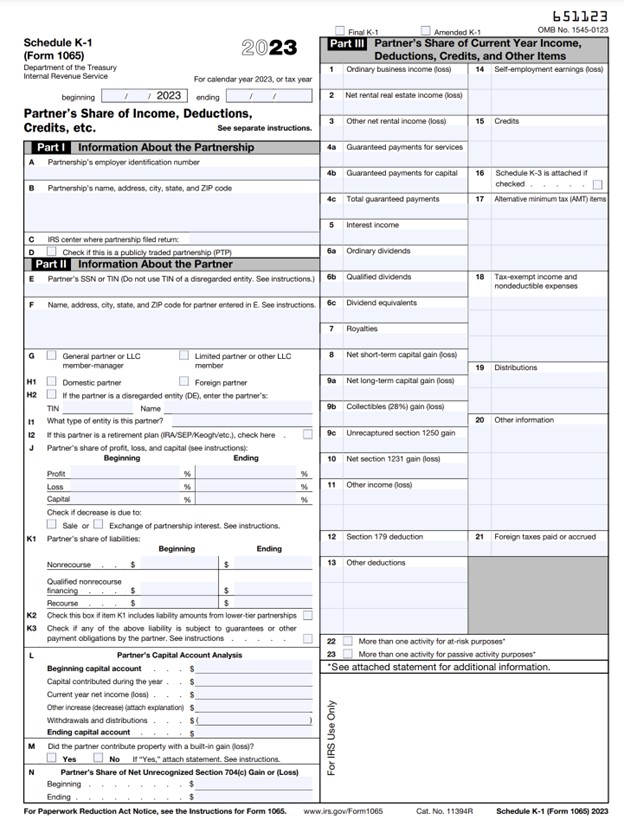

Understanding a Schedule K-1 federal tax form

Business partnerships, financial entity partnerships, and S corporations send a Schedule K-1 (also called Form 1065) to their limited partners (LPs), shareholders, or beneficiaries. The schedule reports their share of the entity's income, losses, deductions, credits, and any other distributions (whether paid out or not).

As pass-through entities, they don't pay taxes at the corporate level. Instead, they pass their income and losses through to their partners, who pay taxes on the income at the individual level. Schedule K-1s provide each individual stakeholder with their share of the entity's income and losses so they can report them on their individual taxes.