If you have savings in a traditional IRA, you're required to start taking withdrawals, known as required minimum distributions, or RMDs, after you reach 73 years of age.

In other words, while IRAs let you save and invest for retirement on a tax-deferred basis, the IRS doesn't just let you defer paying tax on your retirement savings indefinitely -- eventually it wants to get paid. Here's how RMD rules work, and how to calculate your RMD each year.

What is an RMD?

RMD stands for required minimum distribution. If you have savings in tax-deferred retirement accounts, such as a 401(k) or traditional IRA, you are required to begin taking distributions (withdrawals) from your account after you reach age 73.

RMD age was previously age 72 before the passage of the Secure Act 2.0 in late 2022. By 2033, RMD age will increase to 75.

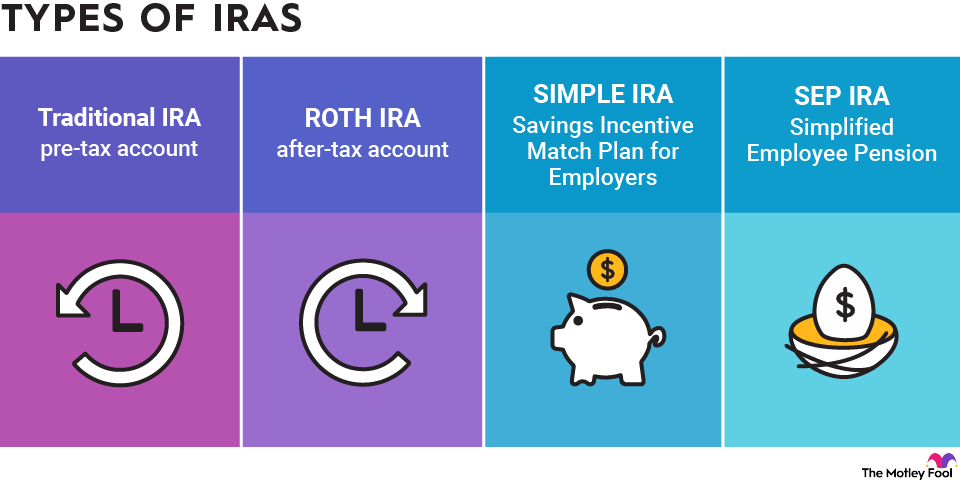

The RMD rules only apply to tax-deferred retirement accounts. After-tax retirement accounts are exempt from the required minimum distribution rules. So if you have a traditional IRA, you'll need to start taking RMDs when you reach 73. On the other hand, if you have a Roth IRA, you don't have to take any RMDs, no matter how old you get. You can leave your Roth IRA investments alone to grow tax-free for as long as you'd like.

How your IRA RMD is determined each year

Your RMD is calculated each year once you reach age 73 and depends on two main variables -- your account balance and your age.

Using one of two IRS life expectancy tables, you can find the expected distribution period that you'll use to calculate your RMD. Most people use the Uniform Lifetime Table, but if your IRA's sole beneficiary is your spouse who is more than 10 years younger than you, you'll use the Joint Life and Last Survivor Table instead. You can use the IRS' worksheet and reference tables (in Appendix B) to help calculate your RMD.

Using your account value -- which is defined as the value of your account at the end of the previous calendar year -- divide by your distribution period to determine your RMD. For example, if you have $500,000 in your traditional IRA at the end of 2025, and you're turning 75 years old in 2026, the Uniform Lifetime Table gives an expected distribution period of 24.6 years. Dividing your account's balance by this number shows a 2026 RMD of $20,325.

For a quick reference, here are the current life expectancy factors from the Uniform Lifetime Table for retirees age 72 through 92.

Age | Distribution Period | Age | Distribution Period | Age | Distribution Period |

|---|---|---|---|---|---|

72 | 27.4 | 79 | 21.1 | 86 | 15.2 |

73 | 26.5 | 80 | 20.2 | 87 | 14.4 |

74 | 25.5 | 81 | 19.4 | 88 | 13.7 |

75 | 24.6 | 82 | 18.5 | 89 | 12.9 |

76 | 23.7 | 83 | 17.7 | 90 | 12.2 |

77 | 22.9 | 84 | 16.8 | 91 | 11.5 |

78 | 22.0 | 85 | 16.0 | 92 | 10.8 |

What if you have more than one account to take an RMD from?

Since many people who have a traditional IRA also have an employer-sponsored retirement plan, such as a 401(k), it's essential to discuss the necessary steps in this situation.

If you have more than one IRA, you can take the RMD from one or more accounts, as long as the total withdrawal satisfies your RMD requirement. On the other hand, if you have employer-sponsored retirement plans like 401(k)s, an RMD must be taken from each account separately.

When do you need to take your RMD?

In general, you need to fulfill your RMD obligation by Dec. 31 each year.

The exception is your first RMD. This is for the year in which you turn 73, when you have until April 1 of the following year to take your first RMD. In other words, if you reached age 73 in September 2025, you'll have until April 1, 2026, to take your first RMD.

A word of caution -- if you wait until the last minute to take your first RMD, you'll also have to take your second RMD by the end of the same calendar year, resulting in two RMDs in the same year. Since withdrawals from these retirement accounts are counted as taxable income, waiting until the last minute could catapult you into a higher tax bracket and therefore result in a higher-than-expected tax bill.

As a final thought, under no circumstances should you not take your RMD in any given year. The IRS penalty for not doing so is harsh. If you fail to take your entire RMD, you'll be assessed a penalty equal to 25% of the amount you didn't withdraw, though the penalty may be reduced to 10% if you take swift action to correct the issue. So make sure you know how much you're required to withdraw, and then withdraw it on time.