With Procter & Gamble (PG -0.80%) set to close the books on its fiscal year in early August, its investors don't have much to complain about. Sure, the consumer products titan's stock has trailed the market modestly in 2016. But that's no surprise given the slowing sales growth pace and the weak outlook for the global industry.

Surging cash returns are playing a big role in keeping shareholders' overall returns in positive territory this year. There's a problem, though: P&G can't keep up this aggressive cash return pace forever.

Image source: Getty Images.

Cash sources

Procter & Gamble has been shoveling cash back to its shareholders lately. Dividend and share repurchase spending was nearly $10 billion over the past nine months. That's on top of the $9.4 billion in stock retirements that went along with its $11 billion sale of its beauty brands.

Including another $2 billion dividend payment in the fiscal fourth quarter, the company is set to deliver $22 billion to investors in the form of dividends and buybacks this year -- or about 10% of its current market capitalization. It turns out executives were right when they claimed in January that fiscal 2017 would be a year of "significant value return to shareholders."

P&G's brand-shedding initiative has been the single biggest source of all those funds. The beauty products deal this year followed another multibillion sale that delivered the Duracell business to Warren Buffett's Berkshire Hathaway. P&G is done selling pieces of itself off now. Its portfolio is down to just 65 franchises from over 160 in fiscal 2014 in what management called the biggest transformation in the company's history.

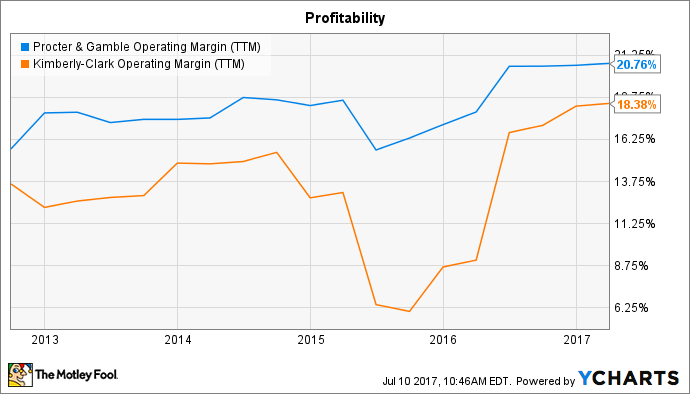

P&G also raised a good chunk of cash through cost cuts. It reorganized every area of the business, from the supply chain to manufacturing to product packaging. All told, the company cleaved almost $2 billion out of its annual expense infrastructure to put its profitability ahead of most peers. Its 21% operating margin, for example, far outpaces Kimberly-Clark's (KMB 0.25%) figure.

PG Operating Margin (TTM) data by YCharts.

There are two drawbacks to this cost-cutting strategy. First, it's just a temporary solution because at some point the company will run out of room to remove expenses. Second, there's nothing stopping rivals from copying that success and matching the lower cost baseline. Kimberly-Clark is slashing expenses right now and Unilever has told investors it plans to achieve a 20% operating margin by 2020.

Watch market share

P&G believes it can return a total of $70 billion to shareholders during the four fiscal years that end in 2019. Fiscal 2017 will mark the single biggest year for this cash avalanche; from there the annual pace should trend back down to line up more closely with earnings growth.

This won't be a big issue as long as organic sales growth has sped up by then to provide internal support for continued capital return spending. For that to happen, though, the company needs to see an improvement in a global industry that's flat right now.

More importantly, P&G must find a way to reverse its two-year market share slide. Shareholders aren't likely to get much good news on that score in its fiscal fourth-quarter report due in early August. Looking forward, investors will be watching for P&G's 2018 forecast that might include evidence that the new, slimmer brand portfolio is finally speeding up the company's expansion pace.