While there is more than one type of account that allows you to save for healthcare, the health savings account, or HSA, is the most advantageous for most who qualify. It's one tax-advantaged way to prepare for healthcare costs and reduce the financial burden on you and your family.

In this article, we'll start with a rundown of how HSAs work. We'll also discuss how to qualify for one and how to open an HSA account for your own healthcare needs.

What is an HSA?

A health savings account is a specialized type of account designed to help people save money and pay for qualified healthcare expenses in a tax-advantaged way.

It's important to mention that an HSA is not the same as a flexible spending account (FSA). FSAs are designed primarily to budget for current-year healthcare expenses. HSAs, on the other hand, are a more flexible type of account, but they have stricter eligibility requirements

How to open an HSA

Often, employers offer the ability to open and contribute to HSAs for employees enrolled in qualifying healthcare plans (more on that later).

In this case, contributions work similarly to a 401(k): Your employer deducts HSA contributions from your paycheck, and that money doesn't count toward your taxable income for the year.

If your employer doesn't offer an HSA directly, you may be able to open a health savings account on your own. To name just a couple of examples, Fidelity offers HSAs (and excellent educational resources and guidance), and an institution called HSA Bank specializes in opening these accounts.

Once you've opened an HSA, the next step is to make your contributions, which you can do in regular installments or a lump sum.

The HSA contribution limits are adjusted annually to account for inflation. It is worth noting that there have been legislative efforts to dramatically increase the amount of money you can contribute to an HSA. But for 2025 and 2026, the HSA contribution limits are as follows.

2025 and 2026 HSA contribution limits

For 2025, participants with individual health coverage can contribute up to $4,300 to an HSA, and the limit for family coverage is $8,550. These limits will rise to $4,400 and $8,750, respectively, in 2026. There is a $1,000 catch-up allowance for account owners 55 or older in both years.

There are a couple of things to note. First, these limits include any contributions your employer makes on your behalf.

Second, you can make HSA contributions until the tax deadline for the contribution year. That means you can make 2025 contributions to an HSA until April 15, 2026.

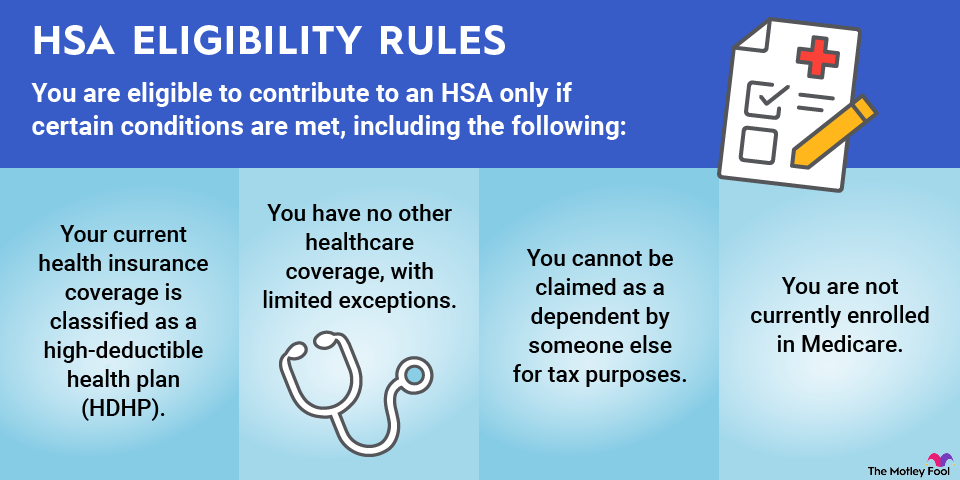

Who can open an HSA?

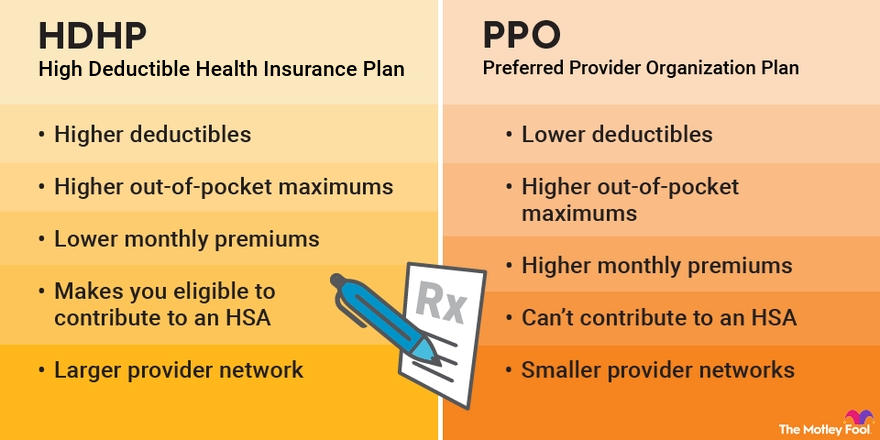

The main qualification for opening an HSA is enrollment in a qualifying high-deductible health insurance plan, as defined by the U.S. government. The exact definition can change over time, but as of now, the HSA eligibility requirements for a high-deductible health plan are:

- An annual deductible of $1,650 or more for individual coverage or $3,300 or more for family coverage for 2025 ($1,700 and $3,400, respectively, for 2026)

- An out-of-pocket maximum no greater than $8,300 for individual coverage or $16,600 for family coverage for 2025 ($8,500 and $17,000, respectively, in 2026)

The HSA requirements also state that you cannot be enrolled in Medicare or an ineligible health plan, even if you are also concurrently enrolled in an HSA-eligible health plan.

How does an HSA work?

HSAs have several excellent features that make them a valuable financial tool for those who qualify.

First, money in an HSA can be carried over from year to year, unlike an FSA, which is generally a use-it-or-lose-it type of arrangement. What's more, HSA money can be carried over and invested while in the account.

This works similarly to most 401(k) plans. HSAs typically offer a menu of investment funds or automated portfolio options to choose from.

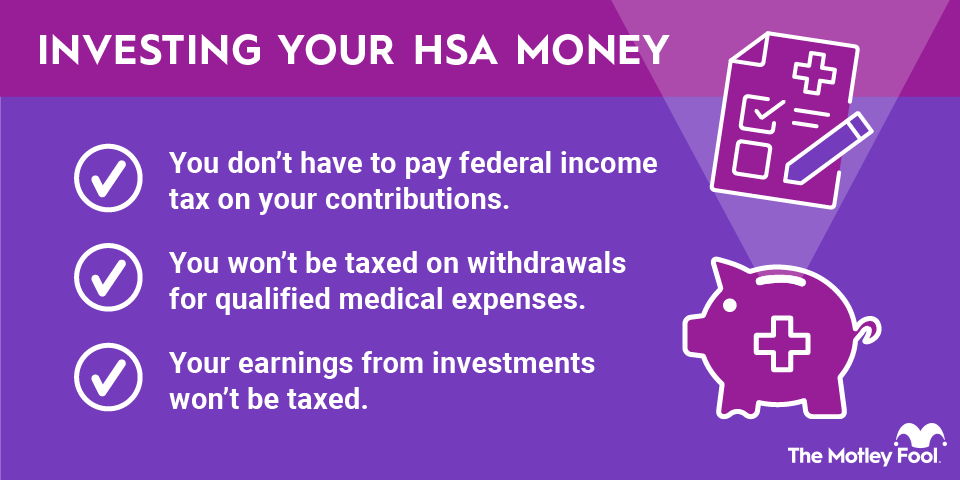

Second, HSAs have a rare triple tax benefit.

- Money contributed to an HSA is tax-deductible in the year you make your contributions.

- While money is in an HSA, it can be invested on a tax-deferred basis. That means you won't have to pay taxes on any dividends or capital gains you receive in the account as long as the money is in it.

- Money withdrawn from an HSA to pay for qualifying healthcare expenses is 100% tax-free, no matter how much it grew while invested in the account.

This triple tax advantage is unique and can be very beneficial -- especially if you leave money in your HSA long enough to generate meaningful returns. No retirement accounts offer the ability to deduct contributions and take tax-free withdrawals of investment profits.

Related investing topics

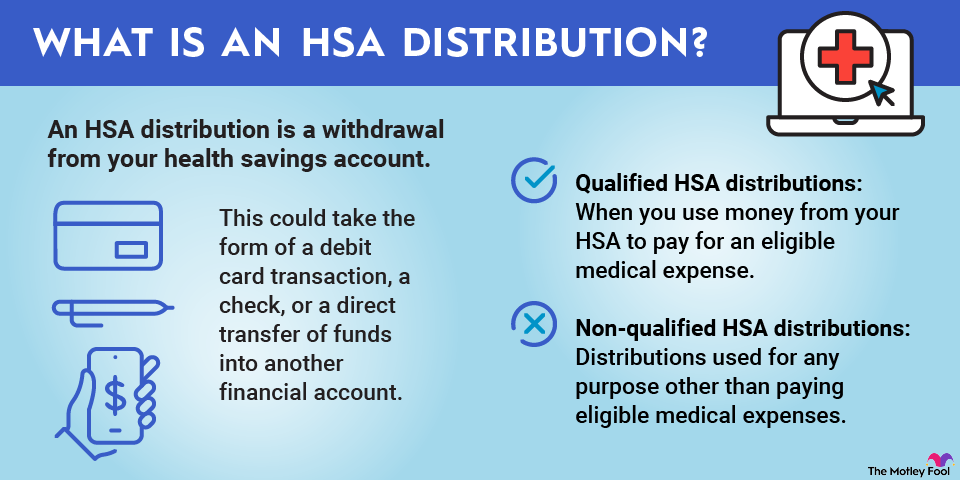

It's also important to note that once you turn 65, you can use the money in an HSA for any reason, not just healthcare. For this reason, an HSA can also be a valuable component of your retirement savings strategy.

The IRS will treat any non-healthcare withdrawals as taxable income, so it's still preferable to use the money for healthcare costs. However, if you have more in your HSA at the time of retirement than you'll need for healthcare, it's beneficial that it can essentially serve as a retirement plan.

As an additional note, you don't have to use the money in your HSA to pay for healthcare expenses as they arise. For example, if you have a $500 emergency room bill and the cash to cover it, it can be a smart idea to leave the money in the HSA to grow and compound for the future.

Should I open an HSA?

The short answer is yes, if you can.

If you qualify to contribute to an HSA, there's little justification for not taking advantage of it. Opening an HSA is a relatively quick and easy process, even if you do it on your own. As we've seen, these accounts offer benefits that even the best tax-advantaged retirement accounts cannot match.