Wall Street analysts spend years focusing on just a handful of companies in order to master their inner workings. Warren Buffett spends the bulk of his day reading books, corporate reports and the like. Ultimately, however you apply your efforts, investing well requires context, and to gain it requires looking beyond surface-level impressions.

With that in mind, let's take a look at Intel (INTC +3.41%) and Micron Technology (MU +0.81%).

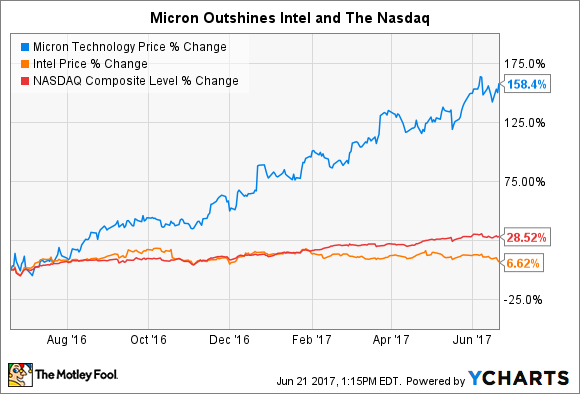

First up is their 12-month stock charts, which shows Micron outshining both Intel and the Nasdaq.

However, if you look at the same three over the last three years, Micron has actually underperformed Intel and the Nasdaq Composite by a wide margin. So in order to truly understand these two chipmakers, we need to more deeply examine three key aspects of their investing profile to see which looks like the better buy today.

Financial fortitude

It's hard to successfully invest in a company whose finances are in shambles, which makes looking at Intel's and Micron's financial health a logical place to start. Take a look at these four popular measures of solvency and liquidity.

|

Company |

Cash & Investments |

Debt |

Cash From Operations |

Current Ratio |

|---|---|---|---|---|

|

Micron Technology |

$3.9 billion |

$12.4 billion |

$3.8 billion |

1.9 |

|

Intel |

$17.2 billion |

$25.7 billion |

$21.6 billion |

1.7 |

Data source: Yahoo Finance

A few things jump out here. First, Intel operates on an entirely different scale than Micron. Second, though both carry more debt than assets, Intel's $8.5 billion in net debt -- simply cash & investments minus debt -- is equal to Micron's $8.5 billion in net debt.

However, Intel truly separates itself from Micron in its cash-flow-generation capabilities Intel holding a roughly 5-to-1 advantage over Micron in this important category. Especially since both companies have current ratios close to two, the cash flow disparity between the two becomes the real differentiator here.

Winner: Intel

Image Source: Getty Images

Durable competitive advantages

Both Intel and Micron loom large within their respective areas of the semiconductor market, but only one can be said to carry legitimate competitive advantages.

Fortunately for Intel, the company holds a near-monopoly over the PC and server microprocessors industries, though names like Advanced Micro Devices challenge on the margin. This dominant market share footing gives Intel substantial pricing power, as evidenced by its plush gross margins, which tend to hover in the low 60% range.

If anything, Intel's primary problem is its growth outlook as PCs and servers are both fairly mature industries. Moreover, having missed the boat entirely on mobile -- itself a slowing industry these days -- Intel is diving headlong into new growth markets like the Internet of Things, artificial intelligence, and self-driving cars. In fact, the company made its most bold move into one of these spaces to date when it agreed in March to buy self-driving car component maker Mobileye for $15.3 billion. The company still faces some growth obstacles but its overall competitive position generally seems stable and favorable.

The same cannot necessarily be said for Micron. The company is one of the three core producers of memory chips with Samsung and SK Hynix. Unfortunately for Micron, memory chips are largely a commodity product, which gives the companies operating in the space limited pricing power; its gross margins usually hover in the 20% range.

In times when demand outstrips supply, as is the case currently, memory chip companies can generate substantial profits. However, their profits also crater when memory prices soften, which can lead to significant losses, particularly for stand-alone memory chip producers like Micron and its shareholders.

Winner: Intel

Valuation

Looking to our last category, let's briefly review various trading multiples for Intel and Micron, using these three popular valuation metrics as a starting off point.

|

Company |

P / E |

Forward P / E |

P / Cash Flow |

|---|---|---|---|

|

Micron Technology |

46.5 |

5.8 |

7.9 |

|

Intel |

15.2 |

11.8 |

8.3 |

P = price. E = earnings.Data source: Yahoo Finance , Morningstar

Here we see the boom-and-bust nature of Micron's earnings profile nicely contrasted against Intel's more steady and mature financial makeup. Check here for more on the P/E ratio. Micron is coming out of a period of substantial losses on the back of weak memory prices that triggered losses for the company in 2016. Perhaps this is just a matter of personal perspective, but I'm more drawn to Intel's more conservative valuation and business structure as a recipe for success over the long term.

Winner: Intel

And the winner is... Intel

This probably should come as little surprise, but Intel notches a fairly easy win in this comparison versus Micron. To be sure, Micron has done a nice job consolidating its share of the memory chip business as much as possible.

However, the casino-like nature of its industry can erase shareholder gains almost as quickly as it can create them. As a matter of philosophy, we Fools prefer to view our investments as long-term -- say 10-plus years -- holdings, and from that perspective I find myself far more confident that Intel will be thriving a decade from now.