A head and shoulders pattern is a formation on a technical analysis chart that indicates a security or commodity is in the process of reversing gains or losses. In a declining trend leading to losses, the pattern is illustrated by a rise and fall in the price, followed by a higher increase and decrease, then a final pattern displaying a rise and fall that resembles the initial change.

The pattern is underscored by a “neckline” that can be a straight line under the head and shoulders. For a trend showing future gains, the pattern is reversed; the head and shoulders pattern is essentially inverted.

Technical analysis uses price trends observed on charts to identify investment opportunities. Many investors believe that compiling historical prices and visualizing the data can reveal promising investments.

Technical analysts use a number of different patterns to identify investments that are potentially worthwhile. Stock chart patterns include double tops, double bottoms, cup and handle, flags, and triangles (ascending, descending, and symmetrical). The most well-known pattern, however, is the head and shoulders formation that signifies a reversal of a bullish or bearish trend.

In a head and shoulders pattern, the left shoulder is indicated by a hump that shows a rise and fall in prices. It’s followed by a larger hump, which, in turn, is followed by a smaller rise and fall that resembles the initial hump. In a classic head and shoulders pattern, a horizontal “neckline” can be drawn underneath all three humps. If prices continue to fall past the neckline after the right shoulder -- the most recent decline -- then the trend is most likely bearish.

An inverted head and shoulders pattern that reflects a bullish trend is also possible. In this case, the head and shoulders are inverted. Prices reach a low before recovering, fall more sharply before recovering again, and finally go through a final fall-and-rise trend, with the final rise approximating the starting point. Like the declining head and shoulders pattern, a neckline can be discerned above the head and shoulders rather than below them.

Bullish

When you identify a head and shoulders pattern, it’s generally a safe assumption that a stock or commodity price is headed up or going down. Unfortunately, it’s not always obvious that a head and shoulders pattern is actually present.

Inexperienced investors often have difficulty identifying a head and shoulders pattern. It’s easy to misread a pattern based on complete volume. A decline might be only for a brief period -- rather than part of a long-term trend -- if the volume of shares being traded doesn’t decrease as the price moves higher. Likewise, the decline could be short-lived if volume doesn’t increase when the price moves below the neckline.

Time is also an element. Inexperienced analysts can often rely just on shape to assume charts are displaying a bearish or bullish trend. A common rule of thumb, however, is that the rise on the initial shoulder needs to be twice as long as the distance between the shoulders for the head and shoulders pattern to be a true reflection of an actual trend and not just a brief blip in prices. This is a particular problem for intraday traders who discover head and shoulders-like patterns on one- or four-hour charts.

Examine the neckline. It’s rare that a neckline will be a perfect horizontal line. But you’d like to see either a relatively horizontal line or one that’s ascending, i.e., rising from left to right. A descending neckline that falls from left to right is the sign of a weak pattern.

Finally, make sure that you’re looking at an actual head and shoulders pattern. If one shoulder is higher than the head, you’re not. Don’t rely on an apparent downward trend near the end of a head and shoulders pattern to form the basis for an investment decision. Stock and commodity prices have a bad habit of moving erratically, and you don’t want to jump the gun.

Sometimes, it’s possible to use a head and shoulders pattern to spot a counterintuitive trend. After the Russian invasion of Ukraine, for example, most analysts predicted that natural gas prices would soar after sanctions were imposed on Russia and gas supplies were shut off to most of Europe, especially with winter approaching.

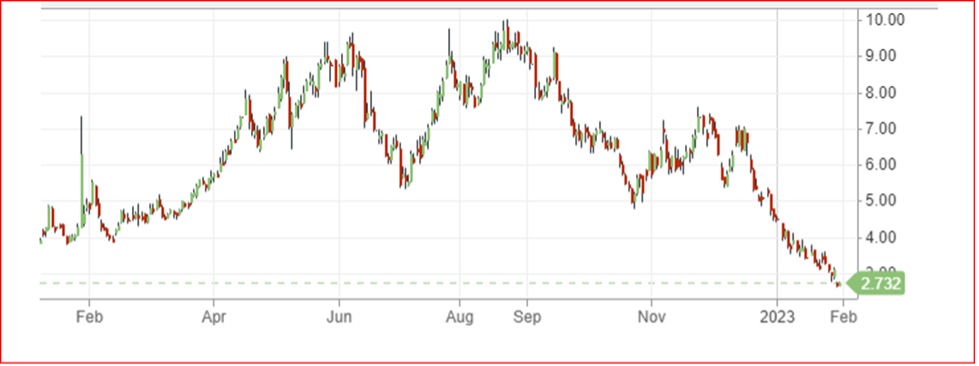

A stock chart, however, indicates a very different story began to emerge early in the winter of 2022. In the immediate wake of the invasion, natural gas prices rose sharply, peaking in early June. They continued to fall for the next month before rising again. Prices again peaked in August before falling again and then dropped throughout the fall before rising again and falling below the neckline in late December.

Natural Gas Prices, February 2022-2023

Several things stand out about this chart. First, the head and shoulders pattern is relatively clear, with a horizontal neckline. It occurs over a lengthy period -- almost an entire year. Volume was also reasonably healthy; between Feb. 1, 2022, and Jan. 30, 2023, average daily volume approached 113,000, a sufficiently large amount to discount the possibility of outliers.

A head and shoulders pattern isn’t an ironclad guarantee of a trend reversal, and it shouldn’t be used as the only criteria for a major investment. Patterns are no substitute for diligent and careful research.