In retirement, most investors go from building a nest egg to spending the money they've spent a lifetime saving. To fund retirement, dividends are a great option for at least part of a retired investor's portfolio.

We asked three Motley Fool investors for stocks that were not only great dividends, but also carried high dividend yields. STAG Industrial Inc (STAG -1.67%), HCP, Inc. (DOC 0.65%), and 8point3 Energy Partners LP (CAFD) have high dividend yields, and are also businesses that are built to last.

Image source: Getty Images.

A staggeringly large market opportunity

Brian Feroldi (STAG Industrial Inc): Many real estate investment trusts (REITs) grow by buying beautiful buildings in "super-primary" markets like New York City, San Francisco, and Washington D.C. By contrast, STAG Industrial couldn't care less about the pizzazz that comes from owing top-tier properties. Instead, STAG's growth strategy is to buy industrial buildings in secondary markets that house only a single tenant. This business model isn't glamorous, but it can be highly lucrative.

What is STAG's rationale for targeting these types of properties? The company believes that the competition for ugly buildings in secondary markets is far less intense. What's more, most investors won't touch a building that only has a single tenant since the vacancy risk is so high. These factors allow STAG to buy properties on the cheap and earn strong returns on capital.

Investors who bought into this strategy early have been rewarded for their loyalty. STAG's total return since coming public in 2011 is a market-smashing 242%. What's more, there's ample reason to believe that the company is just starting to get warmed up. Management estimates that its addressable market opportunity exceeds $250 billion. For context, this means that STAG has currently captured about 1% share of its investable universe, which provides it with ample room for growth in the years ahead.

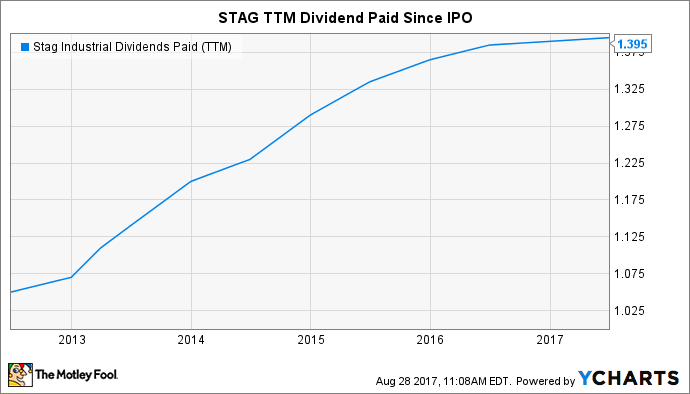

That huge market opportunity should excite income investors because STAG has a history of using its growing income stream to reward shareholders.

STAG Dividends Paid (TTM) data by YCharts.

With a current yield of 5% that consumes about 87% of core funds from operations (FFO) -- which is a REIT proxy for earnings -- STAG offers investors a safe dividend payment that's poised for long-term growth. That's a combination that almost every retiree should find attractive.

On the right side of demographic trends

Tyler Crowe (HCP): The market hasn't treated shares of HCP well over the past few years. The company's rental revenue was concentrated on a few tenants, its leverage was getting a little high, and its exposure to skilled-nursing and post-acute-care facilities made its revenue streams a little too unpredictable for an investment trust that wants to pay investors a high-yield dividend and steadily grow that payout. Over the past couple of years, though, the company has made significant changes to its portfolio to address these issues. More importantly, HCP is on the right side of a major demographic shift in the U.S.

As a healthcare REIT that focuses on senior housing, medical offices, and life-sciences buildings, HCP is serving one of the fastest-growing age groups: the over-75 crowd. Over the next decade, the percent of people 75 or older is expected to grow from 6% of the population to 10%. That's an additional 11 million people who will likely have a higher need for healthcare services and senior housing.

HCP has been positioning itself to capture this demographic trend lately, through some significant portfolio adjustments. Last year, it spun off its acute-care facilities to pay down debt and get away from facilities that were publicly subsidized -- private-pay facilities are more reliable revenue streams. Management also sold some of its senior-living facilities such that its portfolio isn't concentrated on so few tenants. All of these moves have positioned the company for better growth opportunities in the coming years.

With shares trading at a dividend yield of 5%, now seems like an opportune time to look at adding HCP to a retirement portfolio.

A rock-solid renewable-energy dividend

Travis Hoium (8point3 Energy Partners): Stocks with high yields can often be a warning sign of a flaw in a business for investors. But with 8point3 Energy Partners, there's a lot to like in both the business and the dividend. The company is a yieldco that owns solar projects that have contracts to sell electricity to utilities, commercial companies, and homeowners over the course of the next 20 years, or more. The cash generated by these projects is then used to pay the 7.2% dividend the stock holds today.

What's great about 8point3 Energy Partners today is that its dividend is stable for the foreseeable future, but the stock could surge in coming years. The company's sponsors -- First Solar and SunPower -- have put their stakes in the company up for sale, and the entire company could be bought out. If that happens, investors will get the premium paid for the stock, and likely make a nice profit.

But if the sponsors are bought out, the stock will remain public and a new sponsor will come in with the goal of growing the company long term. A sponsor with a pipeline of projects to drop down to the yieldco could help drive the stock higher and give the market confidence the dividend will grow in the future. Either way, the financial future for owners of 8point3 Energy Partners looks bright.