Saving money isn't easy for most 21-year-olds. Even if you're a disciplined spender, you're probably nowhere near your earnings peak.

The median weekly earnings for a full-time worker between the ages of 16 and 24 is $738 as of the fourth quarter of 2023, according to the U.S. Bureau of Labor Statistics. That works out to $38,376 per year, which doesn't leave much wiggle room in your budget if you're responsible for all of your living expenses. Plus, many people at age 21 haven't yet started working full time.

The general rule of thumb is that you should save 20% of your salary for retirement, emergencies, and long-term goals. By age 21, assuming you have worked full time earning the median salary for the equivalent of a year, you should have saved a little more than $7,000.

Read on to learn why you shouldn't be discouraged if your savings are nowhere close to that number.

Reasons not to panic

Reasons not to panic

Saving 20% of your paycheck may not be doable on a $35,880 salary. For many 21-year-olds, simply earning that much is unrealistic. You may not be able to work full time because you're still in school or are surviving on a combination of part-time jobs and side hustles.

Your savings rate is influenced by both your income and your expenses. If you live with your parents, saving money is a lot easier. If you have student loan debt, your expenses are higher, and you may prefer to focus on paying that off first.

What people should be saving and what they actually save also differs by a lot. The median household savings account balance is $5,300, according to the Federal Reserve's 2019 Survey of Consumer Finances. So having $7,000 in your savings account would put you ahead of your mostly older peers.

How to save money when you're 21

How to save money when you're 21

At age 21, the habits you're building matter a lot more than your actual savings balance. If you can just start saving, even if it's not much, you'll be in very good shape with time. Here are the habits to develop now so you can achieve your financial goals, no matter how big they are.

Build your emergency fund

Regardless of your age, it's essential to start building an emergency fund with three to six months' worth of living expenses. The good news is that, when you're 21, your living expenses are typically pretty low. If you have health insurance and you don't have kids or own a home, you can probably get away with the three-month minimum.

Try to budget a small amount of your income to put in a dedicated savings account, even if you can only manage $10 or $20 a week. Once you have a steady income, you can gradually work up to saving six months' worth of expenses.

Keep your three-month emergency fund in cash, not in the stock market. Money for emergency use needs to be immediately available to you in a pinch.

Avoid credit card debt

While student loans are a big source of worry for a lot of young people, credit cards are typically a far more toxic form of debt. The average interest rate when you carry a credit card balance is above 16%, which is much higher than the average interest rate for student loans.

At age 21, you haven't had too much time to amass a hefty credit card balance. Pay off any balance you have already acquired once you've set aside the money for your three-month emergency fund. You don't need to avoid credit cards altogether since using a credit card is typically the best way to build a credit history. But avoid charging anything you can't afford to pay off at the end of the month.

Invest to take advantage of compounding

When you're in your early 20s, compound interest and earnings are especially powerful. If you can afford to invest in the stock market at this age, the payoff will likely be huge in retirement. If you invest $5,000 at age 21 and earn 9% annual returns, you'd have more than $220,000 by age 65 — even if you never contributed another cent.

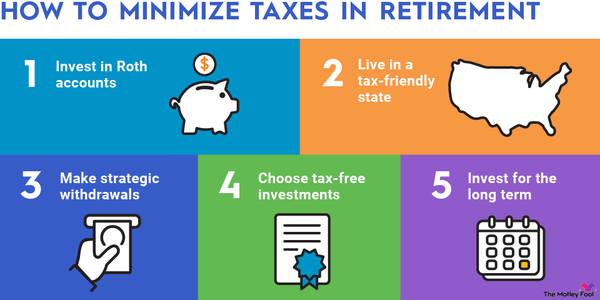

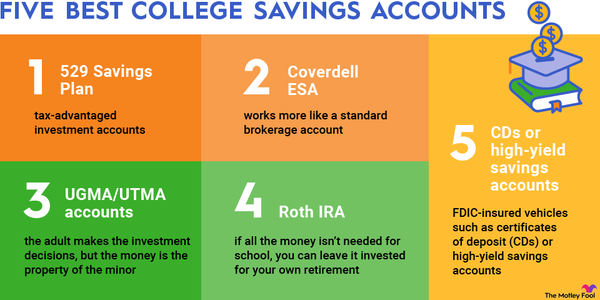

Investing in a Roth individual retirement account (IRA) is a great way to start saving for retirement when you're in your early 20s. You don't get to deduct your contributions from your taxable income, but you can receive money tax-free once you reach age 59 1/2. Paying taxes on that money now, when you're probably in a low tax bracket, is a small price for all that tax-free growth. You can contribute up to $6,500 to a Roth IRA in 2023, up from $6,000 in 2022.

If you have access to a work-sponsored retirement plan, whether now or in the future, aim to contribute enough to get the full company 401(k) match. If your employer matches 50% of your contribution, then you've already doubled your money.

Tackle student loans selectively

If you have student loans, you may feel like your No. 1 financial goal is to pay them off as fast as possible. But not all student loans are equal — private loans generally have the highest interest rates and should be paid first. Then you can consider paying off more slowly any federal student loans with low interest rates as you also pursue other financial goals such as saving.

Related retirement topics

Don't succumb to lifestyle inflation

The most important thing you can do now to reach your savings goals is to curb lifestyle inflation, which is the tendency we have to increase our living standard whenever we start making more money. At 21, you're probably not living too lavishly yet. The longer you can maintain any frugal habits you've developed, the better off you'll be.

That doesn't mean you need to live with roommates or eat rice and beans forever. But, as the size of your paycheck increases, your expenses should increase by a smaller amount, and you can save the difference.

Plenty of wealthy people were broke at 21. Focus less on how many dollars you have in savings and more on the habits that you're building. If you can make saving money a regular practice and live below your means now, you are practically certain to achieve financial success.

Expert Retirement QA

Expert Retirement Q&A

David C. John, MA, MBA,

The Motley Fool: What is your advice for someone who may be worried about retiring because of recent financial setbacks?

David John: If your health, family responsibilities, and job status allows, continue to work longer than you might have before. The extra time allows you to save more and for the markets to continue to recover from past losses. Most important, delay taking your Social Security for as long as possible so you'll have a larger, inflation-protected benefit.

The Motley Fool: There are no hard and fast rules about when to retire or how much we should have saved, but what three pieces of advice would you give someone who is just starting their first retirement savings account?

David John:

- Make saving a priority and contribute a consistent percentage of your income that grows over time every payday.

- Invest only in a diversified option like a target date fund that uses passive index funds. Don't try to beat the market with your retirement money.

- Don't take a withdrawal unless you absolutely have to. Instead, start a separate emergency fund in addition to your retirement account.