Adjusted gross income is an amount that takes your total, or gross income, and makes certain adjustments to determine your income for certain tax break qualifications.

However, this leaves some big unanswered questions. For example, what is the difference between adjusted gross income and taxable income? What tax breaks count as adjustments, and which are counted as deductions? And how can adjusted gross income affect your tax bill?

Adjusted gross income, commonly abbreviated as AGI, is one of the most important concepts for U.S. taxpayers to understand. In this article, we'll take a closer look at adjusted gross income, how yours is determined, and why it matters so much to you.

Understanding adjusted gross income (AGI)

Before we go any further, there are three key income numbers you should be aware of: gross income, adjusted gross income, and taxable income.

- Gross income refers to the total amount of money you earn in a given year. It includes wages, salaries, tips, self-employment income, investment income, retirement income, and other sources.

- Adjusted gross income is your gross income with a few "adjustments," as the name implies. We'll get into these adjustments in the next section, but it is designed to give a better picture of how much money you made in a year.

- Taxable income takes things a step further and applies any tax deductions to which you are entitled. For example, mortgage interest is a deduction that qualified taxpayers can apply to reduce their taxable income.

For the purposes of income calculations, tax deductions are split into two categories -- adjustments to income and deductions. Adjustments to income are often referred to as "above the line" deductions, or items that can reduce your adjusted gross income. Any other deductions are considered "below the line" deductions since they can reduce your taxable income but have no effect on your AGI. Because they reduce your AGI as well as your taxable income, above-the-line deductions are typically regarded as the more valuable of the two categories.

How does AGI affect your tax bill?

Here's why understanding AGI is important. Adjusted gross income is the number used to qualify you for several tax benefits. For example, the maximum charitable deduction you can take in a given year is based on a percentage of your AGI. The ability to contribute to a Roth IRA is based on a slight variation of your AGI. And, in the context of the COVID-19 pandemic, the income cap for things such as the enhanced Child Tax Credit were based on AGI. Other benefits based on AGI include the student loan interest deduction, adoption tax credit, and tuition tax credits.

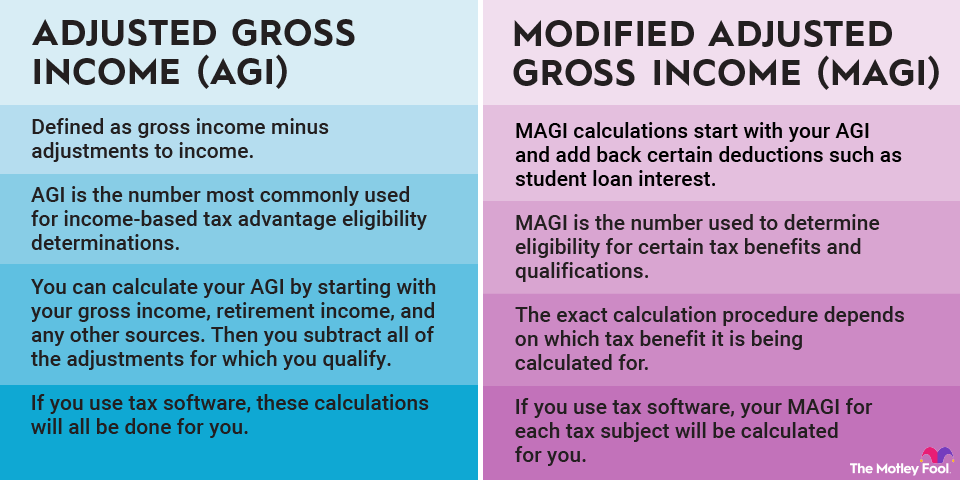

There are many other examples, but the point is that adjusted gross income is the number most commonly used for income-based tax advantage eligibility determinations. It's also worth noting that AGI is used by many states to calculate state income tax liability.

Examples of common adjustments

There are several adjustments to income that can reduce your AGI in a given tax year:

- Contributions to a qualified tax-deferred retirement plan, such as a traditional IRA.

- Contributions to a health savings account, or HSA.

- Educator expenses, up to the annual maximum.

- Student loan interest, up to the maximum allowed.

- Half of the self-employment tax you paid.

- Self-employed health insurance premiums.

- Alimony payments.

- Moving expenses for members of the U.S. military.

- Employee business expenses, but only for select groups such as armed force reservists.

There are a few others, but these are the most common adjustments to income.

How to calculate adjusted gross income (AGI)

The short answer is that you can calculate your adjusted gross income by starting with your gross income, including income from a job, self-employment or freelance income, retirement income such as Social Security payments and 401(k) withdrawals, unemployment compensation, investment income (such as from stock sales or dividends) and any other sources. Then you subtract all of the adjustments for which you qualify.

As an example, let's say that your gross income is $100,000. You have the following adjustments:

- $5,000 in qualified retirement plan contributions

- $1,000 in student loan interest

- $2,000 in contributions to an HSA

By taking your $100,000 gross income and subtracting the $8,000 in adjustments you qualify for, you have an AGI of $92,000.

Note that this is different from taxable income. Before the tax brackets are applied to your income, you'll subtract your other deductions, such as the standard deduction.

Finally, it's also worth mentioning that if you use tax software, such as TurboTax or TaxAct, these calculations will all be done for you. But it's still important to understand which deductions can reduce your AGI each year since these can be extremely valuable when qualifying you for other tax advantages.

Adjusted gross income vs. modified adjusted gross income

There's a slightly different version of adjusted gross income known as modified adjusted gross income, or MAGI, which is technically the income number used for certain tax benefits. In a nutshell, MAGI calculations start with your AGI and add back certain deductions, such as student loan interest.

Modified Adjusted Gross Income

As if this wasn't complex enough already, there is not a single calculation formula for MAGI. The exact calculation procedure depends on which tax benefit it is being calculated for. As an example, if you're trying to determine eligibility for Roth IRA contributions, you'd add back student loan interest, foreign earned income, foreign housing deductions, excluded savings bond interest, and excluded employer adoption benefits (obviously, many of these don't apply to the majority of taxpayers). On the other hand, to determine liability for the net investment income tax, you would only add in the foreign adjustments.

As with AGI, if you use tax software, your MAGI for each tax subject will be calculated for you, so there's no need to know the individual requirements. The key takeaway is simply that certain tax benefits and qualifications use a slightly different version of AGI.

Related investing topics

The bottom line

Adjusted gross income isn't representative of the actual amount of income you received in a given tax year. However, it is a very significant tax concept that is important for U.S. taxpayers to know since it determines eligibility for several valuable tax benefits, as well as liability for certain taxes, such as the net investment income tax. While you're unlikely to have to calculate your own AGI by hand, knowing how it works can help you learn how to allocate your money to qualify for as many tax benefits as possible.