Understanding stock buybacks

When a company has excess profits or otherwise has accumulated cash on its balance sheet, it can use the money in a few different ways, including:

- Reinvest profits into the business by developing new products or increasing its inventory.

- Acquire other businesses.

- Pay a dividend to shareholders.

- Use the cash to buy back shares of its own stock.

Many companies use some combination of these methods. For example, many stocks that pay dividends also buy back shares.

The mechanics of stock buybacks are usually quite simple. First, the buyback program is established. The company's board will authorize the buyback, typically for a specific dollar amount with an expiration date. For example, you might read that "Company XYZ's board of directors has approved a $500 million buyback authorization, beginning on July 1, 2024, and ending on June 30, 2025."

To be clear, a buyback authorization doesn't mean the company will buy back any shares. In fact, buyback authorizations go unused quite frequently. But the authorization gives management the ability to do it.

Next, the company buys back shares if management chooses to do so. It typically does so on the open market, just like you and I would buy shares of a stock. In some cases, buybacks can be done directly from shareholders through a process known as a tender offer.

Finally, the repurchased shares are absorbed by the company, and the number of outstanding shares decreases.

Why do companies buy back their shares?

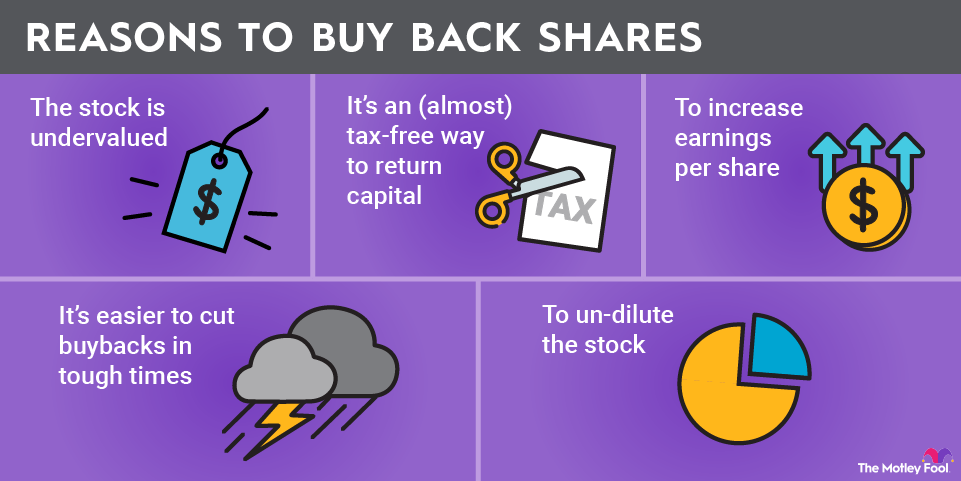

At first, it might sound odd that companies buy back shares of their own stock. Why not just give that money to investors directly as dividends? But there are some solid reasons for doing so. Specifically: