It's easy to admire Warren Buffett. As the longtime CEO of Berkshire Hathaway (NYSE: BRK-A)(NYSE: BRK-B), Buffett is widely considered the greatest investor of all time. So perhaps unsurprisingly, he's also consistently ranked as one of the richest men in the world despite giving away billions each year to charity. And there are plenty of other reasons so many people like the lovable billionaire.

But there's often one overarching question on the minds of Buffett fans: Which stocks should you buy today? So we asked three top Motley Fool investors exactly that. Read on to learn why they chose Berkshire Hathaway, Trex (TREX +0.24%), and Wells Fargo (WFC +1.97%).

IMAGE SOURCE: THE MOTLEY FOOL

Go straight to the source

Steve Symington (Berkshire Hathaway): At risk of oversimplifying the goal of our headline, I think the ultimate stock to buy for Buffett fans is the very company he still leads: Berkshire Hathaway.

After all, Berkshire continues to derive its strength from its proven combination of profitable insurance operations (think Geico and General Re, for example), its enviable investment portfolio (the decades-long success of which made Buffett famous), and its diversified group of non-insurance, non-investing businesses that include everything from Burlington Northern to Brooks, Duracell, Fruit of the Loom, See's Candies, Dairy Queen, Pampered Chef, and Benjamin Moore, to name only a few among dozens of other industry leaders and global brands.

Of course, with around $95 billion in cash on its balance sheet at the end of last quarter, you can bet Buffett and Berkshire Vice Chairman Charlie Munger can't wait to shrewdly put more of their company's funds to good use with future acquisitions -- at least, in addition to last month's move to acquire Texas-based electric utility Oncor for $9 billion -- which should only further widen Berkshire's moat and cement its status as arguably the most powerful conglomerate the world has ever seen.

Better yet, shares are reasonably priced trading at roughly 1.5 times book value as of this writing, making Berkshire Hathaway perhaps the perfect stock for any Buffett fan to buy today.

Too small for Buffett to bother with (but exactly what he likes)

Jason Hall (Trex Company Inc.): Buffett's success has, quite possibly, become his biggest detriment, since there are a lot of wonderful -- yet small -- companies the Oracle of Omaha can't even consider for Berkshire's portfolio. And Trex is one of my very favorites, with a market cap of just over $2 billion, making it ideal for us "small" investors.

A few things make Trex a very Buffett investment. To start, it has a quite strong competitive position -- Buffett's "moat" -- based on its strong brand appeal, deep ties with decking professionals, and its market-leading distribution. This is why Trex commands over 40% of alt-wood decking sales and grows its share every year.

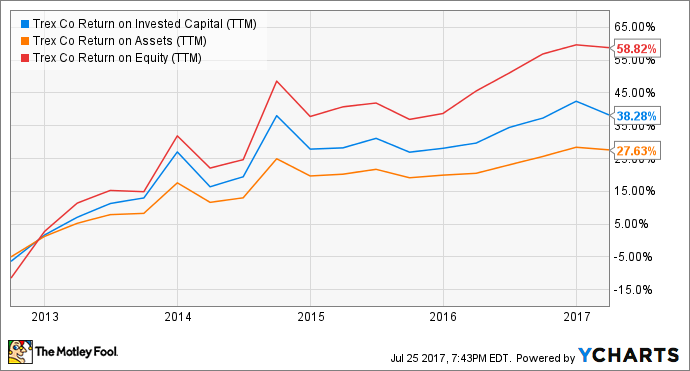

Furthermore, Trex's management has done an incredible job of leveraging sales growth and getting very strong returns on growth investments:

TREX Return on Invested Capital (TTM) data by YCharts.

Trex has delivered awesome returns for investors over this period as well, with shares up almost 440%. At the same time, there's plenty of future growth potential, since Trex only makes up about 6% of total board-feet of decking sold in North America, when you include wood into the equation.

Its stock isn't exactly cheap, trading for 31 time trailing earnings and 24 times forward estimates. But it's also not outrageous, considering the long-term prospects and how well management has been able to wring incremental profits out of sales growth.

Bottom line: To paraphrase Buffett, Trex is a wonderful business at a fair price. That's always a better buy than a fair business, even at a wonderful price.

There must be something special about this bank

Chuck Saletta (Wells Fargo): As Buffett has famously said, "It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you'll do things differently." Despite the very real damage that banking titan Wells Fargo has done to its reputation from the fake-account scandal, Wells Fargo remains a strong holding of Buffett's Berkshire Hathaway.

Indeed, Berkshire Hathaway owns so much of Wells Fargo stock that it recently had to sell some in order to stay on the right side of U.S. regulators. For Buffett -- who knows a thing or two about the importance of reputation -- to own that large a chunk of a company that has so badly damaged its own reputation, Wells Fargo's underlying business must be really compelling.

Wells Fargo was one of the fastest large banks to recover from last decade's financial crisis, and its dividend has recovered past the level it was paying prior to the cuts forced by that meltdown. While the fake-accounts scandal did knock down Wells Fargo's growth trajectory a bit, the bank is still expected to be able to increase earnings by nearly 8% annualized over the next five years. Wells Fargo trades at around 12 times its forward earnings estimate, a reasonable price to pay for that potential growth.

With a financial business able to recover that quickly from the largest financial meltdown in a generation trading at a still reasonable valuation for its potential growth, Wells Fargo's attraction becomes clearer. Buffett is no stranger to finding value in scandal-plagued stocks. Wells Fargo looks a lot like a solid business facing temporary tough times. With the patient capital that Buffett likes to deploy over the long haul, its recovery may very well justify his continued confident investment.