Can you invest your HSA money?

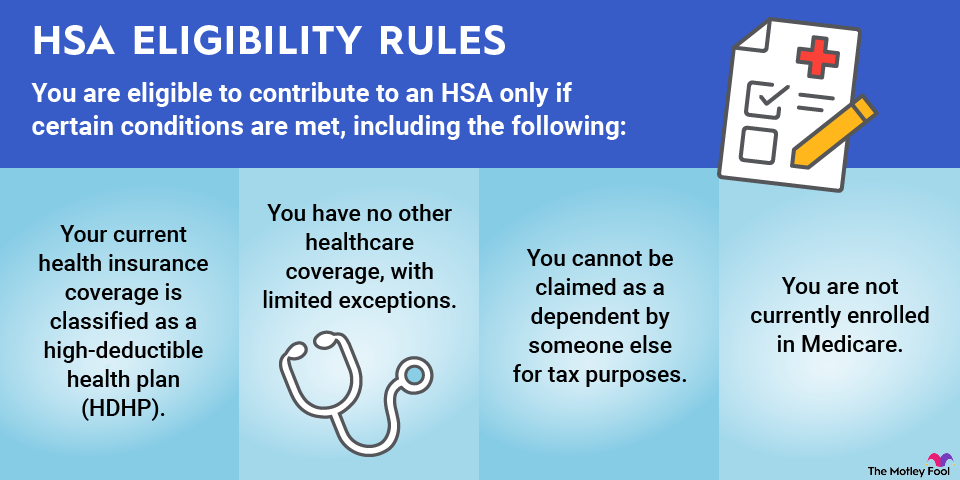

The answer to this question is maybe. Many HSA administrators require a minimum balance in your account before allowing you to invest. Check with your HSA administrator to find out if there's a minimum balance required for your HSA before you can invest. Keep in mind, though, that just because you can invest your HSA money doesn't mean that you necessarily should.

Why should you invest your HSA money?

HSAs were established primarily for individuals to use for their health expenses. But they can also serve as excellent retirement savings accounts with important benefits. Arguably, the biggest upside for HSAs is that they offer a triple tax advantage:

- You don't have to pay federal income tax on your contributions.

- You won't be taxed on withdrawals for qualified medical expenses.

- Your earnings from investments won't be taxed.

You benefit from the first two tax advantages even if you don't invest your HSA money. However, if you do invest your HSA money, the third advantage helps you as well.

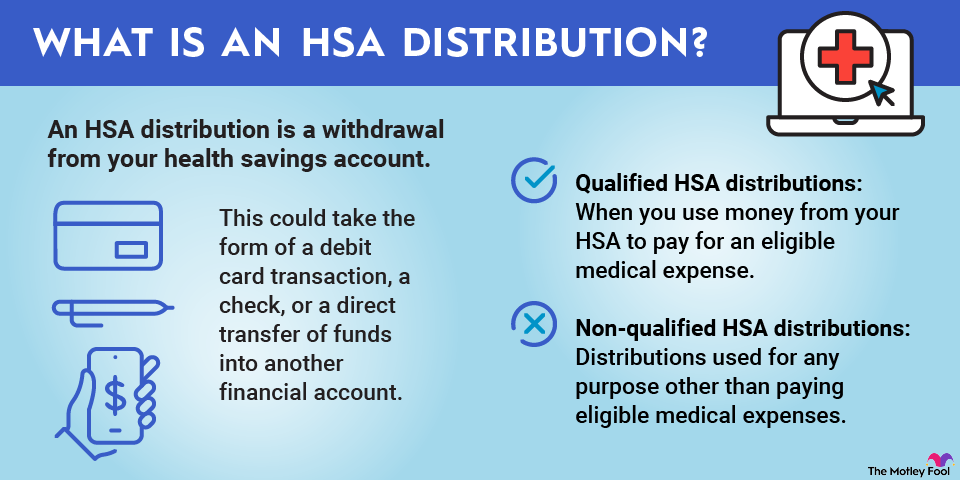

There is a caveat to this advantage, though. If you withdraw HSA money before you turn 65 for reasons other than qualifying medical expenses, you'll be taxed at your ordinary income tax rate. You could also incur an additional 20% tax penalty on HSA distributions for non-qualified reasons.

Investing HSA money can be an especially attractive option for some. If you have maxed out your other tax-protected retirement savings account contributions and you still have additional money to invest for retirement, HSAs provide a great way to boost your overall retirement savings.