HSA rules for withdrawals

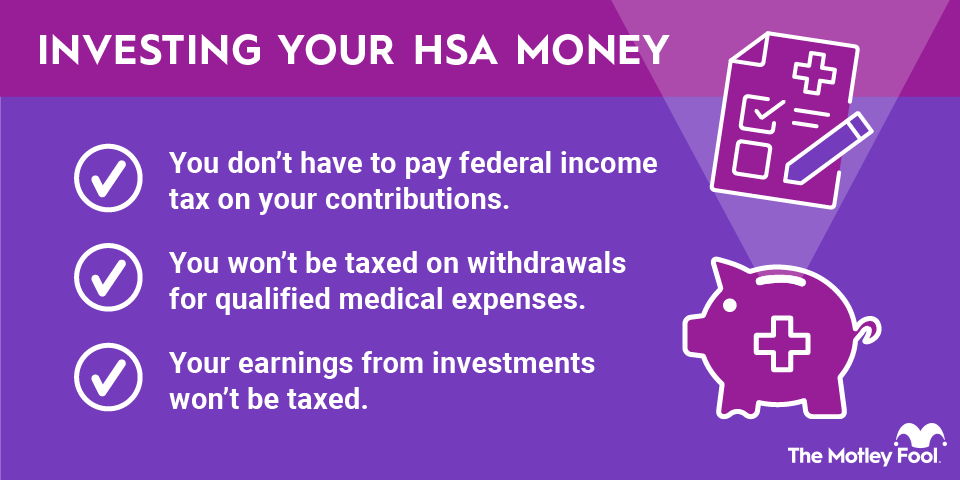

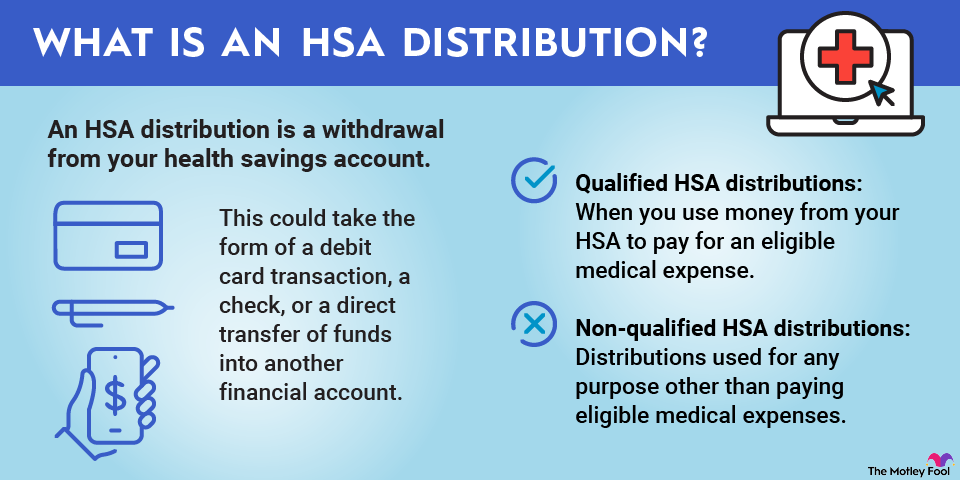

If you withdraw money from an HSA for any reason other than to cover eligible medical expenses, you will be subject to a 20% penalty on the amount withdrawn unless you are age 65 or older. This 20% penalty is double the 10% penalty that applies to early 401(k) or individual retirement account (IRA) withdrawals. You'll pay ordinary income tax on money withdrawn from an HSA not used for qualifying medical or dental expenses, regardless of whether you incur the penalty.

Unlike flexible spending accounts, you do not have to spend money in an HSA in the same year you make the contribution. You also are not subject to the rules for required minimum distributions (RMDs) that apply to other types of pretax retirement savings accounts, such as 401(k)s and traditional IRAs.

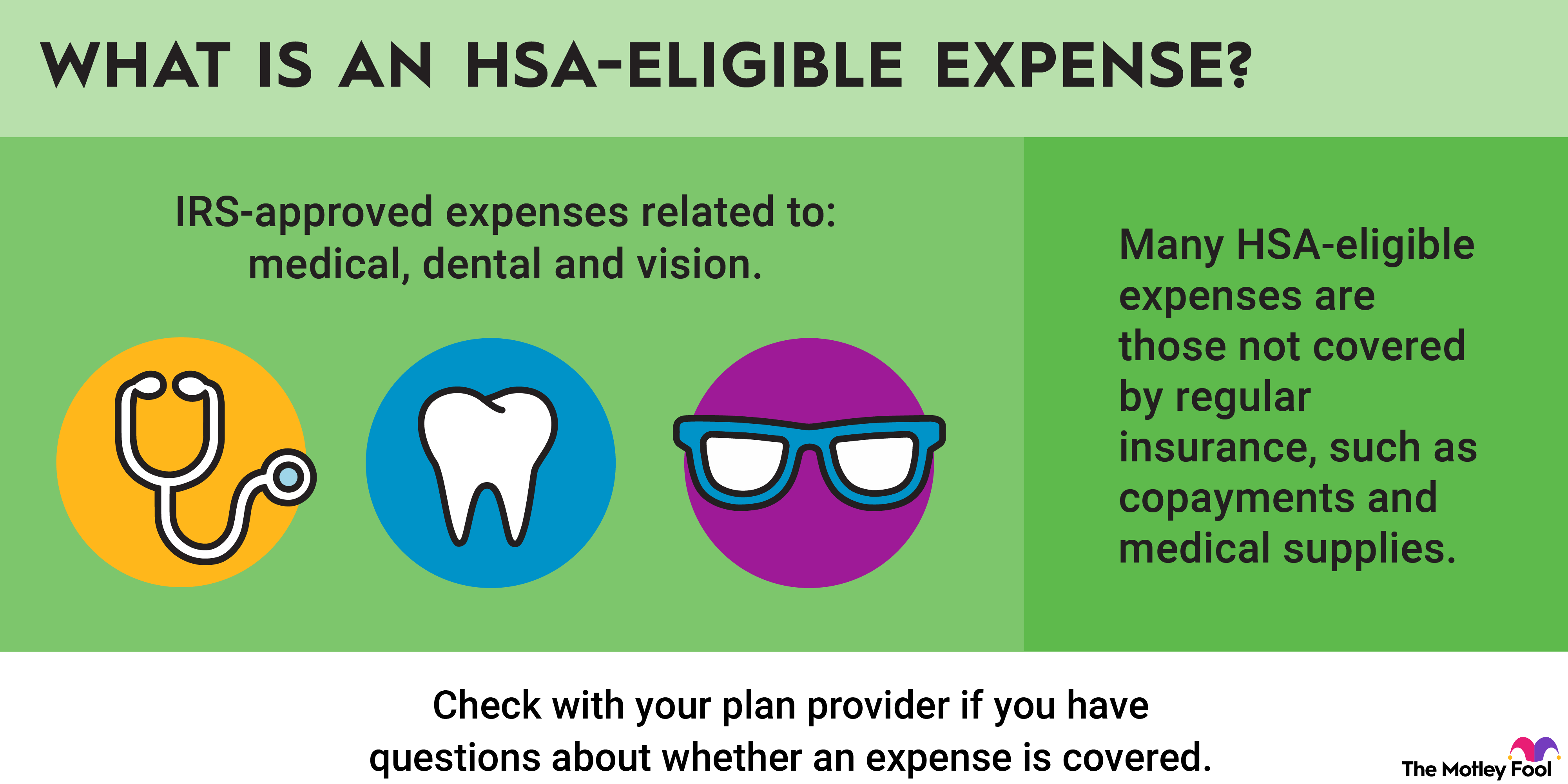

What is a qualifying medical expense for an HSA?

The IRS defines qualifying medical expenses as "the costs of diagnosis, cure, mitigation, treatment, or prevention of disease, and for the purpose of affecting any part or function of the body."

The IRS doesn't consider a medical expense to be "qualifying" just because it may generally benefit your health. For example, the IRS specifically states that vacation costs are non-qualifying expenses, even if taking a break may be beneficial to your mental or physical health. Qualifying expenses must be "primarily to alleviate or prevent a physical or mental disability or illness."

The IRS provides a long list of qualifying expenses in Publication 502 to help you determine if you can use your HSA funds to pay for a particular product or service. You can use your HSA funds to pay qualifying expenses for both yourself and eligible dependents.

You can generally use HSA funds to pay for medical services offered by practitioners, along with diagnostic devices, supplies, and equipment that care providers need to offer their services. Some of the most common HSA-eligible expenses are:

- Prescription medications

- Acupuncture and chiropractic care

- Ambulance services

- Dental services, including dentures

- Eye care, including contact lenses and glasses

- Infertility treatments

- Hearing aids

These are some of the expenses the IRS specifically designates as not HSA-eligible:

- Babysitting or child care for a normal, healthy baby

- Controlled substances, such as medical marijuana or drugs that are federally illegal

- Cosmetic surgery

- Dancing lessons

- Diaper services

- Electrolysis

- Funeral expenses

- Future medical care

- Hair transplants

- Health club dues

- Household help

- Illegal operations and treatments

- Insurance premiums

- Maternity clothing

- Medications imported from outside the U.S.

- Nonprescription drugs, except insulin

- Personal use items such as toothpaste and toothbrushes

- Surrogacy expenses

- Swimming lessons

- Teeth whitening

- Veterinary care (unless it's for a service animal)

- Weight loss programs, unless part of treatment for specific diseases

Several online stores sell only HSA-eligible products. Searching these stores' databases can help you determine if a particular medical product is covered by your HSA. You are not required to buy HSA-eligible items from any particular provider.