Small-cap stocks can occasionally get a bad rap. What are often collectively thought of as volatile, risky, and money-losing companies can actually turn into strongly profitable businesses that can handily outpace the returns of more mature companies. The challenge is in weeding out the potentially great small-cap stocks from the bad apples.

With this in mind, we asked three Motley Fool contributors to name a small-cap stock that they believe has the potential to handily outperform over the long term. Coming to mind were offshore driller Noble Corporation (NEBLQ), smart home and business solutions provider Control4 (CTRL), and electronic display designer and manufacturer Daktronics (DAKT 1.21%).

Image source: Getty Images.

Drilling deep for small-cap value

Sean Williams (Noble Corporation plc): Though it's been an exceptionally volatile stock of late, one small-cap stock that could deliver big returns over the long term (and that also happens to be a personal portfolio holding) is offshore driller Noble Corporation.

It's no secret what's wrong with Noble or the offshore drilling industry in general: Crude prices are down more than 50% in less than four years. Drillers had been liberally using debt to finance the purchase of newer, more efficient rigs, when oil was north of $100 a barrel, but the tumble in crude prices has left the industry, including Noble, with weaker demand and higher debt levels.

While there's no denying that Noble's turnaround is going to take years, we've witnessed a number of encouraging signs and actions from management that Noble will not only survive this downturn but thrive when crude prices do rebound.

Noble has made excellent progress on reducing its capital expenditures (capex), lowering its debt, and pushing its debt maturities out. Capex in 2017 is expected to come in at just $115 million, which is almost 95% below the $2.1 billion it spent on combined newbuilds, maintenance, and projects in 2013. In terms of debt, Noble has an average of $190 million due annually between 2018 and 2022, with the next large debt repayment, coming in at $1 billion, not expected until 2024.

Image source: Getty Images.

The company has also seen positive utilization of its jackup rigs – jackups are the first offshore rigs to benefit when crude prices rise. Utilization rates for jackups in Q1 were 93%, and half its jackup fleet was committed through 2018, according to a March presentation by the company.

Most importantly, the company's backlog remains healthy at $3.5 billion, its contract drilling service costs have been halved since 2017, and it possesses one of the youngest drilling fleets on the water. Newer rigs are more preferable, given their improved recovery efficiency over older rigs and ability to command higher dayrates. This yields a company that's still generating significant positive cash flow. As long as Noble continues to generate healthy positive cash flow, the potentially for a big long-term rebound in its share price remains in play.

A bold new world

Daniel Miller (Control4): In a world that's increasingly interconnected, a company such as Control4 Corp. should realistically be on everybody's watch list. Control4 Corp provides high-end solutions and products for smart homes and has carved out a niche in the premium -- and more profitable -- end of the spectrum.

Image source: Control4's May 2017 investor presentation.

But the reason this company is a small stock to own for the long term is simply its potential growth. It seems clear we're heading to a more interconnected world where our homes are a ripe market for products and services. Control4 estimates that there are 14.1 million U.S. households with more than $150,000 annual income -- its premium target consumer -- and that it currently has only a 1.4% market penetration. By those figures, there is plenty of growth to be had in the years to come.

One leading indicator of Control4's growth is its expanding dealer network. To grow its sales, it has to have a capable and knowledgeable sales force, and its network has surged recently. Consider that its global dealer network was 3,463 in 2014, 3,688 in 2015, and a staggering 5,338 in the first quarter of 2017.

Control4's expanding dealer network should lay the groundwork to expanding market penetration, and as we continue to head toward a more interconnected world, households will increasingly buy into these products. This is a small-cap stock that hasn't had any issue growing its top line, but management has to continue executing efficiently to produce a better bottom line, because that's what the stock price will follow.

Yes, you've seen this company in action. No, you probably didn't notice.

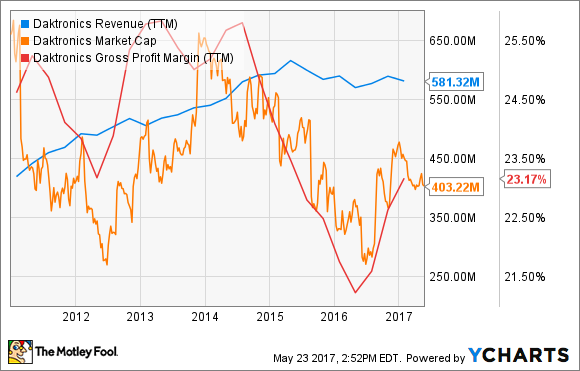

Anders Bylund (Daktronics): Electronic signage specialist Daktronics has delivered steady revenue growth for seven years, but investors have largely shrugged off that positive trend. Instead, the stock chart has become a pretty close match for Daktronics' jagged gross-margin trend line.

DAKT Revenue (TTM) data by YCharts

The cuts and jolts in that chart are amplified by a couple of interesting factors. Daktronics' revenue stream is bumpy and lumpy, because a single high-profile contract won or lost can swing the needle for several quarters in a row. The stock is also underfollowed among Wall Street analysts, with only three financial firms offering an earnings forecast for next week's fourth-quarter report. Together, these facts make it difficult for investors to pin down precise financial targets for the short term.

That's both a crying shame and a useful investing tool.

On the downside, uncertainty is always bad news for share prices. As a result, Daktronics shares can currently be bought for just 8.8 times free cash flows on a trailing basis.

On the upside -- did you notice that tremendous price discount, paired with solid cash flows?

Daktronics converts nearly 8% of its incoming revenues to free cash, powering a muscular 3.1% dividend yield.

As a Daktronics shareholder myself, I find the stock easy to follow thanks to its presence just beyond the spotlight in so many familiar venues. The company's scoreboards and timing systems can be found at your local college and high school arenas, but also in some of the world's largest stadiums. In the recently reported third quarter, Daktronics screens replaced all of the digital screens around London's iconic Piccadilly Circus.

So you get an interesting business model, steady sales growth, and a strong dividend payout, all at deep-discount prices and backed by nearly five decades of operating history. What's not to love?