If you've ever heard someone talk about the hockey stick curve in business, they're referring to a point of inflection. A point of inflection can be a transitional moment for a start-up or even a mature business, but it doesn't happen on its own.

Keep reading to learn what a point of inflection is, how it happens, and why it's meaningful in business.

What is a point of inflection, exactly?

Taken literally, a point of inflection refers to a point on a graph where a line or curve changes direction, often dramatically. In business, this can illustrate revenue, profit margin, or cash flow.

Because of this definition, the term is often used metaphorically in business to denote a significant change related to performance, leadership, competition, technology, or another area. It could also be thought of as a turning point, although an inflection doesn't necessarily imply a 180-degree turn.

The significance of a point of inflection

It's common to hear CEOs and other leaders talk about inflection points in their businesses, and the reasons are understandable. They are trying to create a positive narrative, and claiming to be at an inflection point implies that the business is about to accelerate or pivot in a meaningful way.

While sometimes this is just talk, inflection points are real, and businesses do occasionally experience a hockey stick-type inflection.

That could be because cash flow has accelerated as it reached a critical mass with its customer base, revenue growth is accelerating due to a technological breakthrough, or profit margins have significantly improved as the business scales.

These events can lead to multibagging returns for investors so they're important to understand. Learning how to anticipate them will make you a better investor.

How a point of inflection works

Start-up businesses experience a number of meaningful points of inflection. One of the first might be cash burn starting to decline. Start-ups typically lose money as they invest in the business early on before sales come in. So an early important inflection point for a business can be when its cash burn -- the amount of money it's losing in a given period -- starts to decline.

This is essentially the first step to positive cash flow, although that could come years later. Reaching positive cash flow is also often an inflection point for the business as it enables the company to self-fund, meaning it no longer needs to raise capital. It can reinvest that cash flow in the business, pay down debt, or return it to shareholders.

Reaching positive cash flow can also be associated with a point of inflection in margins. This could be because operating costs like research and development (R&D) and technology tend to scale, or because gross margin could fall as the business outsources a manufacturing component, gains pricing power, or scales enough to negotiate lower costs.

Understanding the drivers behind points of inflection can help you anticipate them, allowing you to potentially capitalize on multibagging opportunities.

An example of a point of inflection

One recent -- and very significant -- point of inflection happened to Nvidia (NVDA +2.30%) after the launch of ChatGPT. Nvidia's revenue soared as demand for its chips skyrocketed.

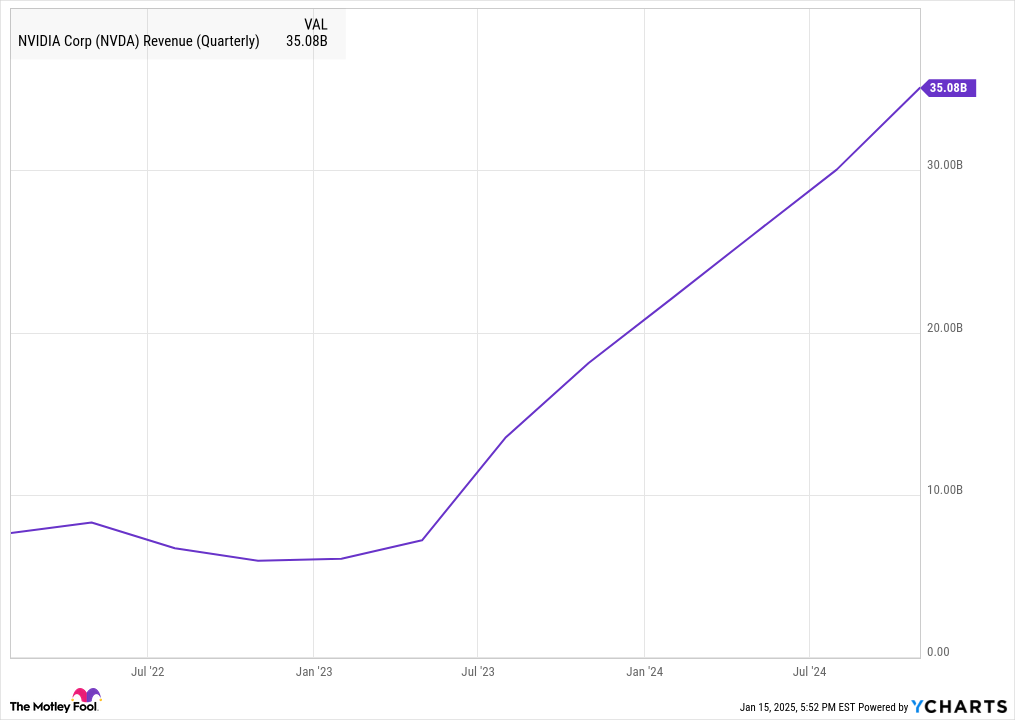

As the leader in the graphics processing units (GPUs) that power generative AI technologies like training and inference, Nvidia suddenly saw high demand for its products. The chart below shows what that inflection point looked like.

As you can see, Nvidia's revenue hit an inflection point in the second quarter of 2023 as orders for its components started to roll in after the launch of ChatGPT and the subsequent race to roll out new generative AI.

Nvidia's quarterly revenue went from $10 billion to more than $35 billion in less than two years as it experienced the inflection point from generative AI.

If you were familiar with the company and its technology, you could have anticipated this inflection point following the launch of ChatGPT, and some investors did. Billionaire Stanley Druckenmiller started buying Nvidia in the fourth quarter of 2022, and accelerated his purchases after the launch of ChatGPT, saying, "Even an old guy like me could figure out what that meant, so I increased the position substantially." He made hundreds of millions of dollars from the trade, though he regretted selling early.

Related investing articles

Paradigm shifts like ChatGPT and generative AI can lead to inflection points for companies like Nvidia. Being on the lookout for those shifts, whether they happen in geopolitics, government policy, technology, or a black swan event can help you take advantage of them and find the next inflection point.