Wondering whether your student loans are tax deductible? Although you can't deduct the entire payment, in many cases, you can deduct student loan interest, which can make a big dent in your tax liability. Of course, there are rules and limitations, but we'll go through those below.

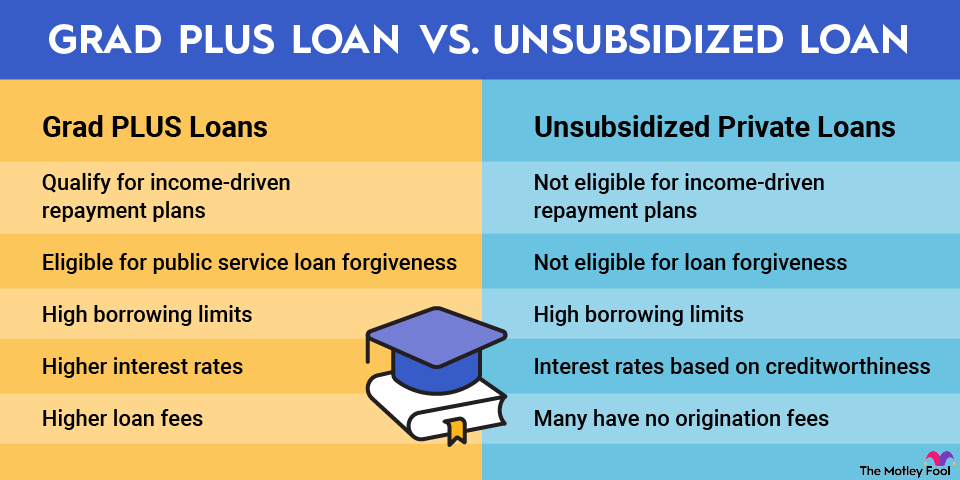

Interest Rate

What is the student loan interest deduction?

The student loan interest deduction is a tax deduction that allows you to write off up to $2,500 in student loan interest payments each year. This is only for the interest portion of your student loan; you cannot deduct the entire payment amount. So, for example, if you have a student loan with no interest, you wouldn't be able to take this deduction.

Since this is a tax deduction rather than a tax credit, it works against your taxable income rather than the bottom-line tax bill. So if you're making $65,000 a year and paying $2,500 in student loan interest, your taxable income would drop to $62,500 with a student loan interest deduction. You'd calculate your tax bill using this number minus any other tax deductions you're eligible for.

Who qualifies for the student loan tax deduction?

Your student loan tax deduction eligibility is based on your modified adjusted gross income (MAGI). Your MAGI is your income minus certain types of deductions, such as IRA contributions, foreign income, passive income, and others, but it is generally more than your adjusted gross income.

In 2023, if your MAGI is below $75,000 for single filers or $150,000 for married filing jointly, you can claim the full student loan tax deduction if certain conditions are met. If your MAGI is between $75,000 and $90,000 for single filers or $150,000 to $180,000 for joint filers, you can deduct a phased-out amount.

Modified Adjusted Gross Income

If you earned above these thresholds, you won't qualify for tax deductions for student loan payments. Other requirements include:

- Using your loan for qualified education expenses, such as tuition, room and board, and books

- Being legally obligated to repay the loan

- Securing the loan for yourself, your spouse, or a person who was your dependent when you took out the loan

- Paying the interest payments yourself, rather than having someone else make them on your behalf

- Not using the married filing separately status when filing your taxes

- Not being claimed as a dependent on someone else's taxes

How to claim the student loan interest tax deduction

If you paid less than $600 in student loan interest, you'll need to get out your student loan statements and calculate the total amount you paid in interest during the last calendar year so you can put the figure on your tax forms. If you paid more than $600, however, you'll automatically be sent a form 1098-E in the mail or via email.

The Internal Revenue Service provides a worksheet to calculate your student loan interest deduction in Publication 970, Tax Benefits for Education. Once you've worked through the worksheet (or let your tax software handle the heavy lifting), you can enter that number on Schedule 1 (Form 1040), line 21.

Related investing topics

Is it worth claiming student loan interest on taxes?

If you've paid interest on student loan tax payments and qualify for the deduction, there's absolutely no reason not to take it. Just as saving and investing money are key to building wealth, so is reducing your tax burden. It's a pretty simple process, especially if you automatically get a 1098-E in the mail.