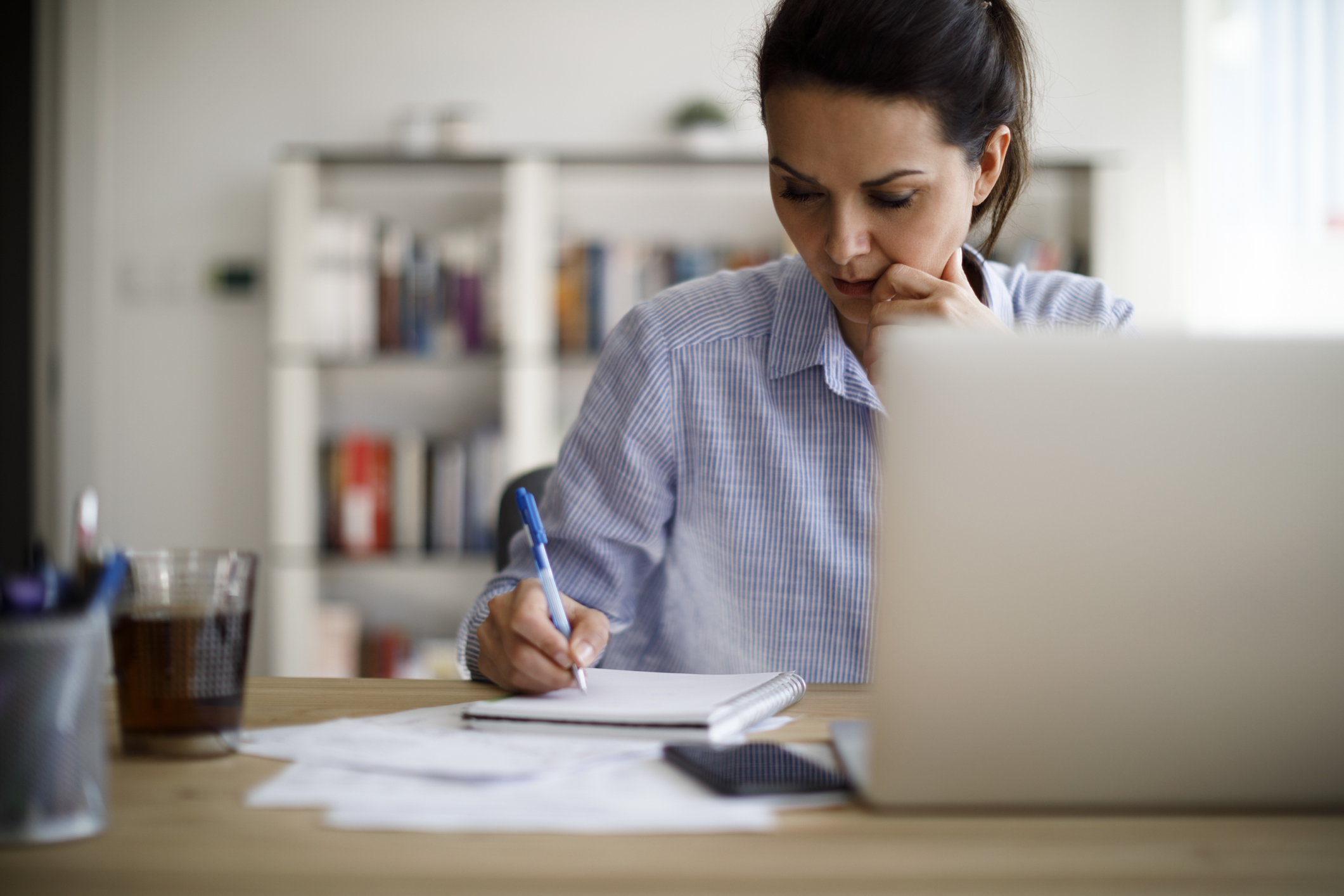

It's also worth mentioning that not all retirement plans are equal in terms of income. Money you withdraw from a traditional IRA or 401(k) will be considered taxable income. On the other hand, any money you withdraw from a Roth IRA or Roth 401(k) is generally not taxable, which may alter the calculation slightly.

There are also other potential considerations. Many workers have to retire earlier than planned. For example, approximately 3 million workers retired earlier than anticipated in 2020 due to the COVID-19 pandemic.

Older workers often have to retire early due to layoffs, health problems, or caregiving duties. Saving for a longer retirement than anticipated gives you a safety cushion.

It's also important to consider the impact of inflation on your retirement plans. Inflation has garnered significant attention in recent years, as it has only been a few years since we experienced the highest inflation in a generation.

Even when costs rise at a typical rate, inflation often hits senior households harder than working-age households. That's because seniors spend a higher portion of their income on expenses such as healthcare and housing, which tend to increase faster than the overall inflation rate.

While we're trying to present the broad strokes here, it's still a good idea to consult a financial advisor who can tailor a retirement savings goal to your particular situation and help set you on the right path with a savings and investment plan that ensures you reach your goals.

By using the methods discussed in this article, you can get a good idea of how much you'll need to save to retire comfortably. Keep in mind that this isn't designed to be a perfect method, but rather a starting point to help you assess where you are and any adjustments you might need to make to get where you need to be.