The Motley Fool has a disclosure policy.

HSA-Eligible Expenses in 2024 and 2025

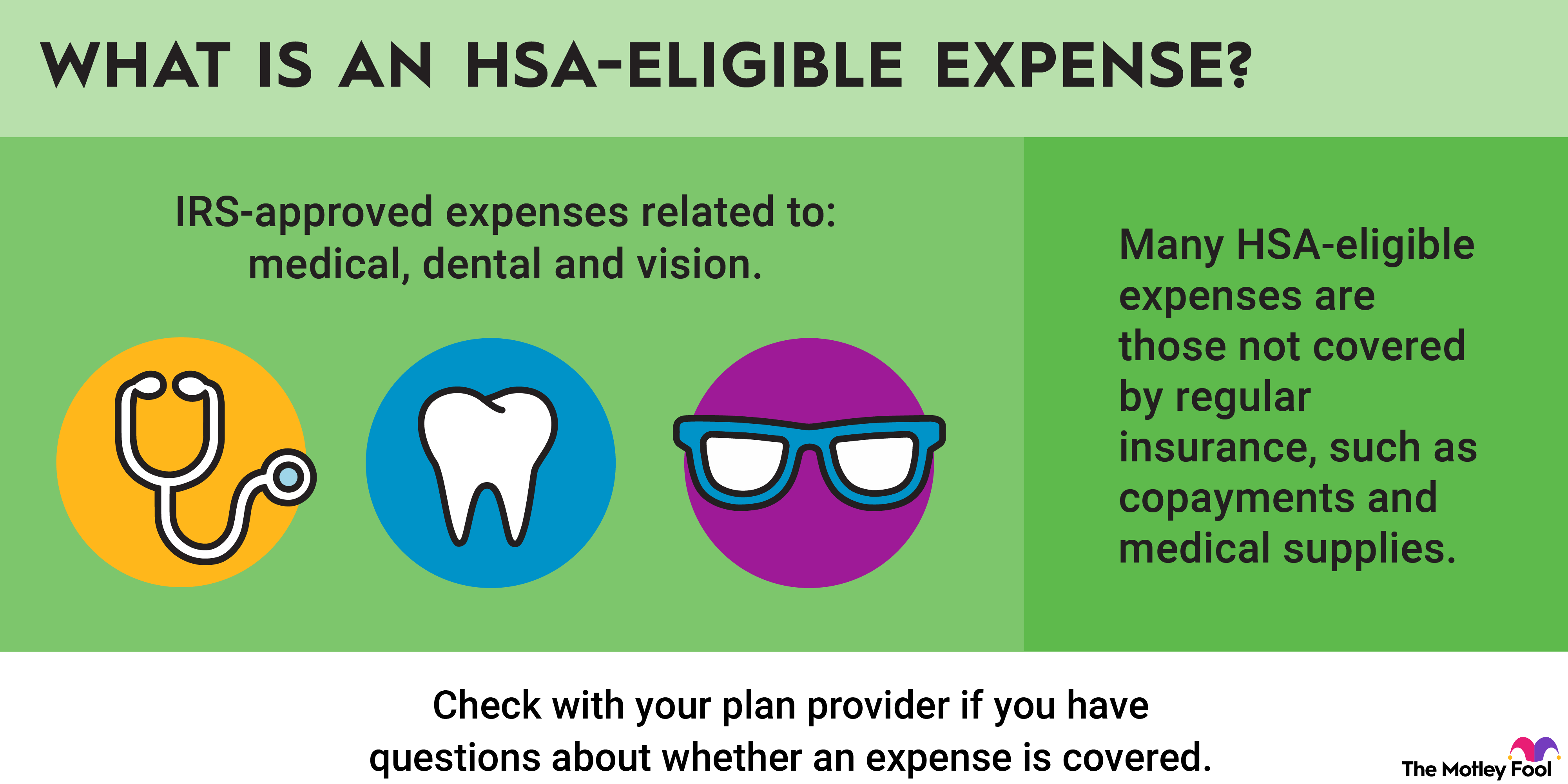

Learn what counts as an eligible health savings account expense.

Key Points

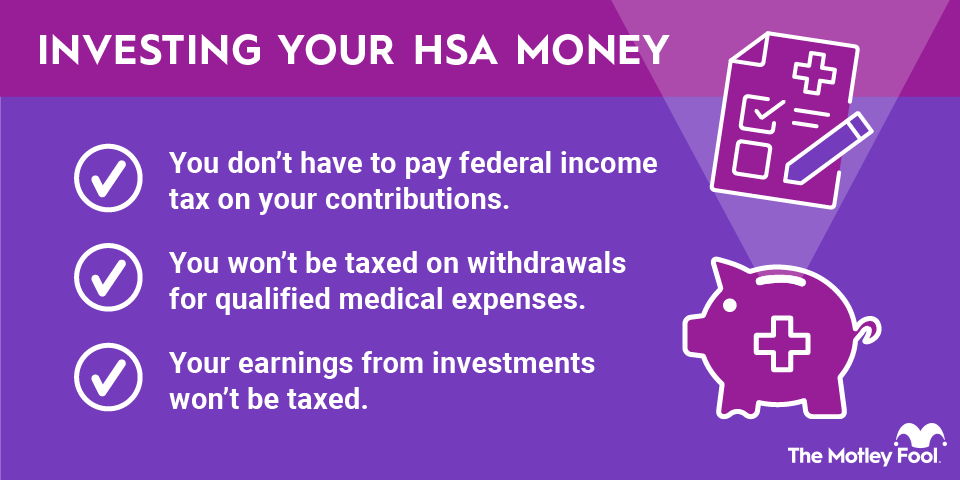

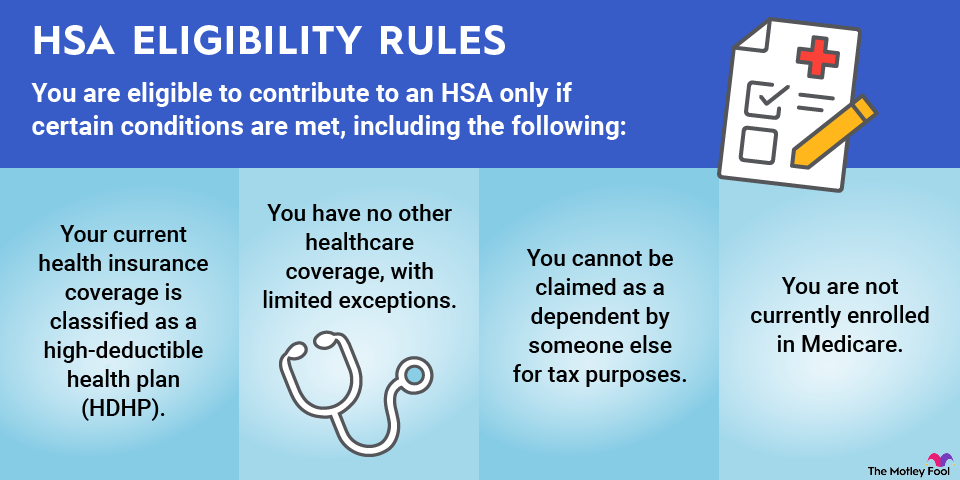

- HSAs offer tax benefits and cover IRS-approved health expenses, reducing taxable income.

- Funds for HSAs can be accumulated through contributions from both you and, potentially, your employer.

- Eligible HSA expenditures include costs not typically covered by health insurance like dental and vision care.